After much speculation, the Singaporean government finally revealed this year’s budget for the country. In his speech, Singapore Finance Minister, Heng Swee Keat talked about three major shifts facing Singapore in the coming decade – a greater emphasis on Asia, the emerging of new technologies and an aging population.

The budget that Heng Swee Keat presented featured some surprises as well as some already expected measures. In his budget speech on Monday, Heng Swee Keat brought up that the government is increasing spending on healthcare, infrastructure and security and an increase in government revenue is needed to finance such spending.

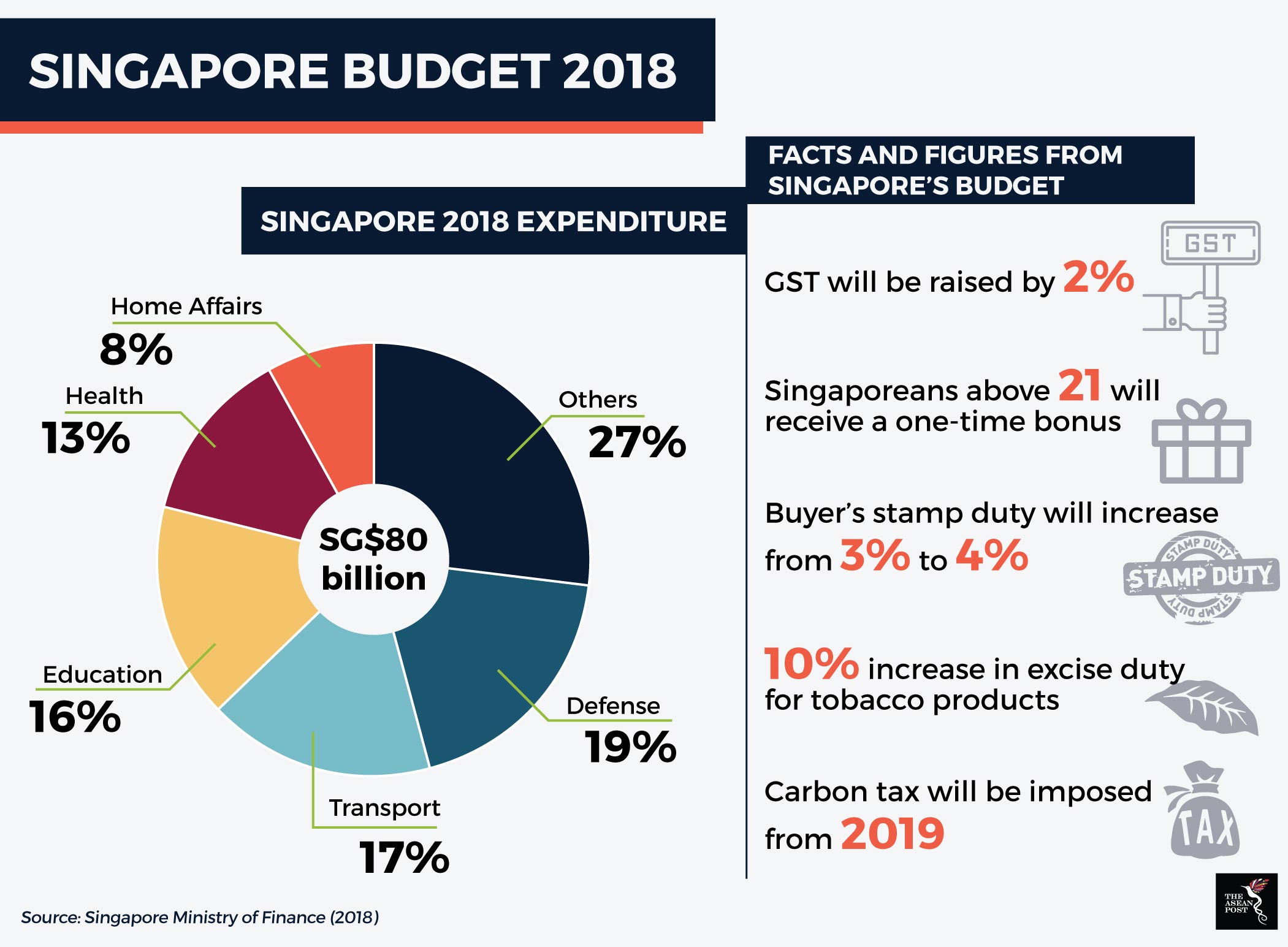

One of the measures to increase government revenue announced in the budget is the raising of a goods and services tax (GST). The tax hike in the GST comes as no surprise with many already expecting it to be announced in the budget. Prior to the budget announcement, Bloomberg surveyed 12 economists, and 11 of them expected the budget to increase. Furthermore, the government has been hinting at a tax hike for a while already. “Heng Swee Keat (Singapore Finance Minister) was right when he said raising taxes is not a matter of whether, but when,” said Prime Minister Lee Hsien Loong at the People’s Action Party Convention in 2017.

Heng Swee Keat announced that the government intends to raise GST from 7% to 9% sometime between 2021 to 2025. The increase in tax is the first increase in over a decade. “We have sufficient resources to meet our spending needs until 2020... but in the next decade, between 2021 to 2030, if we do not take measures early, we will not have enough revenues to meet our growing needs,” Heng Swee Keat told parliament during his budget speech.

There was speculation that an e-commerce tax might be announced but instead the government mentioned that digital purchases will now be subject to GST. Dubbed the “Netflix tax” by The Straits Times, people who purchase streaming services from websites such as Netflix and Spotify may be subjected to the tax. According to the Straits Times on Thursday, other digital services which could be subjected to the tax includes online newspapers and journals, mobile apps and software downloads.

The government also increased the top marginal buyer’s stamp duty rates for residential properties from 3% to 4%. The increased rates will only apply to a residential property valued at more than SG$1 million. Aside from that, in an effort to cut greenhouse emissions, Singapore has pledged to introduce carbon taxes from 2019.

The tax hikes introduced are meant to finance the forecasted increase in government spending. Bloomberg reported earlier this week that infrastructure spending is slated to increase to S$20 billion this year. Meanwhile, Singapore is also facing the problem of an aging population. Singapore’s aging population is expected to have an impact on social spending such as welfare and healthcare. In the same Bloomberg report, Heng Swee Keat mentioned that average healthcare spending is set to increase to almost 3% of the GDP. The report also highlighted that the spending on healthcare has doubled since 2010 to S$10.2 billion this year.

One of the biggest surprises from the budget was the bonus “angpao” for the citizens. Heng Swee Keat announced that every Singaporean above 21 will receive a one-time hand out due to their big budget surplus. Each citizen will receive either SG$100, SG$200 or SG$300 based on their income level.

Despite the cash handout, Singaporeans might feel the pinch of the tax hikes. While consumers will bear the burden of taxation, the budget outlined an increase in corporate income tax rebate. Shifting the burden of taxation on to their citizens could have an adverse effect on their happiness.

As government spending increases, there are also worries about a potential deficit in 2018. The Finance Minister announced that the 2018 fiscal year might see a SG$0.6 billion deficit in the country’s overall budget. While the deficit can be considered miniscule compared to those of other countries, any deficit needs to be taken seriously, especially now when Singapore is looking to increase expenditure.