The story of economic growth within the Association of Southeast Asian Nations (ASEAN) is a remarkable one. Having successfully weathered economic headwinds like the 1997 Asian financial crisis and the 2008 global economic meltdown, ASEAN’s gross domestic product (GDP) has more than quadrupled since 1999, from US$577 billion in 1999 to US$2.5 trillion in 2016, making it the sixth-largest economy in the world.

Moving forward, the region is poised to maintain its strong and steady economic progress with 2018 growth rates averaging 5.3 percent according to forecasts by the Asian Development Bank (ADB). These formidable numbers are down to several key factors.

A growing workforce

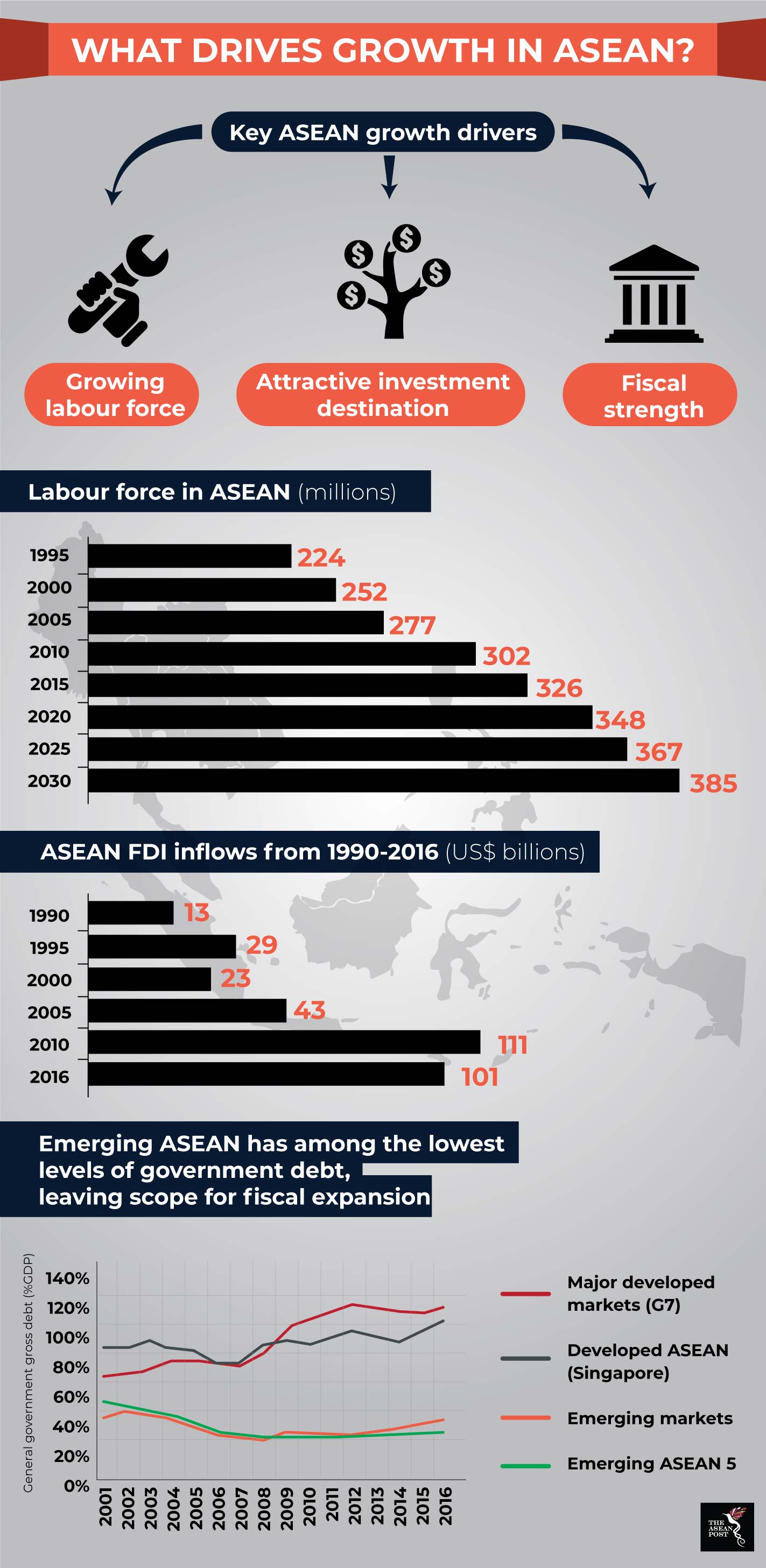

From a supply-side perspective, a significant expansion of ASEAN’s labour force has been an integral contributor to the region’s overall growth. It is estimated that over 100 million people have joined the region’s workforce over the past 20 years and this trend is only expected to follow an upward trajectory.

Projections by the International Labour Organisation (ILO) indicate that ASEAN will add another 59 million people to its workforce by 2030 – making it the second largest growing labour force in the world behind India. This means ASEAN would stand to account for 10 percent of the global labour force by 2030 with 175 million people – the third largest labour force in the world behind China and India.

On the other hand, demand-side growth factors for ASEAN’s labour would be driven by an ever-expanding middle-income segment. This group is slated to represent two-thirds of the overall population by 2030, more than double compared to 29 percent in 2010. This emerging middle class would be more willing to pay for products of higher quality while expecting convenience and wider choice, thus driving demand for more goods in the market. This increased consumption would impact the labour market directly, increasing labour demand as businesses of the future adapt to changing market trends.

An attractive investment destination

A burgeoning workforce which is advanced and professional will also be a pull factor for foreign direct investment (FDI) into the region. Despite rising capital flow volatilities with the recent rate hikes in the United States (US), the long-term outlook for ASEAN markets is still relatively positive.

ASEAN has weathered similar global outflows before and still managed to record substantial FDI growth between 1990 and 2016; becoming the fourth most popular FDI destination globally and the second-largest destination in Asia.

Source: PricewaterhouseCoopers

ASEAN’s share of FDI inflows has been dominated by the region’s manufacturing sector as well as the financial services sector with the European Union (EU), China, South Korea and Japan being major investors. FDI in CLMV (Cambodia, Lao PDR, Myanmar and Vietnam) economies rose by eight percent year-on-year in 2018 driven mainly by manufacturing and infrastructure.

Amid global protectionist undertones and a looming trade war between the US and China and the EU, ASEAN would also stand to benefit from intraregional FDI. Intra-ASEAN investment has risen significantly – 14 percent year-on-year since 2016 focussing mainly on the agricultural and mining sectors. Internal investment accounted for a record 25 percent of all investment in ASEAN economies in 2016 and this trend is projected to continue into the future.

Fiscal strength

ASEAN’s low levels of debt exposure and recovering foreign reserves also make it a strong region for growth and helps negate the negative effects of global markets volatility. Emerging ASEAN markets enjoy low government debt levels of around 39 percent of GDP in 2016. This is lower than the average for emerging markets worldwide at 47 percent and significantly lower than developed economies of the Group of Seven (G7) at 120 percent.

Such low levels of government debt help emerging ASEAN economies to adopt expansionary fiscal policies by increasing government expenditure to further boost economic expansion. Moreover, local currency denominated debt would be a more preferred option as rising interest rates in the US would incur higher debt servicing costs due to its debt being denominated in US dollars.

In addition, ASEAN economies have also improved their foreign exchange reserves which would be key in safeguarding against capital flow volatility. Strong foreign reserves serve as a vital indicator towards the stability of the economy and offer protection against external shocks which could affect short-term debt repayment.

Foreign reserves in ASEAN have recovered to the levels seen in 2013-14, having recorded strong growth last year. Indonesia and Thailand have taken the lead in this regard which would allow them more economic wiggle room to invest in core infrastructure, education and other aspects of their economy in order to fuel domestic growth.

ASEAN remains strong amid worries of an economic downturn due to prevailing protectionist sentiments. To guard against uncertainty, the next logical step in ASEAN’s growth would be to further develop economic linkages between the 10 economies to bolster trade and increase investment collectively. While the region remains a haven for optimistic investors, ASEAN would be well advised to remember that things can always change.