Amazon recently announced that it would partner with the Vietnam E-commerce Association (VECOM) to allow local small and medium-sized enterprises to sell and export their goods using the company’s platform there. The e-commerce giant's foray into Vietnam is its second into Southeast Asia thus far.

Presented with stiff competition from Lazada, Tiki and Shopee in Vietnam, Amazon is likely to be still testing the market there. What better way than to partner with Vietnam’s SMEs, who constitute at least 98% of all enterprises there, according to business intelligence by Dezan Shira and Associates.

Meanwhile, Amazon’s entry would also provide local Vietnamese SMEs with the know-how they need to progress further. Lack of access to financing, low linkages with global supply chains, and unfair competition are just a few challenges faced by SMEs here.

“Amazon’s arrival is set to spur local market development. Services suppliers will compete to develop selling services, logistics solutions, ecosystems and much more,” TranTrong Tuyen, VECOM general secretary told online publication, VietnamNet.

Despite Lazada and Shopee’s market presence, Vietnam's e-commerce market is still in the early stages of development, with online retail accounting for just 1% of the total retail market there. E-commerce players present in that market have so far had to promote the platform vigorously in order to build traction.

Shopee, for instance, was reported to be offering plenty of discounts, seller training and free nationwide shipping. Lazada, meanwhile, cut sellers commissions by up to 50% in order to attract a higher number of retailers to its platform there.

Vietnam's e-commerce sector is still an attractive one. It is one of the fastest growing on a global level, according to market research by Kantar Worldpanel. E-commerce revenue in Vietnam grew 23% to US$5 billion is 2016, and expanded by a further 25% in 2017, according to reporting by the Nikkei Asian Review.

Should it launch fuller operations there, Amazon will benefit from the purchasing power of a rising middle class, which expanded by 14% between 2005-2015 and is likely to grow by a further 18% between 2016 and 2020, according to research by the Bookings Institute.

Currently, the main setbacks will be in terms of lack of infrastructure, even as its landscape still suffers from poor road access, for one. Yet this might not go on for long. Projects are currently underway to build connections between Hanoi and Lang Son, Van Don and Mong Cai, and Hanoi and Cao Bang, according to the Oxford Business Group. Other challenges e-commerce firms face is a lack of key components of the e-commerce system, including delivery services, payment systems, technology, warehouse capacity and human resources.

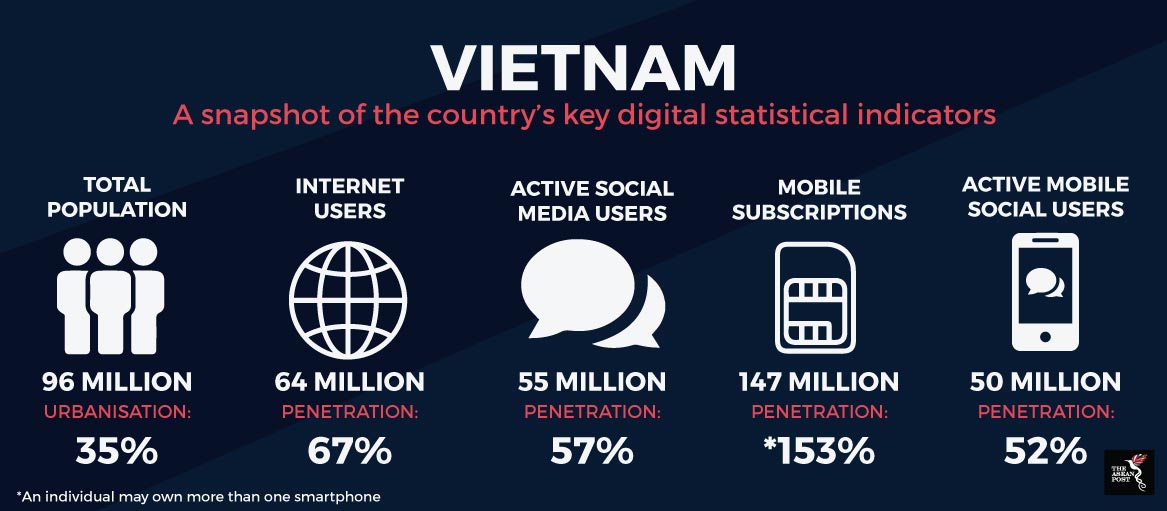

Source: Hootsuite, 2018

On Amazon’s part, it is these abovementioned factors which may warrant a slower, wait-and-see approach. It has already had to play catch-up with its predecessors in the region, namely Lazada and Shopee. Its entry into Singapore, too fell short of local expectations. Its Prime offerings, for instance, were described by Singaporeans as 'lacklustre'. In particular, the disappointment was with Amazon's digital offerings there, which they said did not match those offered in the United States.

Innovating for Singapore’s market in general may in fact involve creating a more immersive shopping experience, since mall culture is such a mainstay there.

“Singapore is a very small city state, so shopping is one of the favourite pastimes for all Singaporeans,” Chan Hock Hai, a fund manager with Singapore’s Amundi Asset Management told Bloomberg in 2017.

Amazon may also still need to get used to consumer habits in Vietnam and localise its offerings accordingly. Sweetening the deal for locals might involve more than simply replicating services it already offers in its other markets. The prices might also not prove to be as attractive compared to existing e-commerce players. Amazon could change its business strategy for this region, or risk playing catch-up for some time to come.