The Monetary Authority of Singapore (MAS) and Indonesia’s financial services authority, Ororitas Jasa Keuangan (OJK) recently signed a Memorandum of Understanding (MoU) to strengthen cooperation in fintech and to foster innovation in financial services between the two nations.

The signing of the MoU took place on the side-lines of the Indonesia-Singapore Leaders’ Retreat in early October.

The MoU will facilitate information sharing on emerging market trends and developments in the fintech industry as well as to promote joint innovation projects between the two. As per details of the agreement, the relevant authorities of both countries would establish a framework to aid fintech companies to better understand the regulatory regime and opportunities in each jurisdiction. As such, this will significantly lower the barriers of entry for fintech companies looking to expand to the other’s market.

Ravi Menon, Managing Director of MAS said the agreement would reap benefits that would also have a positive impact on fintech in the ASEAN region.

“Singapore and Indonesia have vibrant fintech sectors, and MAS and OJK share a common interest in promoting innovation in financial services to enhance financial inclusion within the region,” he said, adding that the “MoU presents a good opportunity to strengthen cross-border efforts to promote the fintech ecosystem in ASEAN.”

Fintech development

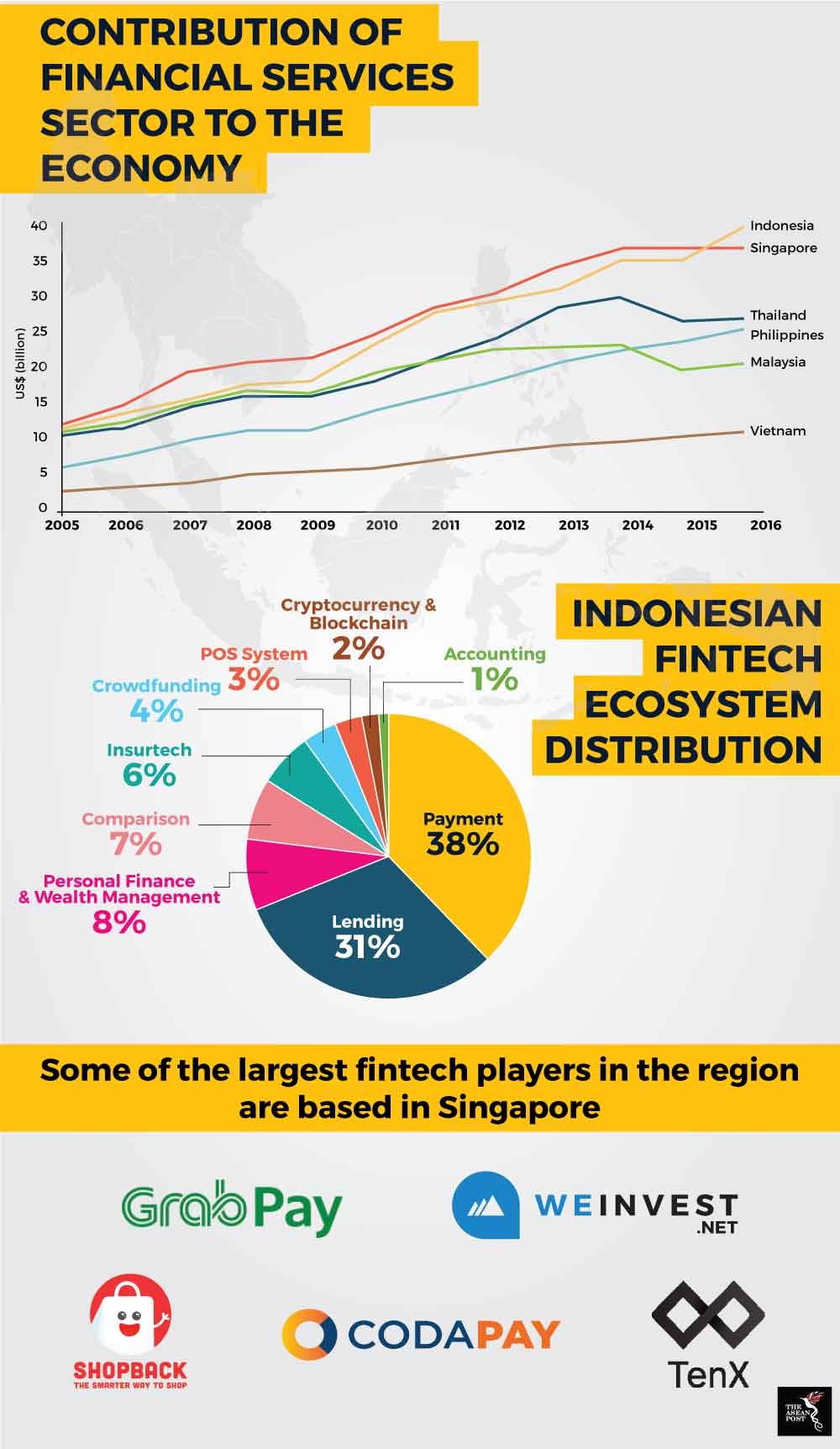

The regional financial services sector has seen rapid growth since 2005 and this trend is projected to follow an upward momentum thanks to developments in fintech.

In 2016, investments in the Southeast Asian fintech market grew 33 percent from US$190 million in 2015 to US$252 million. As of September 2017, total investment had already exceeded that of 2016 at US$338 million driven mostly by seed and angel investors.

Singapore has long been the paragon of the region’s financial sector. The country has seen disruption in its financial sector in the form of fintech companies. The island republic is home to one of the most successful fintech regulatory sandboxes in the world, which launched in June 2016.

Source: Various

The sandbox allows for the freedom of experimentation in a controlled environment where specific legal and regulatory laws are relaxed for the duration of the sandbox period. Besides that, the technologies developed are also expected to be deployable on a broader scale within Singapore.

However, countries like Indonesia are fast catching up in terms of building, scaling and deploying fintech applications. Unlike Singapore, Indonesia benefits from an immense market potential – upwards of 264 million people – that is also a contributing factor to fintech enthusiasm.

In 2016, Indonesia leapfrogged Singapore as the largest financial services market in ASEAN in terms of financial gross value add (GVA). In the same year, there were only around 50 fintech firms in Indonesia but now there are more than 150 such firms operating in the country.

In late 2017, the Indonesian central bank introduced its fintech sandbox which allows fintech players to test their services for six months under the regulatory eye of the central bank. According to KPMG, Indonesia is home to more than 300,000 active users of e-wallets, prompting the central bank there to better regulate fintech services for fear that it may cause systemic risks to the prevailing financial system.

Indonesia has also indicated that it is willing to experiment with new technologies like blockchain which could potentially be a more secure operating framework than conventional banking and financial operating structures.

In January this year, the Indonesian central bank, Bank Indonesia (BI) announced plans to launch its own digital currency backed by blockchain technology. It would work similarly to cryptocurrencies but unlike cryptocurrencies which are decentralised currencies, the digital rupiah will be issued by BI.

BI’s relative friendliness towards blockchain has emboldened Indonesian banks to explore possibilities with blockchain too. According to reports, five major banks – Bank Negara Indonesia, Bank Rakyat Indonesia, Bank Mandiri, Bank Danamon and Bank Permata – are toying with the idea of implementing blockchain in their systems.

Singapore’s tried and tested fintech infrastructure and Indonesia’s eagerness to capitalise on fintech’s potential makes for a lucrative strategic partnership between the two. In the long run, the resultant ideas and initiatives from the MoU could have a spill over effect on other ASEAN economies which would only make for a more robust regional fintech industry.

Related articles: