The ASEAN region is emerging as one of the key geographical locations for low-cost manufacturing - creating added opportunities in terms of industrial-related employment, export revenues and foreign direct investment inflow. ASEAN countries are fast becoming the preferred destination to relocate operations because of advantages such as having a large worker-orientated population, wide domestic markets, growing skilled labours, better wage structures and policies as well as rapidly improving infrastructures. In recent years, the growing number of manufacturing hubs in ASEAN is a direct result of rising wages and costs in China's manufacturing wage sector.

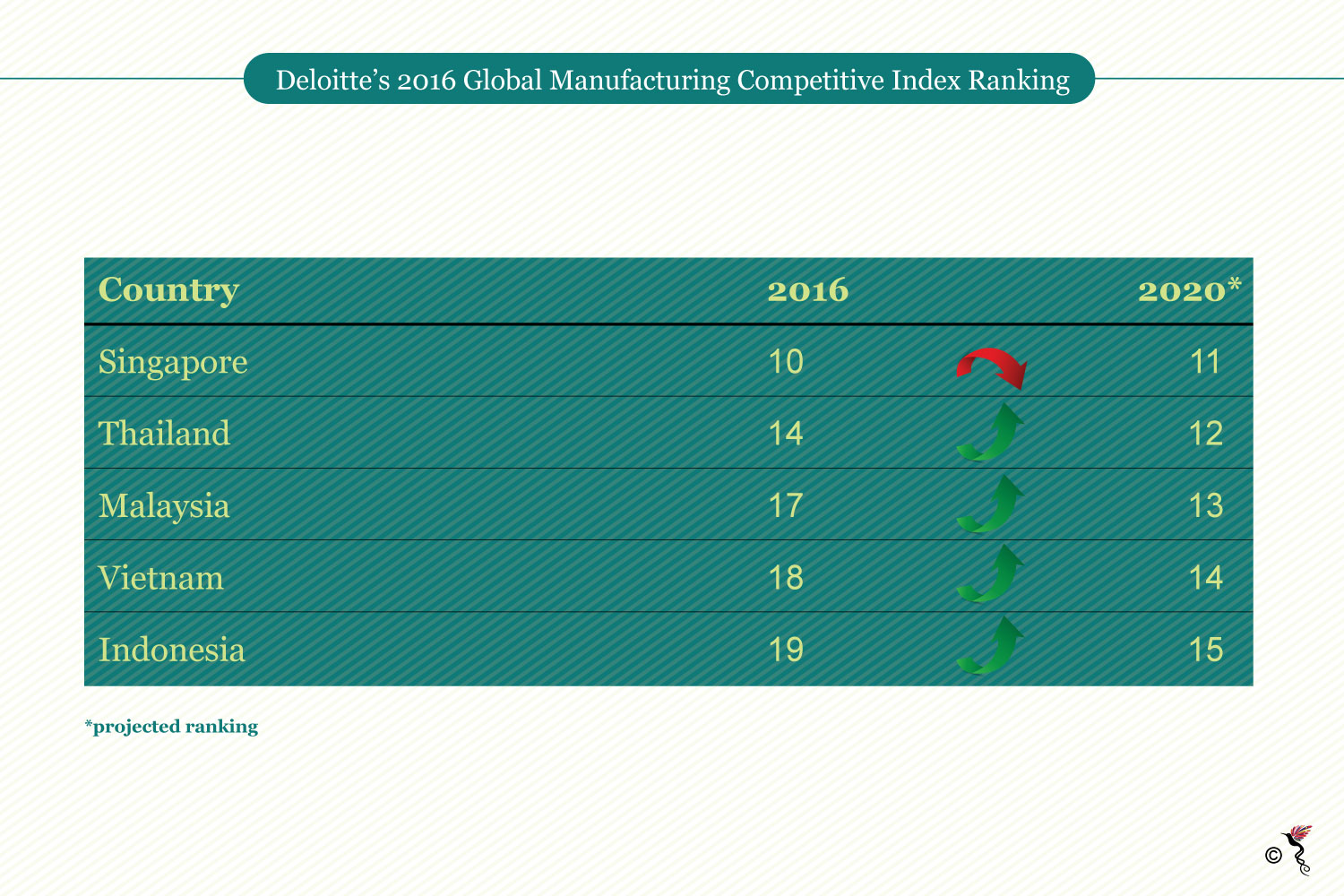

Deloitte’s 2016 Global Manufacturing Competitive Index Ranking of five ASEAN countries, out of 40 other countries.

