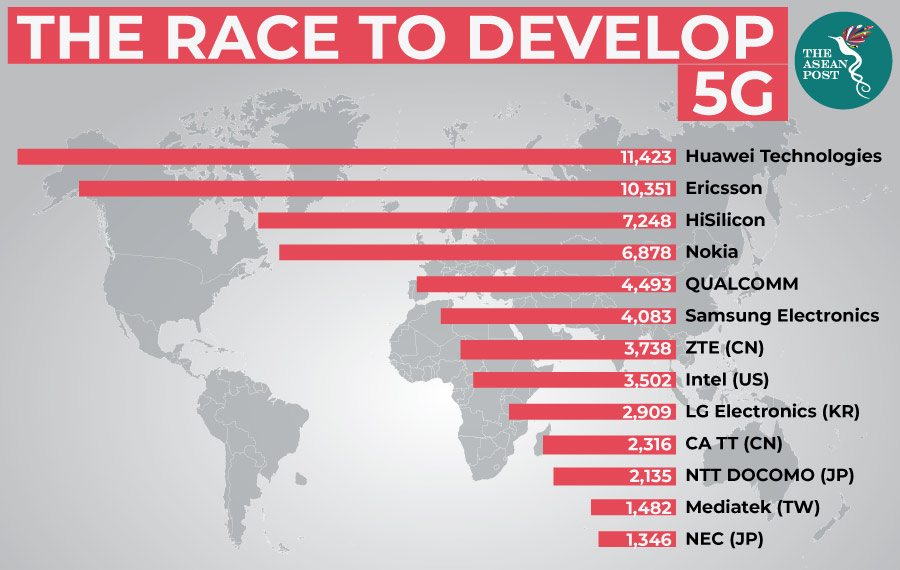

The quest to develop 5G capabilities is increasingly becoming this generation’s space race, sparking tensions among its aspiring pioneers. At the forefront of this race is the United States (US) which – with its recent appetite for protectionism – has moved aggressively to consolidate its position, going as far as drawing first blood with the Huawei conundrum in China, with President Donald Trump signing an executive order that effectively banned the use of Huawei equipment in US telecom networks on the premise of “national security concerns”.

In typical Trump fashion, this ban was eventually reversed following the Group of Twenty (G20) summit after both, China and the US agreed to resume trade talks.

It is worth noting that until the initial US ban, Huawei had been making significant grounds in the 5G race – a technology it has been developing since 2009 – ranking first place in technology contributions to 5G standards. This has given way to the narrative that the US is ostensibly threatened by China and as such has resorted to strong-armed tactics to thwart the rise of its rivals to win this race.

The use of aggressive tactics has complicated matters for the US’ close allies that come under the “Five Eyes” intelligence alliance that includes Britain, Canada, Australia and New Zealand. The United Kingdom (UK) for instance, does not share the same position as the US and continues to grant access to Huawei to its 5G networks.

Moving forward, these alliances and stances are expected to continue to be in a state of flux, with the US and China jockeying aggressively to win the 5G race.

Malaysia’s pragmatic stance on 5G

It is in this global context that Malaysia’s decision to roll out 5G development will be crucial. Despite concerns of national security – with accusations of Chinese espionage and potential blowbacks from the US – the current consensus is that the potential technological benefits that can be accrued from 5G far outweigh these concerns.

Indeed, Malaysian Prime Minister Mahathir Mohamad has expressed that the door is open for Huawei to do business in Malaysia – more so with the prospect of further 5G development in Malaysia via the country’s Fiberisation and Connectivity Plan (NFCP) and the National 5G Task Force.

It goes without saying that Malaysia stands to gain from this roll out. From IR 4.0 to transforming industries, 5G is expected to be the crucial catalyst for countries to move up the value chain. At its crux, 5G means faster speeds and connections which will help to fix bandwidth issues. In practical terms, this will mean the ability to power an ecosystem of smart cities, autonomous driving, improved healthcare and a fully-realised Internet of Things (IoT) – outcomes that cannot be realised under existing 4G and 3G networks.

5G: A day-to-day perspective

What will 5G mean on a day-to-day basis for the average citizen? To put it simply – more connectivity. Think of what social media has done to our social networks and bring that up to a grander scale. Consider its application on a city of the future:

• With 5G, emergency services will be handled more efficiently with the application of a piece of technology like the 4K Virtual Reality (VR) drone system, which enables real-time data to be relayed to hospitals and ambulances.

• 5G technology will mean that the driverless cars dreamed up by impressionists in the 20s can now be a reality. There’s the prospect of 5G Hologram technology calls – the Jetsons’ trademark will no longer seem absurd.

