Infrastructure projects are the catalyst that drives economic growth. Physical infrastructure such as roads, ports, rail, highways, airports, power and water supply are needed for the transportation of goods, people mobility, ensuring the production of manufacturers and so many other daily activities.

Infrastructure, just like other types of capital expenditure, will become obsolete after years of continuous usage and exposure to various usage and environmental factors. In order to continue the operations, this ageing infrastructure will require periodic maintenance, modernisation and replacement in whole or parts.

On average, the annual expenditure on maintenance and modernisation would typically range from two percent to 20 percent or more depending on various factors not just the size, nature, capacity but also their purpose, design, materials, quality of construction and most importantly, the way it operates and is maintained.

These operational expenditure (OPEX) items are expenditures over a period of 20 to 30 years or more! It is highly possible that the capital spending on an infrastructure throughout its life-cycle will be a lot more than the initial capital expenditure to build it. And we do not see enough of this analysis being done when building our assets, cities or mega projects.

There is a critical need to look into this and optimise the expenditure to be spent on the infrastructure throughout its life-cycle. Life-cycle cost analysis (LCCA) is particularly helpful in this aspect to ensure the cost-effectiveness of an infrastructure project.

LCCA is a tool to determine the most cost-effective option among different competing alternatives to purchase, own, operate, maintain and, finally, dispose of an object or process, when each is equally appropriate to be implemented on technical grounds. The LCCA takes into consideration all the costs incurred in the life-cycle of the infrastructure. This refers to the most cost-effective option to build, operate, maintain and decommission the infrastructure.

To provide more clarity, for a highway pavement, in addition to the initial construction cost, LCCA takes into account all the user costs, (e.g. reduced capacity at work zones), and agency costs related to future activities, including future periodic maintenance and rehabilitation. All the costs are usually discounted and totalled to a present-day value known as net present value (NPV). A lifecycle model is usually incorporated with the total cost of ownership to provide a more complete and comprehensive costing model to the developer or, more precisely, the owner of the infrastructure asset.

In order to provide certainty in Asset Performance, it’s important to replace assets at the right time in line with good practice, organisation policy and manufacturer’s recommendations. Therefore, an effective capital planning prior to the actual cost incurred can improve the efficiency in the usage of time and resources.

Cost savings can also be due to standardising the approach to purchasing, smoothening out of costs, and obsolescence through procurement of assets through supply chain partners. The aim is also to improve stakeholder’s confidence as reduced uncertainty in cost planning can lead to better asset performance and decrease the disruption and risks to the business.

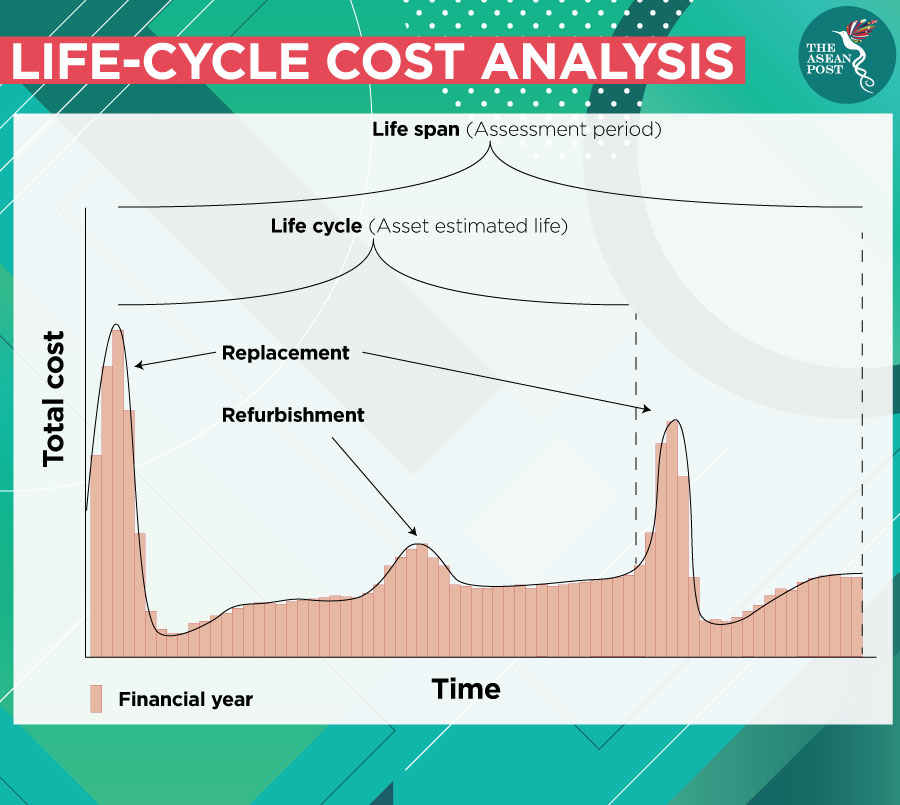

Life-cycle is not to be confused with life-span of a built asset. Life-cycle is the asset’s estimated life before the next replacement happens whereas the life-span might consist of more than one life-cycle. It is also known as the assessment period which is determined by the owner. A typical life-cycle costing exercise includes capital expenditure (CAPEX), OPEX, replacement expenditure and cost of disposal.