According to Deloitte's 2016 Global Manufacturing Competitive Index, ASEAN countries namely Thailand, Malaysia, Vietnam and Indonesia is projected to achieve a significant positive growth in its export manufacturing sector by 2020 - and move up in the index ranking.

ASEAN’s leading export manufacturing hubs

ASEAN’s frontline economies are rapidly growing as manufacturing hubs at the back of lower labour costs, larger consumer markets, constantly improving infrastructure and increased quality in human capital.

Vietnam

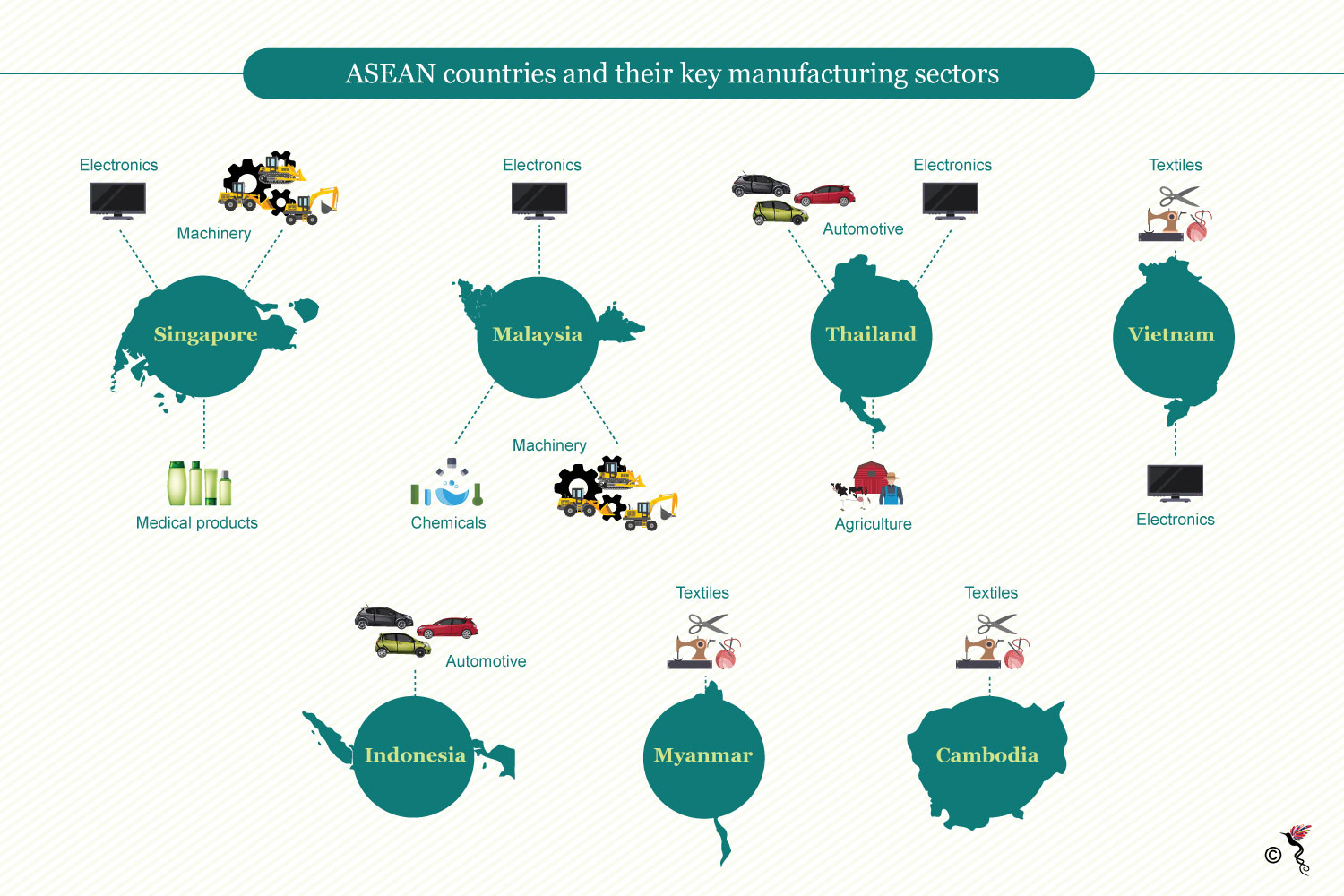

Leading the way is Vietnam, mainly due to its' speed to market capabilities and strong focus on social compliance - at factory and societal level. In terms of legal structures and enforceability, Vietnam is both a reliable and consistent jurisdiction to operate in. The country recently, in its efforts to make the export manufacturing sector more attractive and investor friendly, begun rolling out policies to promote English as medium of business at management level as well as assessing investment in new machineries and automation. Same time, as factories begin to move from urban to rural areas, the cost for labour is significantly reducing thus again making inward investment attractive. Other driving factors also include the growing number of young skilled labour and a stable political environment.

Indonesia

Automotive is one of the priority industries for Indonesia in terms of national interest, economic growth and increased productivity. Indonesia's improving political conditions, stabilising currency value, increasing domestic demand from its fast-growing middle class coupled with the implementation of progressive economic policies is expected to drive export manufacturing activities in the country. In order to increase production as well as further boost and expand the sector, Indonesia is looking to attract investors from the automotive sector globally.

Malaysia

Malaysia is a favoured export manufacturing hub - driven by its pro-business policies, stable economic and political environment, urbane financial facilities and well-developed infrastructure. The country is a leading export manufacturer in terms of electronic products which constitutes high-end consumer electronics and information and communication technology (ICT) products. Other key manufacturing exports include petroleum, chemicals and machinery.

Thailand

Thailand is also an attractive export manufacturing hub - at the back of the nation's flourishing domestic consumer market, skilled labour force and signing of free trade agreements. The nation also houses decent infrastructure and is strategically located at the crossroads of ASEAN, China and India. Primary driver of export manufacturing in Thailand is its food and agricultural products. Other key segments within the export manufacturing sector includes electronic appliances, textiles, computers, furniture and fitting, petrochemicals and automobiles. Thailand is also swiftly moving into green automobiles and high valued electronics like ICT. The country's main exports are to developed economies - namely Japan and US. However, given its low unemployment rate and resultant demand for higher wages, Thailand's competitive standing compared to the rest of ASEAN's top key export manufacturing hubs may drop with this being the driving factor. Labour and operating costs are typically the determining factor for organisations when deciding to relocate aside from tax incentives, transportation and logistics. This factor is consistent with the export manufacturing competitive index projection that shows a smaller leap in ranking for the country.

Singapore

Singapore is consistently growing as a leading export manufacturing hub in ASEAN - driven by its corruption-free government, advanced infrastructure and well-educated workforce. Singapore's economy depends heavily on various export manufacturing - including petrochemicals, electronics, engineering and biomedical. Singapore also offers low corporate tax rate (lowest in ASEAN) and offers incentives such as cash pay-outs for training as well as research and development. Singapore's highly developed free-market economy offers a host of opportunities to investors - being one of the most business-friendly and competitive economies worldwide. However, there is a growing concern that Singapore will become a less competitive manufacturing hub as business costs is expected to increase - compared to other ASEAN countries. There may be further deterioration may also due to the country's heavy dependence on China, US and the Eurozone export market. Thus, explaining the slight drop in the projected ranking for Singapore's manufacturing competitive index.

Key types of export manufacturing in selected ASEAN member countries.

ASEAN rising prominence as an export manufacturing destination

It is without a doubt, ASEAN is fast becoming a rapidly growing economic region, driven by its large consumer population of 625 million, active economic reforms, trade liberalisation to encourage competitiveness and ASEAN-China's close trade and investment ties. The products of ASEAN's manufacturing hubs are expected to be channelled into high demand markets like China and Japan. These products range come from a wide range of industries including autos, electronics and textiles. The long term growth and trade prospects for ASEAN looks promising in the years to come - with intra-ASEAN trade expected to grow rapidly as well.

Trade liberalisation also plays a pivotal role in accelerating the growth of ASEAN’s manufacturing output and distribution via regional trade agreements such as ASEAN Free Trade Agreement (FTA) 2010. The ASEAN Economic Community has played a prominent role in growing the export manufacturing market in Southeast Asia through infrastructure development, liberalisation of foreign-direct investment rules and improving the ease of doing business for both foreign and domestic firms investing anywhere in ASEAN.

With the presence of the ASEAN Economic Community (AEC) since 2015, ASEAN continues to develop as an open and integrated market - that allows for increased product choices at competitive costs. As the ASEAN Secretariat outlines it, "The AEC initiatives have supported businesses to explore markets and extend their market reach at reduced costs through simplified cross-border trading processes and improved investment climate".

ASEAN can further stimulate substantial growth in the manufacturing sector by continually implementing the AEC integration plan to increase intra-regional and global trade, attract more production from large corporations and adopt the application of big data and mobile Internet - where many ASEAN manufacturing firms may lag behind their competitors.