Blockchain came into the popular lexicon along with other terms such as cryptocurrency and artificial intelligence as part of the larger movement of new disruptive technologies that has swept the world. Initially seen as a disruptor to traditional banking, many are now starting to understand the appeal of blockchain and its potential to alter the landscape of the financial sector.

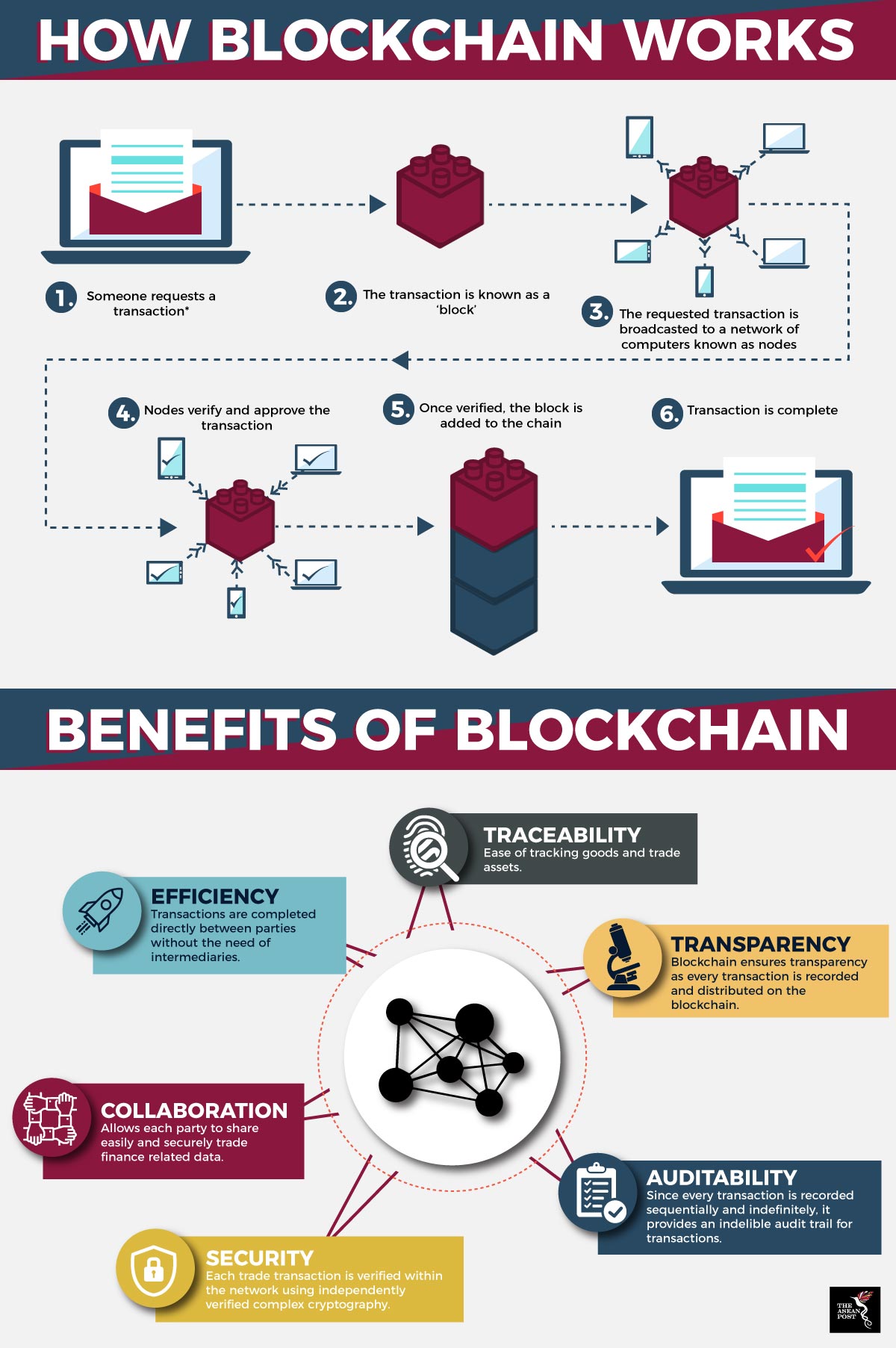

Blockchain is essentially a digital ledger consisting of blocks of information that are kept secured by a cryptographic key. Each block is linked to other blocks and for each change that is needed to be made on the ledger, other computers have to verify it first. Before this, blockchain was seen as being disruptive to banks because it eliminates the need for banks to act as an intermediary authority to oversee transactions. Because of how information is distributed and the manner in which the system requires verification, blockchain is now seen as a tool that could democratize financial services.

Major banks the world over are already beginning to embrace blockchain. At the moment, IBM is developing blockchain-based technology for banks such as Deutsche Bank, HSBC and UNicredit. With more banks beginning to come onboard, blockchain could become a mainstream technology utilized by the financial sector in the near future. The World Economic Forum (WEF) forecasted that by 2025, 10 percent of global gross domestic product (GDP) will be stored on blockchains or blockchain-related technology.

Blockchain benefits

One of the main attractions of blockchain is its unique security feature. Unlike banks, this security feature is inherent in its systems rather than a bank's security policy. Blockchain’s distributed ledger technology establishes its own trust and security networks through peer-to-peer security efforts. This makes hacking much harder as blockchains are decentralised and distributed across networks that are continually updated and kept in sync. Since they are decentralised, blockchains do not have a single point of failure unlike banks that are managed by a central security system.

Source: Various sources

Aside from security, blockchain could also make banking more efficient and transparent. Traditional banking is often seen as bureaucratic and inaccessible. With blockchain technology, money can be transferred with ease through peer-to-peer networks without having to incur extra fees which most banks charge. Blockchain technology is also available for everyone to use. Since its systems are easy to adapt, many fintech companies are taking advantage and using it to provide banking opportunities to those without access to banking. Southeast Asia’s unbanked population is one of the largest in the world, with 27% of the region’s people currently without a bank account.

Blockchain in Southeast Asia

While still not `universally accepted, blockchain is slowly making inroads in the region. Indonesia was probably the first country in the region to seriously consider blockchain technology and its potential. In January this year, Bank Indonesia announced plans to launch its own digital currency that is backed by blockchain technology. It would function similar to how cryptocurrencies function since it relies on blockchain technology. However, unlike cryptocurrencies which are decentralised currencies, the digital rupiah will be issued by the country’s central bank, Bank Indonesia.

Meanwhile, banks in Thailand are already looking to embrace blockchain. In March, 14 banks came together and jointly launched the Thailand Blockchain Community Initiative. This initiative will also involve seven corporations and state enterprises. The banks taking part there include some of Thailand’s biggest banks such as Bangkok Bank, Krung Thai Bank, Siam Commercial Bank and Kasikornbank. IBM has been tasked to assist with the technology behind blockchain for the initiative.

An example of fintech firms utilising blockchain to make banking more efficient and cheaper can be seen at work in the Philippines. In 2017, the Philippines received US$28 billion in cash remittances from its migrant workers. The problem with cash remittances however, is that banks who carry out these transactions charge a small sum for the service. Bitcoin and blockchain based company Coins.ph now allows these migrants to move their money back to the Philippines in a cheaper and more seamless way.

Blockchain technology is starting to gain a foothold in the Southeast Asian financial sector. There are still so many uses for this technology that have yet to be explored. With the proper support from banks and the government, blockchain technology can make banking more efficient and accessible for all.