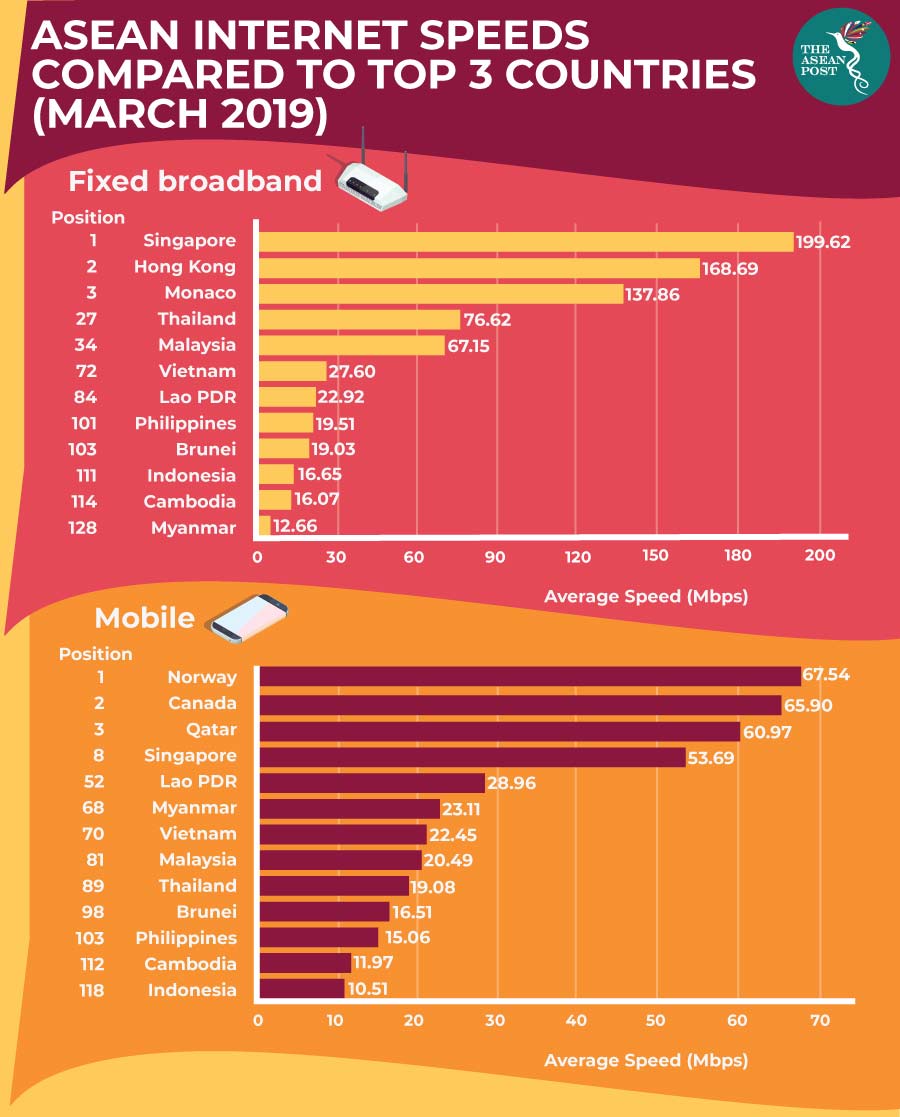

At the forefront of technology in ASEAN, it is no surprise that Singapore’s fixed broadband speed of 199.62 megabits per second (Mbps) was the fastest in the world in March.

The city-state’s broadband speed beat the likes of Hong Kong (168.69 Mbps) and Monaco (137.86 Mbps), according to Ookla’s Speedtest Global Index – a widely used indicator to measure internet speeds across the globe.

Within the ASEAN region, Thailand (76.72 Mbps, 27 in the world) and Malaysia (67.15 Mbps, 34 in the world) finished second and third in the fixed broadband category, respectively.

Meanwhile in the mobile internet category, Singapore’s 53.69 Mbps ranked it eighth fastest in the world. It is still the best ASEAN nation in the category, beating Lao and Myanmar that finished 52 (28.96 Mbps) and 68 (23.11 Mbps), respectively. Norway (67.54 Mbps), Canada (65.90 Mbps) and Qatar (60.97 Mbps) finished top three in the category.

Providing free analysis of internet access performance metrics, an unprecedented total of more than 20 billion tests have been run by Ookla’s Speedtest since 2006.

The speed of an internet connection determines how enjoyable the experience is for an end-user. If a webpage or application takes a long time to load, users tend to skip past it. Interactive applications, such as video streaming, online games and video chats, require a fast Internet connection as well.

In corporate settings, uploads speeds are important for sharing large files, high-resolution graphics and high-definition video with clients. Modern conferences today increasingly use multimedia presentations, large screens, live broadcasting and video conferencing, and attendees – many of whom will come to meetings with two or three devices that can sap a property’s Internet bandwidth – will demand access to high-speed Wi-Fi.

As Speedtest data is derived from actual speed tests conducted by users at various locations, they reflect the availability and affordability of connections in each country.

Speed at a price

The Alliance for Affordable Internet advocates for one gigabyte (GB) of mobile prepaid data to cost no more than two percent of the average monthly income in a particular country, which would enable all income groups to afford a basic broadband connection. However, this formula is less useful when there is a big disparity in income levels.

Telecommunication providers (telcos) typically charge a tiered pricing structure, charging more for faster connection speeds. This limits the take-up to large corporations.

Cable.co.uk commissioned a survey on the average cost of one GB of mobile data late last year and found a big disparity between countries. Within ASEAN, Myanmar has the lowest cost per GB at US$0.87/GB, followed by Malaysia (US$1.18) and Indonesia (US$1.21). Globally, these countries placed ninth, 15 and 17, respectively.

The analysis of 6,313 mobile plans in 230 countries found that the average price of one GB of mobile data was US$8.53, with Zimbabwe having the costliest price at US$75.20. Interestingly, Singapore was 81 – charging an average of US$3.67. India (US$0.26/GB), Kyrgyzstan (US$0.27/GB) and Kazakhstan (US$0.49/GB) had the cheapest rates in the world.

Strong growth in Myanmar

With Myanmar’s telecommunications sector rapidly expanding since 2014 when Qatar-based Ooredoo and Norwegian-owned Telenor Group entered the market to break a monopoly set by state-owned Myanmar Posts and Telecommunications (MPT), its citizens have seen a reduction in prices and wider coverage due to the expansion of the country’s telecommunications infrastructure.

On Monday, Mytel – backed by the Myanmar government and Vietnam’s largest telecommunications company, Viettel – announced it was now Myanmar’s third largest telecommunications operator in the country with more than 14 percent market share after just a year of operations.

MPT, Telenor and Ooredoo make up 44.5 percent, 28.4 percent and 13 percent, respectively of the market there.

With Myanmar poised to receive even more foreign investment in its telecommunications sector, its population of around 52 million is set to enjoy increased connectivity, faster speeds and cheaper prices unmatched elsewhere in Southeast Asia.

Related articles: