Malaysian state-owned private equity firm, Ekuiti Nasional (Ekuinas) has divested the entirety of its 60 percent equity interest in cross-border mobile cash transaction firm Tranglo to the Hong Kong-based TNG Fintech Group for US$27.6 million.

This sale gives Ekuinas an Internal Rate of Return (IRR) of 26.8 percent and a money multiple of 1.96 times the capital invested.

Ekuinas acquired its stake in Tranglo in 2015 for US$13 million, marking its maiden investment in the technology, media and telecommunications (TMT) industry. Today, Tranglo is a leading cross-border mobile transaction gateway company that facilitates airtime transfer and money remittance transactions operating in Southeast Asia, Hong Kong and China.

Ekuinas’ Chief Executive Officer (CEO), Syed Yasir Arafat expressed his confidence that Tranglo will continue to sustain its strong performance over the mid-term.

“Throughout the investment period, Ekuinas worked closely with Tranglo’s management team to expand its airtime transfer and money remittance network. In terms of performance, Tranglo successfully grew its money remittance volume by 15-fold since acquisition,” he said.

TNG which purchased the 60 percent stake is an industry pioneer providing next generation financial services to the 1.2 billion unbanked population in Asia. It's flagship e-Wallet application in Hong Kong, TNG Wallet, was launched in November 2015 and has since become one of the most popular e-wallets in the region.

According to Arafat, the selection of TNG as a buyer for Ekuinas’ stake was made after a rigorous sale process that attracted global interest from several parties.

“It was done on a merit-based process, where capability, resource and alignment with management’s vision were equally as important as price. We want to ensure that the next partner would further catalyse the business,” he explained.

“As such, it is important that the buyer has the necessary expertise, experience and capabilities to not only continue operating the business but more importantly, is equipped with the resources to develop and push the business further.”

The unbanked majority

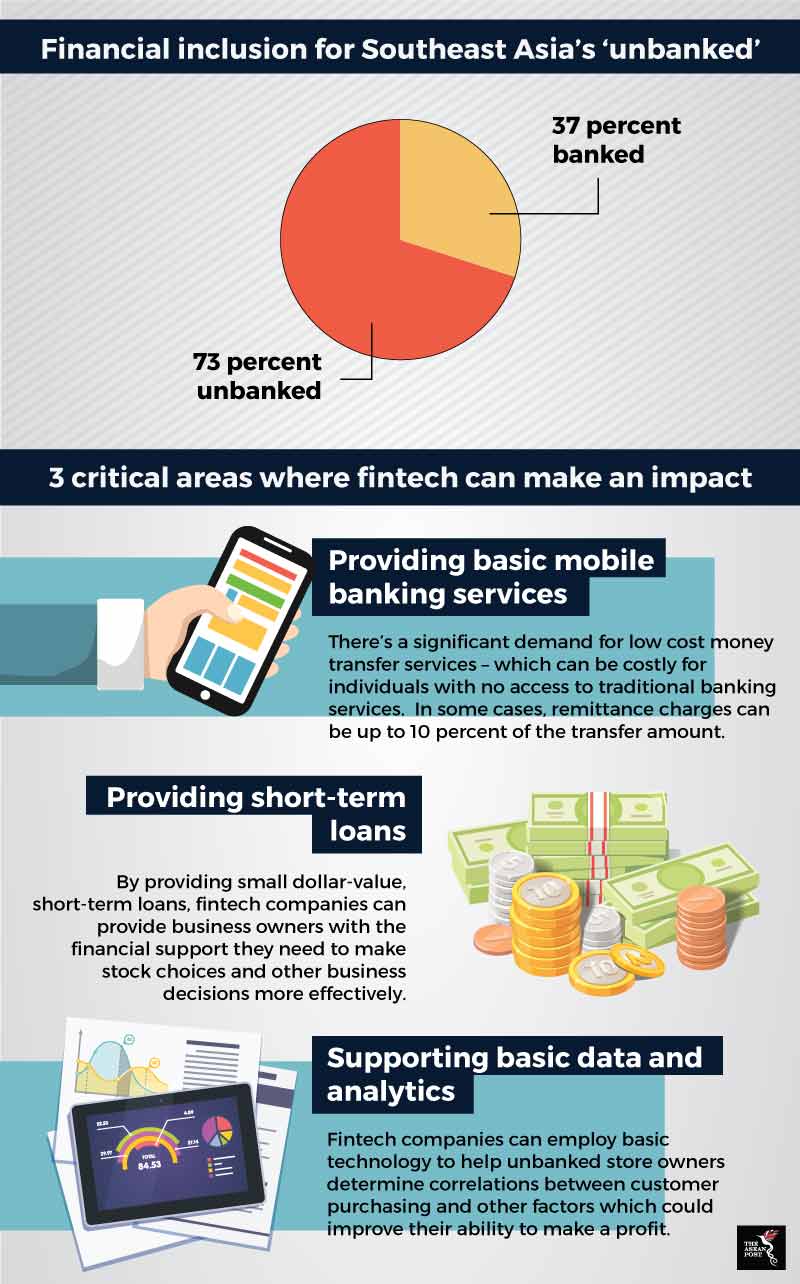

A vast majority of Southeast Asians still do not have access to basic banking facilities let alone a savings account or access to credit facilities.

Source: KPMG

According to a study by KPMG, only 27 percent of those living in Southeast Asia have a bank account – leaving a huge gap in banking penetration with around 438 million unbanked individuals. In poorer countries like Cambodia, the numbers are even lower at just five percent.

The traditional banking model will always make it difficult for those who aspire to secure credit. The need for paperwork will always be there, even though there are alternative ways to prove that one would be a safe credit risk.

This circumstance translates to opportunity for fintech companies to swoop in with digital banking solutions like e-wallets, e-remittances and peer-to-peer lending. Coupled with increasingly cheaper smartphones, wider 3G and 4G network coverage and more affordable mobile data plans, fintech is fast becoming a gamechanger for banking in previously unbanked communities in rural parts of the region, thus helping to create a more inclusive banking ecosystem.

The TMT industry is becoming increasingly competitive, driven by disruption from new fintech entrants. As such, the decision to divest follows Ekuinas’ strategy to continue crystallising its assets when the time and economic climate are right as well as to identify a strategic partner that would be able to push the business into its next phase of growth.

This is the firm’s ninth divestment thus far, bringing its total realisation proceeds to more than US$480 million.

Amid an uncertain global trade and investment environment, Ekuinas has remained resilient and has continued to deliver strong performance for eight consecutive years since its founding in 2009.

In light of global challenges to the business environment brought about by a surge in mega funds from developed nations, the Fourth Industrial Revolution and disruptive technologies, Ekuinas has been equally adaptive as it continues to create sustainable wealth through investments while fulfilling its social objectives.

Ekuinas expects to leverage on its pool of talent and expertise to nurture high-potential talent to ensure it remains competitive regionally, if not globally. In line with its mandate to create Malaysia’s next generation of leading companies, Ekuinas is on track towards putting the country on the map as a hub for successful homegrown businesses and talent.

Related articles:

Can fintech help rural Indonesians?