CAPEX is defined as the initial cost to purchase, construct or deliver the infrastructure asset, which is normally the construction cost of the asset for infrastructure projects. Moreover, the OPEX of the asset consists of several types of cost components including manpower, utility, equipment, insurance, health and safety, spares, planned and routine repairs.

Replacement cost is incurred in every periodic of years according to the replacement age of different types of assets with advice from the manufacturer’s recommendation. Another crucial element in the LCCA is the cost of disposal. By incorporating the cost to remove or terminate the asset from the system, which is also known as salvage value, one can help to offset the cost incurred in a particular year.

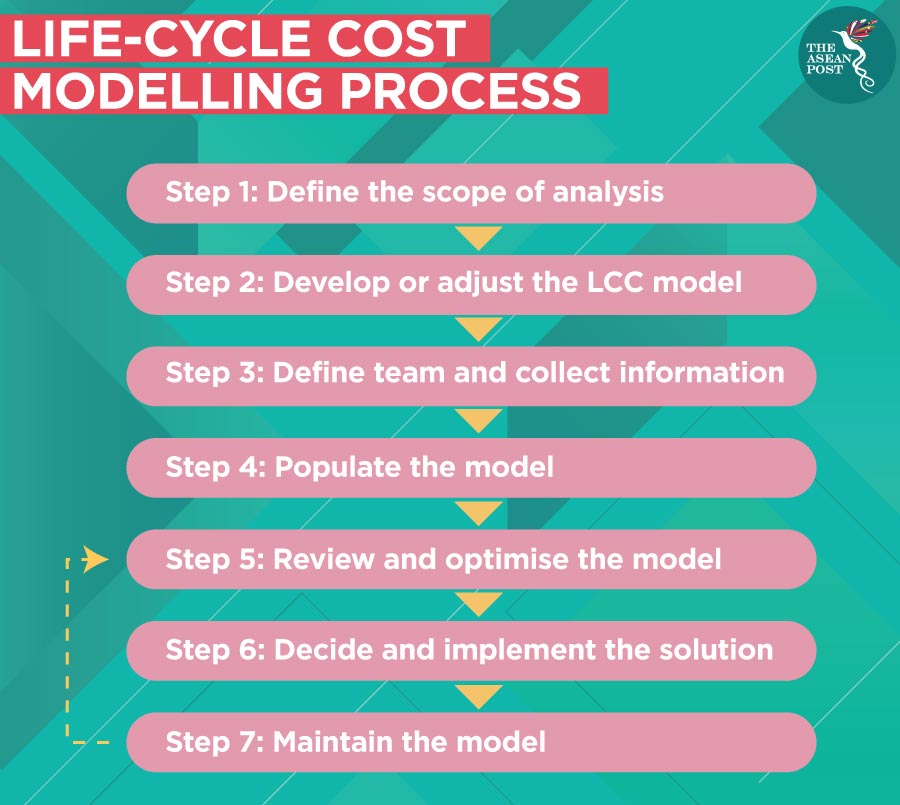

Rigorous life-cycle cost (LCC) modelling enables the design to be value engineered so that the cost profile of an infrastructure can effectively reduce the expenditure throughout the life cycle by a significant amount. These value engineering exercises are done by conducting a series of sensitivity tests on the cost components. LCC modelling must also have the flexibility to adjust the type or cost for assets and materials used for an infrastructure project and simulate the total spending over the life-span. This exercise allows the developer or promoter to be more informed on the financial impact of selecting a particular combination of development options and enabling an effective capital budgeting.

The value engineer process could help the developer or concessionaire to decide the type of assets and materials to be used.

Each asset or material might have different specifications in terms of the acquisition cost and maintenance characteristics. For example, a more expensive asset might have better quality and performance, but it might also carry a higher amount of maintenance costs. However, a cheaper asset might need more frequent maintenance, but the overall spending could be lower.

Further simulation can also be done to determine the timing of the financial obligation at different phases of the asset’s life-cycle. A proper use of LCC could help the user to identify the development combination that will result in a favourable timing for financial exposure to the developer.

By utilising the LCC to conduct extensive testing, comparison and analysis, the user could determine the optimised development combination for the infrastructure project that is likely to have the most preferred cost profile and financial exposure to the developer from all aspects. Hence, the business risk, financial risk and disruption to operations for the infrastructure or any other type of mega development can be significantly reduced.

Life-cycle analysis provides an overall framework for considering total incremental costs over the life-span of the product which can assist to manage the cash cycles of the organisation by projecting the cash requirements accurately. A comprehensive LCCA can provide 'win-win' strategies in terms of identifying appropriate technologies, products and services that are environmentally, economically and socially sustainable.

Consideration of life-cycle costs is essential to evaluate the infrastructure construction, regeneration and rehabilitation alternatives as it ensures better decision-making from a more accurate and realistic assessment of revenues and costs.

Girish Ramachandran is 27 Group’s Executive Director. 27 Group is a 100 percent Malaysian owned local consulting firm that is fast, flexible and focused with unique expertise that blends local socio-economic policy settings, global engineering-built assets and detailed financial analyses. Read more about 27 Group’s consulting services at 27.group.

Related articles:

Myanmar's infrastructure push begins with railway reforms

Duterte’s grand Build, Build, Build infrastructure plan faces a labour challenge