While electric vehicles (EVs) continue to capture the attention of consumers in ASEAN, policies and subsidies in line with those found in countries leading the switch to EVs will make electric vehicles a more attractive proposition for the region.

EVs, including hybrid electric cars, can drastically reduce carbon emissions released into the environment. Compared to conventional cars that release unhealthy amounts of carbon dioxide, carbon monoxide and nitrogen oxide into the environment, battery-electric cars effectively produce zero-emissions from their tailpipes.

Bloomberg Energy Finance last year predicted that 54 percent of new cars sold in 2040 will be EVs, accounting for 33 percent of the global car fleet by then.

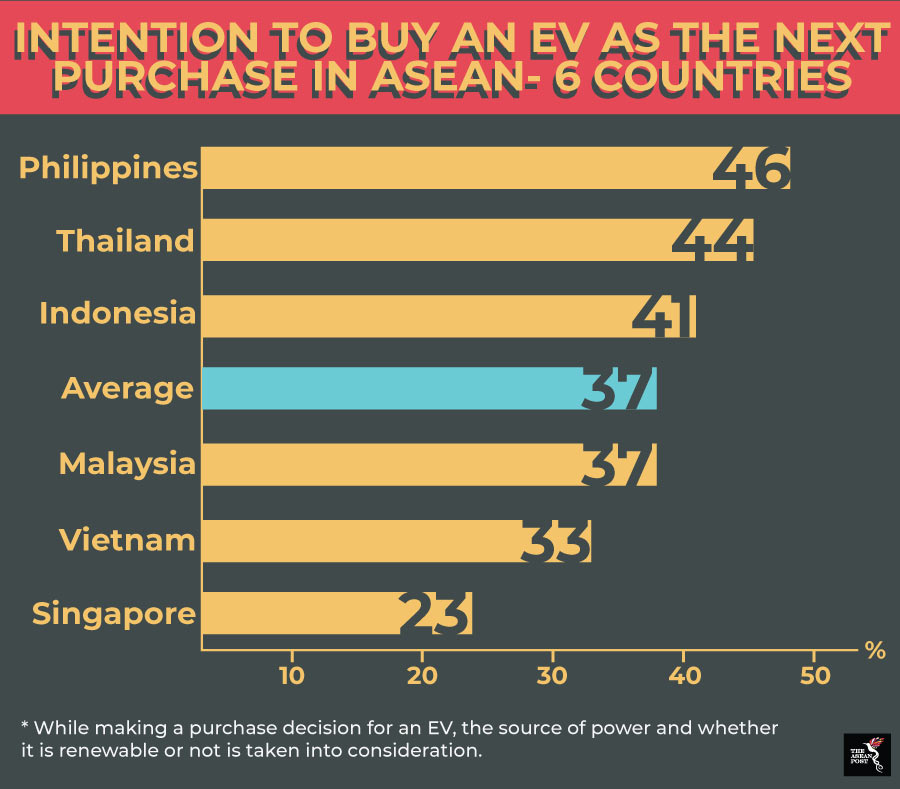

A study commissioned by Nissan last year found that a third of Southeast Asian consumers are open to buying an EV. Titled ‘Future of Electric Vehicles in Southeast Asia’, the study found that while EV sales in ASEAN are generally weak – consumers in the Philippines, Thailand and Indonesia were the most enthusiastic about the future of EVs.

Proper policies and incentives will go a long way in getting more Southeast Asians to drive EVs.

A report published by the ASEAN Secretariat in February titled ‘ASEAN Fuel Economy Roadmap for Transport Sector 2018-2025: With Focus on Light-Duty Vehicles’ found that strong EV sales in the Unites States (US), Europe, Japan and China are mainly driven by policy support and a minimum subsidy of US$3,000.

EVs are exempted from registration taxes in China, Denmark, Germany, India (partly), the Netherlands, Norway, Sweden and United Kingdom (UK). Apart from monetary incentives, policies such as preferential access to otherwise restricted zones (e.g. low-emission zones), priority parking, road toll exemptions and the right to use bus lanes provide incentives to buy EVs – especially in urban areas.

As of 2018, direct subsidies or substantial tax exemptions, especially in countries with high vehicle registration taxes at the time of purchasing an EV, have the strongest impact on EV sales. Norway, the Netherlands and Sweden have EV sales shares in the order of 3.4 percent (Sweden) to 6.4 percent (Norway) while providing monetary incentives in the range of US$5,000 to US$15,000 to EV buyers.

Policies in ASEAN

Speaking at a seminar on EVs in Bangkok last Friday, experts reminded the Thai government that high prices for EVs – along with the lack of EV charging stations – hamper its viability among buyers in the country.

The director of Thailand’s Tax Planning Office at the Excise Department, Nattakorn Uthensut, was then quoted by Thai media as saying that subsidies in other countries are helping boost sales of EVs – pointing out that the US subsidises US$7,500 for every new purchase.

While the Board of Investment of Thailand (BOI) has offered investment privileges for EV manufacturers since 2017, the starting prices of EVs is still quite high in Thailand – ranging from US$31,921 to US$63,842 – compared to gasoline vehicles’ that range from US$19,152 to US$22,344.

As Ipsos Consulting noted in a report on the ASEAN auto industry in June 2018, BOI’s incentives – which include tax holidays and import tariff exemptions – show how vehicle manufacturers are positioning themselves to be best placed to benefit from growing market demand for EVs domestically. As evidence of this, 40 percent of vehicles sold in Thailand in 2017 by Mercedes were plug-in hybrids. The figure for BMW was 13 percent over the same period.

In Indonesia, the government is set to issue regulations for EV owners to receive low-emission incentives for luxury vehicles, reducing the tax from a maximum of 125 percent to between 0 to 30 percent based on a vehicle's carbon dioxide emissions.

Even Brunei, ASEAN’s smallest country, is already embarking on a shift towards EVs.

In March, Brunei announced regulations to reduce the country's carbon dioxide emissions and fuel subsidies. It is also planning to introduce a pilot project to have at least 10 percent of cars on its roads by 2035 to be EVs.

The country’s Minister of Energy, Manpower and Industry Hj Mat Suny Hj Md Hussein noted that as many as 1,960 fuel-efficient and hybrid cars have been registered in Brunei since 2012, saving the country more than US$1.04 million in subsidies and reducing carbon dioxide emissions by 4,361 metric tons.

As EVs become more commonplace on the region’s roads, ASEAN governments and EV car manufacturers should look at more subsidies and tax incentives in order to better develop the industry, boost sales and combat climate change.

Related articles: