A new set of laws governing cryptocurrencies has been introduced in Thailand. According to the government, the new laws aren’t intended as a blanket ban on cryptocurrencies but serve to regulate such digital assets and tokens while protecting investors from the uncertainties of the cryptocurrency market.

This new piece of legislation will also come down hard on the illicit use of cryptocurrency, especially in money laundering, tax evasion and unauthorised transactions. Fraudulent filings could see a perpetrator face a five-year jail term. Those involved in unauthorised digital token transactions could face a fine of up to US$16,000 or two years in jail. Allowing other individuals to carry out transactions using one’s own accounts is also punishable under the new law with a jail term of up to a year and a fine of up to US$3,100.

Regulating cryptocurrency

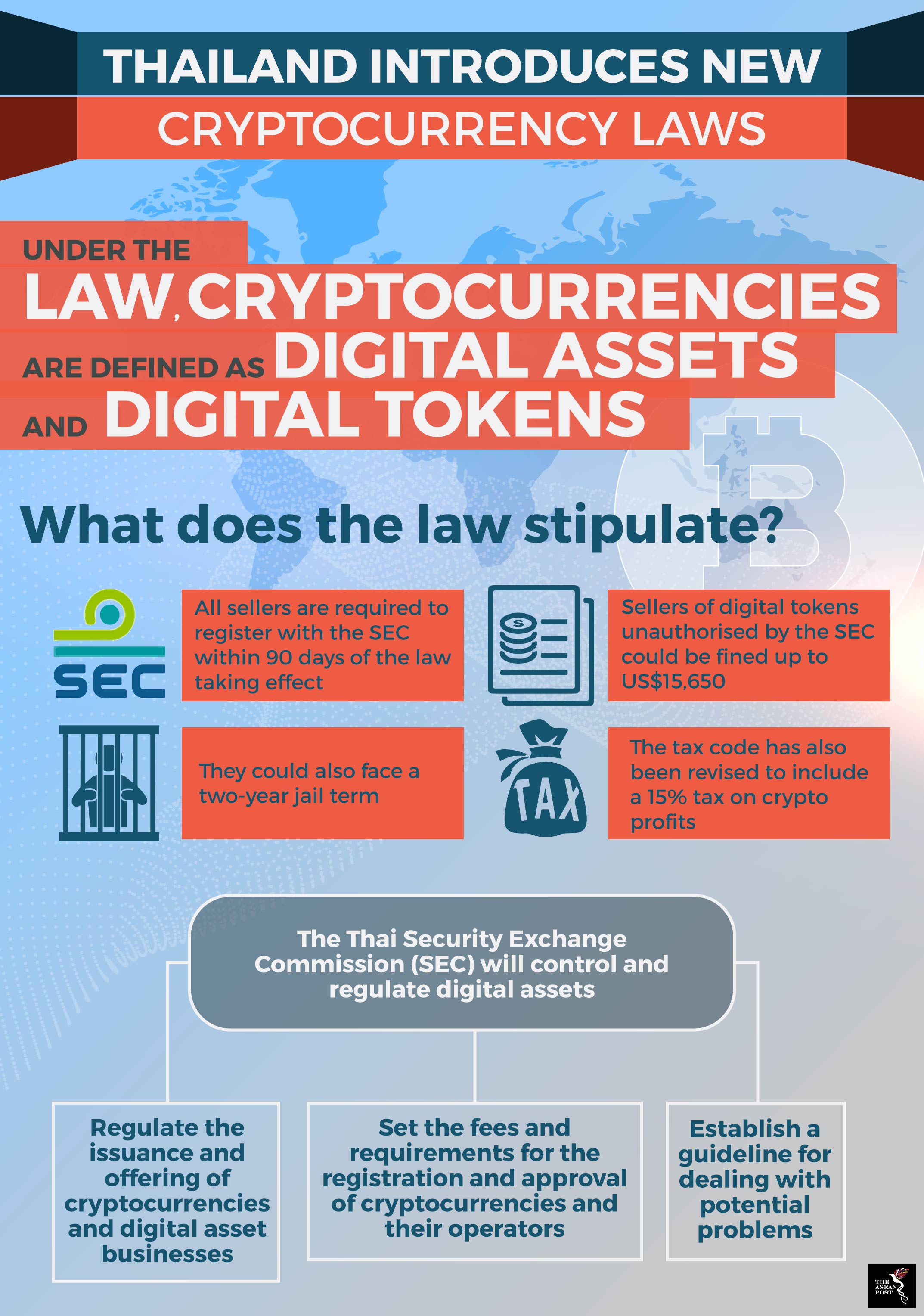

Thailand’s Security Exchange Commission (SEC) is tasked with regulating digital currencies and their operators. The 100-section law outlines several areas for the SEC to act upon, including regulating the issuance of cryptocurrencies and the establishment of necessary fee structures for cryptocurrency operators, as well as formalising a guideline to resolve issues which may potentially arise.

Sellers are required to register with the Thai SEC within 90 days after the law comes into effect. Individuals who fail to do so could subsequently be treated as operating an unauthorised business and could face a maximum jail term of five years. On top of that, they may also be slapped with a fine of up to US$320 per day, for each day business was conducted.

The Thai Ministry of Finance also revised the country’s tax code and has placed a 15 percent capital gains tax on profits made from cryptocurrencies. Investors will also be subject to a seven percent value-added tax when any digital asset trades are made.

Thailand’s experience with cryptocurrencies is one that is rooted in cautious optimism. The Thai central bank, the Bank of Thailand (BOT) has been wary of possible problems arising from unregulated cryptocurrency trading.

Source: Various sources

In February this year, the BOT released a circular instructing national banks not to engage in or provide advice on transactions involving the trading of cryptocurrencies, whether for other financial institutions or retail investors. It also ordered banks to prohibit their customers from using their credit cards to purchase cryptocurrencies, and barred banks from establishing a cryptocurrency platform or exchange.

Despite this, Thailand’s Finance Minister, Apisak Tantivorawong set out to reassure crypto investors that Bangkok has no intentions of banning cryptocurrencies outright. This new law regulating digital assets and tokens is arguably less stiff than a similar law implemented in China which has, for instance, banned initial coin offerings (ICO).

On top of that, the decision to place the Thai SEC in a regulatory role for cryptocurrencies underscores the fact that the Thai government considers cryptocurrencies to be an investment, and not a currency per se. Moreover, the BOT announced earlier this year that it does not recognise cryptocurrencies as legal tender.

Nevertheless, the introduction of taxes on cryptocurrency profits would seem to hamper the development of a comparatively nascent market. Thailand’s move can be attributed to one of two possible motivations: either the Thai government recognises the lucrative potential of digital assets and intends to tap into this tax base, or it is simply looking to discourage excessive investment into the sector to avoid a future bubble.

However, taxation, if done properly could invite more investors to the Thai cryptocurrency market. Clearer regulations would improve transparency in cryptocurrency exchanges and provide more legitimacy to the market. Besides that, Thailand could look into leveraging on its fintech sandbox, launched in late 2016, which would be a perfect testbed for future digital asset regulation.

The introduction of this legislation – like any other – does not come without its critics. However, it may prove to be the safer option in the long run. Global investor sentiment has yet to move away from looking at cryptocurrency as a huge speculative risk, and regulation in this space serves as a necessary brake on cryptocurrency hype, preventing potential bubbles and market panic.