The coronavirus crisis has disrupted businesses everywhere. From large corporations to start-ups and small vendors – industries are feeling the pinch from the pandemic. Sectors such as tourism and aviation have been hit especially hard. Nevertheless, there are several industries that are thriving amid the crisis, this include tech giants and also the global payments industry.

According to Accenture, a professional services company – the global payments industry has proved to be resilient amid the pandemic as the general public still continues to trust payments systems and providers. Nevertheless, like other industries, the sector is not immune to the impacts of the crisis.

“The biggest changes for payments providers due to the pandemic include an increase in non-performing loans, a reduction in revenues and greater demand on customer service teams. Total payment volumes have shrunk due to the reduction in consumption and trade,” noted Accenture in its recent publication.

The multinational company listed a few potential impacts of the coronavirus crisis on the payments industry. These include:

A Cashless Society

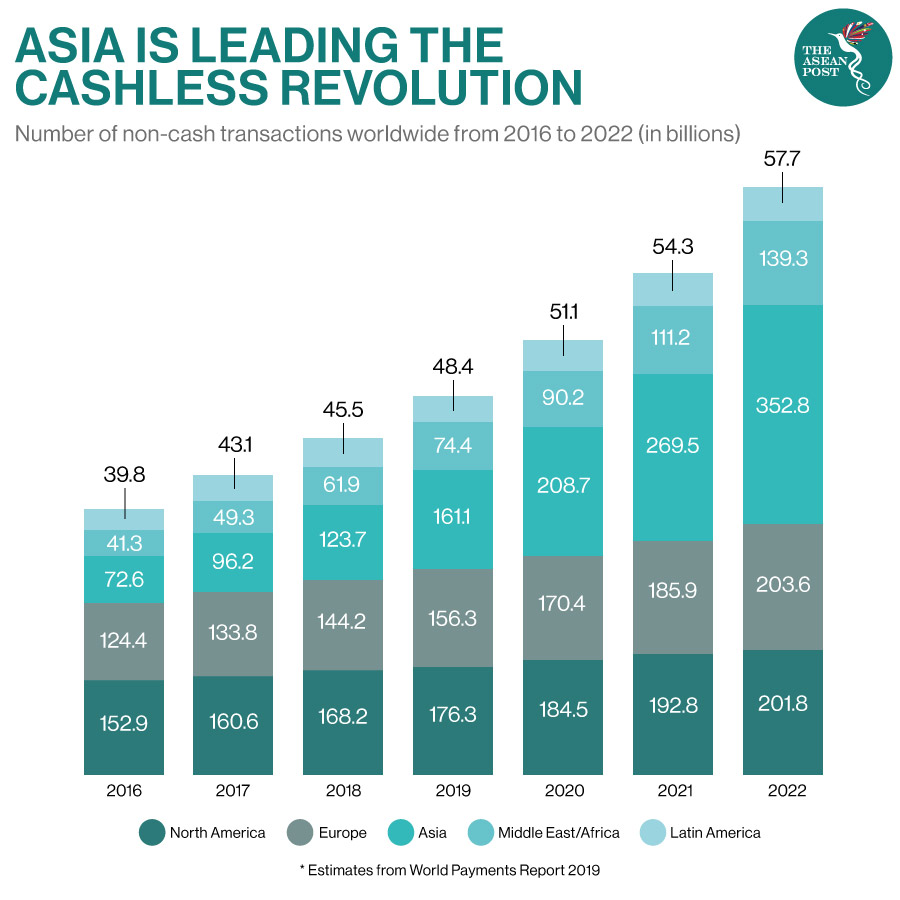

ASEAN citizens are not unfamiliar with digital payments. In a survey by Visa, around 64 percent of consumers in Southeast Asia are confident of going cashless for a full day. Moreover, the 2019 World Payments Report shows that the value of non-cash transactions in Asia is projected to grow from US$96.2 billion in 2017 to US$352.8 billion by 2022, a meteoric rise of over 266 percent.

Contactless payments allow people to pay by tapping their payment cards or phones on point of sales (POS) terminals instead of swiping or inserting their cards. QR (quick response) codes are two-dimensional bar codes which can carry purchase transaction information – allowing merchants to receive payments from customers when scanned. Whereas, digital wallets such as GrabPay allow a payment to be made without even touching a card to a terminal or entering a PIN.

This trend seems to be on track even during the pandemic as the World Health Organisation (WHO) warned in early March that banknotes may spread the COVID-19 virus.

"I know a lot of merchants are putting signage up at the point of sale, ‘Please use contactless’,” Linda Kirkpatrick, a Mastercard executive who works with banks and credit unions told the media.

The recommendation by the WHO to use cashless transactions in order to help control the virus has meant that contactless payments have skyrocketed. Other than that, the COVID-19 pandemic has also further undercut the use of cash by forcing retailers to move online as many consumers are staying home due to virus fears.

Fraud Protection

A report titled ‘COVID-19 Risks Outlook: A Preliminary Mapping and Its Implications’ by the World Economic Forum (WEF) has revealed that one of the most worrisome fallouts from the pandemic is the increase in cyberattacks and data fraud. Some of the most common coronavirus scams include impersonating authorities and demanding payment from victims. The general public is urged to be cautious of robocalls, texts and emails promising virus cures, vaccines and fast stimulus payments.

It was recently reported that as of 25 May, the Federal Trade Commission (FTC) in the United States (US) had recorded more than 30,700 fraud complaints related to COVID-19. It was said that victims of scams have reported losing up to US$40.1 million, with a median loss of US$463.

Cybercrimes are being reported everywhere around the world, including Malaysia, an ASEAN member state. The country’s Commercial Crime Investigation Department (CCID) has warned citizens about scammers posing as ‘agents’ distributing COVID-19 aid by sending random text messages to the public and asking for their personal details such as banking information.

This means that large merchants and financial institutions will need to make “significant investments to improve fraud prevention and detection,” said Accenture. The company also cited artificial intelligence (AI) and machine learning as possible solutions to the problem.

Fintechs

“The drop in the number of global payments means a decline in fees for payments solutions providers,” according to Accenture – and payments fintechs may feel the pinch even more than others.

At this time of crisis, investors are more cautious and conservative in terms of spending. This means that access to funding is becoming difficult as many investors would rather focus on established fintechs with clear business models.

According to media reports, the pandemic will be no different from previous economic downturns in making investment funds scarce.

“The last two economic downturns saw a huge reduction in private financing,” noted market research firm Forrester in a report. “This time won’t be different. Only fintechs that had market traction, were profitable or had secured a big funding round before COVID-19 struck will survive the upcoming consolidation.”

Although Deloitte, a professional services network agrees that many fintechs, like the rest of the financial system, have gone into overdrive to respond to the crisis but “given their differentiated capabilities – namely adaptability and innovation – many fintechs are well positioned not only to survive the crisis, but also to contribute to the industry and society in meaningful ways once the crisis is behind us.”

The change in customer behaviour during the pandemic will likely boost the demand for digital banking services. Many traditional payments providers will perhaps fast-track their digital innovation efforts. The payments industry will have a major role to play in revamping the economy.

Related articles: