The oil and gas industry has seen turbulent times over the last 10 years, with the 2008 financial crisis as a turning point for the industry as a whole. Oil prices peaked at US$145 per barrel during that period, declining by more than 70 percent by the end of the year to US$40 per barrel. Though prices returned to normal by 2011 and stabilized until mid-2014, another crisis in June 2014 ensured that the oil industry would never be the same.

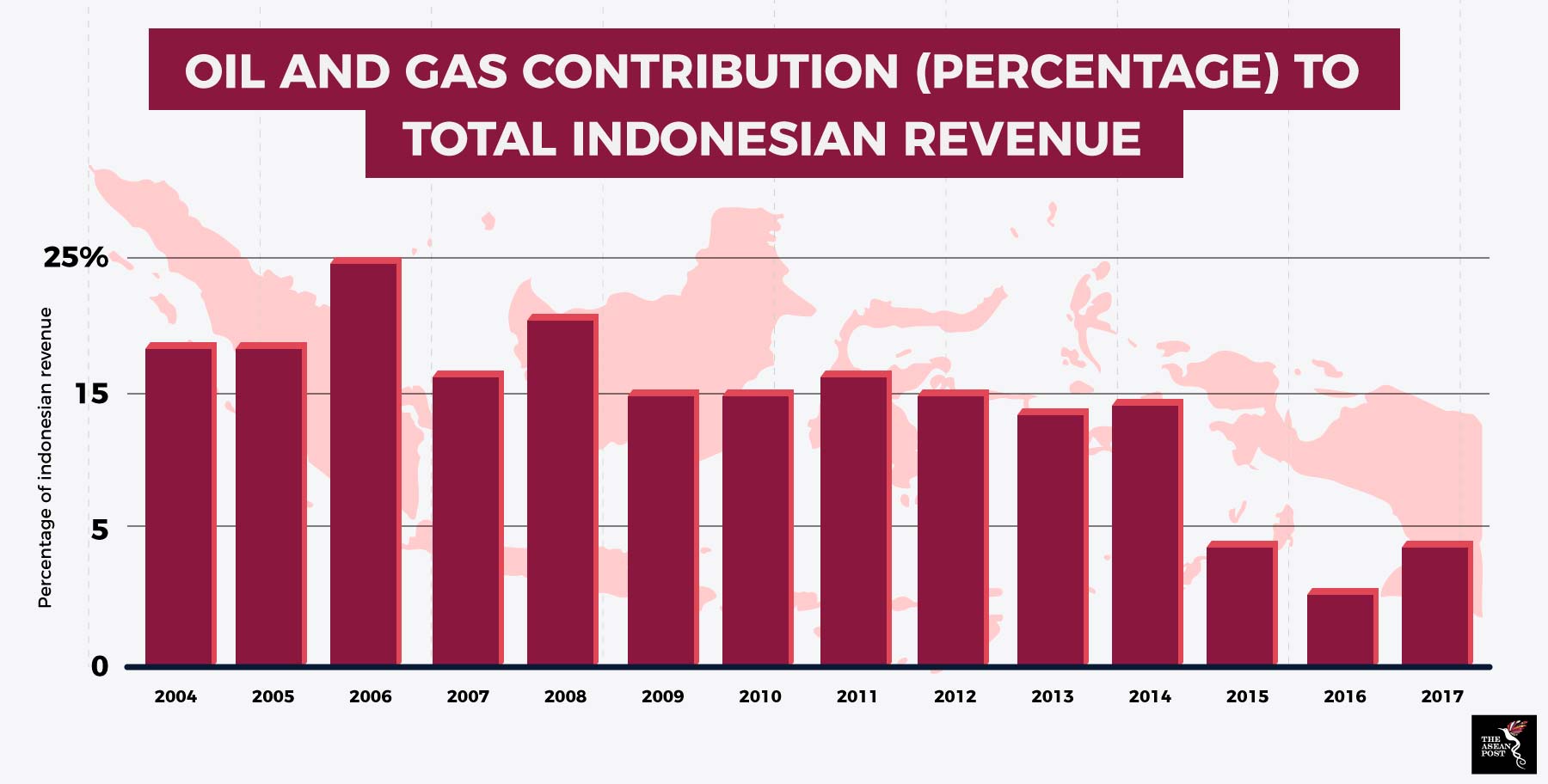

One of the victims of the volatile oil market has been Indonesia. Indonesia’s oil and gas sector used to be one of the highest contributors to the Indonesian economy. Just over 10 years ago, PwC data from a report titled Oil and Gas in Indonesia 2017 revealed that the oil and gas industry contributed about US$45.6 billion to the Indonesian economy, accounting for at least 20 percent of state revenue from 2004 to 2006.

The contribution of oil and gas to Indonesia’s national revenue experienced the sharpest decline during the oil crisis which occurred during 2014 to 2015. Due to falling demand for oil, as well as an oversupply of the commodity, prices dropped from US$115 a barrel in June 2014 to under US$35 per barrel at the end of February 2016, according to a report by Kenneth Rogoff on the World Economic Forum in 2016. By 2014, the oil and gas sector accounted for only 14 percent of national revenue, dropping further to 4 percent in 2015 and a mere 3 percent in 2016.

Despite a growing economy with increasing demand for energy, the oil and gas sector in the country is shrinking, with its glory days long past. According to an analysis of Indonesia’s oil and gas sector last August, investment for oil and gas exploration in Indonesia contracted to US$100 million in 2016, down from US$1.3 billion in 2012.

Source: Various sources

Source: Various sources

Experts noted that Indonesia has already launched initiatives to revitalise the sector, citing the nation’s Energy and Mineral Resources minister, Ignasius Johan, who anticipates US$200 billion in investment over the next 10 years through the offering of incentives such as tax-free imports of drilling equipment and cost recovery. However, Southeast Asian oil analyst, Johan Utama says that Indonesia’s constantly changing regulations paint a picture of an unstable industry, which would actually serve to drive investors away.

PwC’s Oil and Gas in Indonesia 2017 report also highlighted that Indonesia is facing a depletion in oil resources, and is facing difficulty discovering new reserves as well. In a way, this may represent a chance for Indonesia to move away from fossil fuels and to invest further in renewable energy.

Indonesia is already trying to refocus its efforts towards consolidating its geothermal resources. At the moment, according to the International Energy Agency (IEA), Indonesia is the third-largest geothermal power producer in the world. The Energy Ministry plans to raise the nation’s geothermal production capacity to 5,000 MW by 2025. The increase in geothermal energy could see a decrease in Indonesia’s reliance on oil.

Aside from that, the government has announced that it is looking to convert old oil refineries into biodiesel plants. The government is hoping that this move would reduce energy imports and improve the country’s current account deficit.

The International Renewable Energy Agency (IRENA) also noted in a 2017 report that Indonesia has set a goal to achieve 23 percent renewable energy use in its total energy supply by 2025, with the target rising to 31 percent by 2050. According to the IRENA report, Indonesia has the potential to meet its target even sooner, by 2030. IRENA also notes that an accelerated pursuit of Indonesia’s target could see associated economic benefits to the country as a whole. These include the reduction of energy systems costs as well as the costs of air-pollution and carbon-dioxide emissions, which would help the country save up to US$53 billion per year by 2030 – about 1.7 percent of its projected gross domestic output in 2030.

IRENA also pointed out, however, that investing in renewable energy will be expensive. Perhaps instead of focusing on trying to restore the nation’s oil and gas industry to its OPEC glory days, Indonesia could shift its energy and resources towards trying to consolidate its renewable energy sector. Such a move would not only save costs, it would also be beneficial for future generations to come.

Related articles:

The role of fuel subsidies in Southeast Asia

Will oil royalty finish off Malaysia’s PETRONAS?