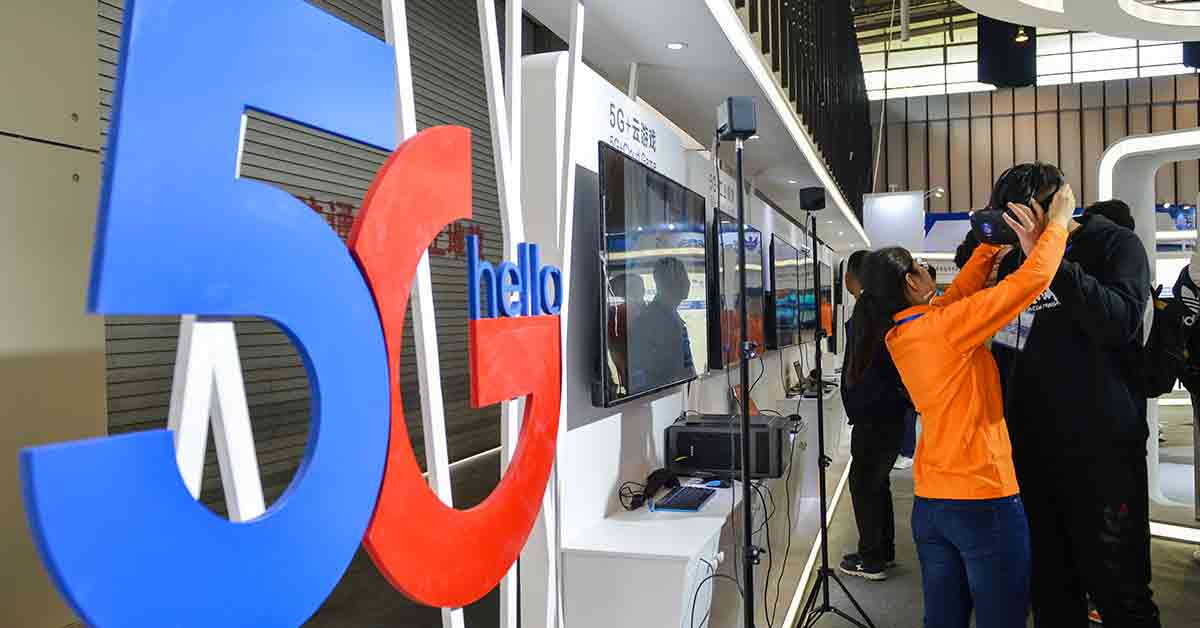

• 5G will be able to connect more devices at the same time and stream events in virtual reality for those who could not attend physically. With this technology, a virtual table tennis game could be watched as well as a racing game that can be streamed from a remote location to a virtual reality headset using 5G.

Sounds compelling? Definitely. Yet, it is worth noting that concerns remain: centred around creative destruction, moral persuasions as well as arguments that the leap to 5G will only bring about incremental returns.

Of more pressing concern will be the costs involved in developing 5G. Making this leap is a two-fold (two-step) process. The first step of developing higher speeds is hard enough, but it is the second step, which requires infrastructure to be built up separately from existing networks that will be the hardest.

This is an investment that will take years to establish. Meaning investments in costs and time for public and private sectors alike. To put things into perspective, China has allocated US$50 billion a year over the next decade to prop up its own 5G infrastructure.

Given that the barriers to entry are still high and 5G’s development remains at a nascent stage, it is no surprise that most players are adopting a wait and see stance. 53 percent of senior executives at the world’s largest network operators polled by a management consultancy observed no near-term deal case for investing in 5G technology.

5G in ASEAN

As things stand, countries in ASEAN have begun exploring roadmaps for 5G development. As alluded to earlier, Malaysia’s telcos are evaluating the viability of 5G which is expected to cost RM700 million (US$169 million) to RM1 billion (US$241.4 million) each year in the initial years. Given the lack of infrastructure, Malaysia has opened its doors to the prospect of working with Huawei to lay out the initial 5G infrastructure. The likes of Thailand have taken similar routes, collaborating closely with China and Huawei to develop testbeds and research centres.

Singapore finds itself ahead of the curve. Given that the Lion City is already equipped with more advanced 4.5G and narrowband IoT infrastructure; it finds itself in a sweet spot to develop 5G technologies; with a potential roll out of networks by 2020.

Ultimately, despite geopolitical uncertainties the prospect of the benefits of 5G in ASEAN are exciting. However, with high barriers to entry, it remains to be seen whether smaller governments and private sector players will be willing to make a big leap into the unknown.

The only certainty here will be the world’s big superpowers continuous jockeying to win the 5G race – hopefully not at the expense of smaller players.

Ee Wei Yuan is a principal consultant at 27 Advisory, while Adam Reza is a former consultant at 27 Advisory. 27 Group is a 100 percent Malaysian owned local consulting firm that is fast, flexible and focused with unique expertise that blends local socio-economic policy settings, global engineering-built assets and detailed financial analyses. Read more about 27 Group’s consulting services at 27.group.

Related articles: