In March, news was abuzz regarding the seasonal heavy air pollution in Thailand. Because this toxic smog is something that Thais are no strangers to, there surely must have been some sighs of relief when the government revealed years ago that it was looking at becoming the hub for the production of electric vehicles (EVs) in the region.

The use of EVs is part of a bigger plan by the government there which is the Thailand Alternative Energy Development Plan 2012-2021 in which its committee had drafted an ‘Electric Vehicle Promotion Plan for Thailand’.

The Thai cabinet approved the plan in March 2015 and requested the Board of Investment (BOI) to further explore the potential of Thailand as a production hub for EVs. As a result, the Electric Vehicle Association of Thailand (EVAT) was formed by knowledge institutes and private organisations.

In 2014, Thailand had only 60,000 electric hybrid passenger cars and just 8,000 battery electric motorcycles that were registered. In 2017, this number had grown according to The Land Transport Department. The department reported a total of 102,308 cars (HEV and PHEV varieties) and 1,394 BEV cars.

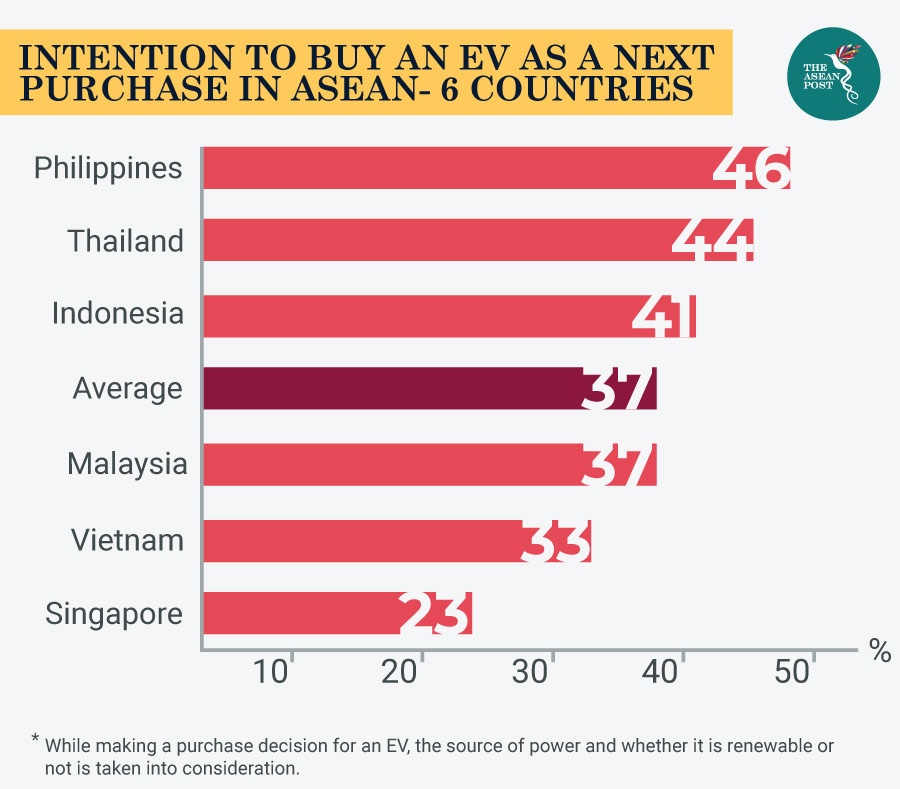

Also working towards this synergy between government initiative and people’s interests is the fact that Thais have shown that they are interested in EVs as well. While EV sales in ASEAN are generally weak, a study commissioned by Nissan last year found that a third of Southeast Asian consumers are open to the idea of buying an EV. Titled ‘Future of Electric Vehicles in Southeast Asia’, the study found that while EV sales in ASEAN are generally weak – consumers in the Philippines, Thailand and Indonesia were the most enthusiastic about the future of EVs.

However, unless Thailand can address certain issues, its dreams of becoming an EV production hub for the region may fall short. One of these issues is pricing.

Speaking at a seminar on EVs in Bangkok recently, experts reminded the Thai government that high prices for EVs – along with the lack of EV charging stations – hamper its viability among buyers in the country.

The director of Thailand’s Tax Planning Office at the Excise Department, Nattakorn Uthensut, was then quoted by Thai media as saying that subsidies in other countries are helping boost sales of EVs – pointing out that the United States (US) subsidises US$7,500 for every new purchase.

This was concurred by Justin Wu, head of Asia-Pacific for Bloomberg New Energy Finance (BNEF), recently when he said that EVs remain expensive and unaffordable for individual buyers in Thailand and ASEAN in general.

While the Board of Investment of Thailand (BOI) has offered investment privileges for EV manufacturers since 2017, the starting prices of EVs is still quite high in Thailand – ranging from US$31,921 to US$63,842 – compared to gasoline vehicles’ that range from US$19,152 to US$22,344.

As Ipsos Consulting noted in a report on the ASEAN auto industry in June 2018, the BOI’s incentives – which include tax holidays and import tariff exemptions – show how vehicle manufacturers are positioning themselves to be best placed to benefit from a growing market demand for EVs domestically. As evidence of this, 40 percent of vehicles sold in Thailand in 2017 by Mercedes were plug-in hybrids. The figure for BMW was 13 percent over the same period.

Wu, however, believes that the high costs will only exist during the initial stages of adoption.

“Once each ASEAN country can adopt EVs for public transport and spread charging stations across the country, the cost of EVs will drop with the start of local manufacturing,” said Wu.

Proper policies and incentives will go a long way in getting more Southeast Asians to drive EVs.

A report published by the ASEAN Secretariat in February titled ‘ASEAN Fuel Economy Roadmap for Transport Sector 2018-2025: With Focus on Light-Duty Vehicles’ found that strong EV sales in the US, Europe, Japan and China are mainly driven by policy support and a minimum subsidy of US$3,000.

EVs are exempted from registration taxes in China, Denmark, Germany, India (partly), the Netherlands, Norway, Sweden and United Kingdom (UK). Apart from monetary incentives, policies such as preferential access to otherwise restricted zones (e.g. low-emission zones), priority parking, road toll exemptions and the right to use bus lanes provide incentives to buy EVs – especially in urban areas.

Several environmentalists and analysts have already mentioned that EVs (which include everything from electric boats to electric tuk tuks) will help clean up the country and most observers would likely agree. But if Thailand is serious about its ambition of becoming a production hub for EVs in the region then it must look at how it can make the purchase EVs affordable in the first place.

Related articles: