ASEAN banks are not doing enough to tackle climate change and environmental degradation.

Largely unaware of the climate-related risks embedded in their portfolios, most of them do not have a strategy to manage these risks.

Despite being home to some of the world’s largest deforestation hotspots such as the Greater Mekong, Sumatra and Borneo, only nine percent of regional banks in a recent study were found to have no deforestation policies – putting their reputations on the line by associating themselves with plantation companies that clear forests with fire and contribute to transboundary haze.

The effects of climate change are being felt across Southeast Asia but a startling 91 percent of the 35 banks in the World Wide Fund For Nature (WWF) Sustainable Banking in ASEAN report released last month continue to finance new coal fired power plants – thus increasing their exposure to climate related transition risks such as carbon taxes, significant improvements in renewable energy technology and the falling cost of clean energy.

And while ASEAN suffers from increasingly intense water-related issues such as floods, rising sea levels and depleting water resources, just 17 percent of the banks recognise water risk – and none of them require clients to conduct water risk assessments.

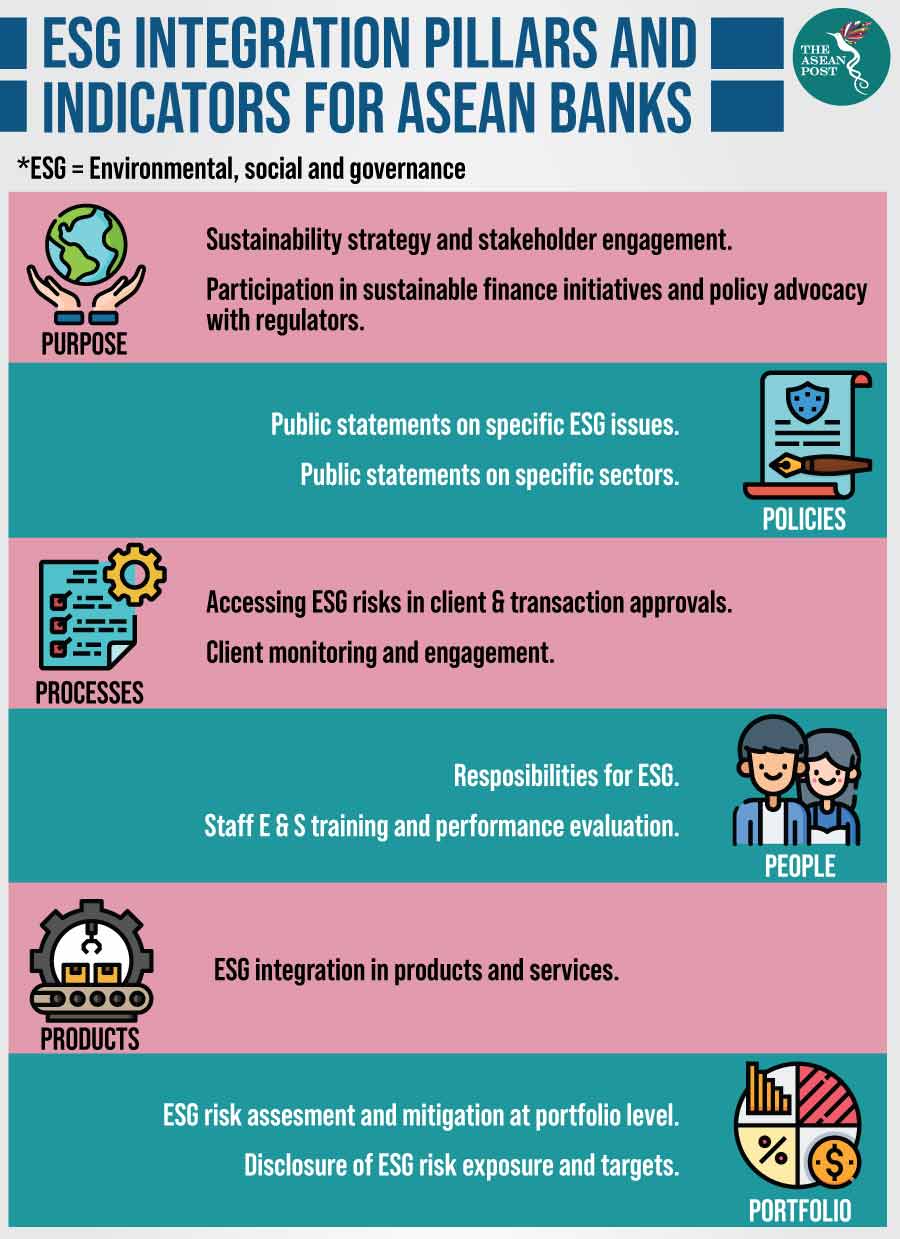

An update of the WWF’s Sustainable Banking in ASEAN report last year, the report benchmarks 35 ASEAN banks in six countries against a set of six pillars for environmental, social and governance (ESG) integration; purpose, policies, processes, people, products and portfolio.

Just four banks – three from Singapore and one from Thailand – fulfilled at least half of the 70 criteria, with 51 percent of the banks fulfilling less than a quarter of the criteria.

Only 14 percent of the banks require their clients to commit to international sustainability standards for their sector policies, and even though regulators are increasingly expecting banks to test the resilience of their loan books to climate risks and report the results, just nine percent of the banks have developed a strategy to manage climate-related risks or have conducted climate-risk assessments.

“ASEAN’s economies are very much interdependent, which magnifies the effects of climate change and environmental destruction,” said Jeanne Stampe, WWF’s Head of Asia Sustainable Finance.

“To ensure that businesses are resilient and the people of ASEAN have a secure future, ASEAN banks need to manage climate and other material environmental risks and opportunities in their portfolios.”

There are opportunities abound for sustainable investment in ASEAN.

The region requires an estimated US$3 trillion of green investments from 2016 to 2030 in sectors such as infrastructure, renewable energy, food, agriculture and land use according to Singaporean bank DBS and the United Nations Environment Programme Finance Initiative (UNEPFI).

While the cost of this transition to low-carbon sustainable economies will be too huge for governments alone to bear, private financing can play a critical role in bankrolling this sustainable development.

Although half of the banks that offer green financial products mostly focused on renewable energy, there remains a huge financing gap in other sectors.

Positives

There are some bright spots though.

Overall, 74 percent of the banks showed marked improvement from last year, with the Singaporean trio of DBS, OCBC and UOB demonstrating leadership by prohibiting the financing of new coal-fired power plants and implementing no deforestation commitments.

Three ASEAN nations – Cambodia, the Philippines and Thailand – will have issued sustainable banking guidelines by the end of this year, following in the footsteps of Malaysia (2018), Indonesia (2017), Singapore and Vietnam (both 2015).

The central banks of Malaysia, Singapore and Thailand have joined the Network for Greening the Financial System (NGFS), which is recommending central banks and supervisors to better integrate climate-related risks into financial stability monitoring.

Meanwhile, Malaysian bank CIMB recently became the only ASEAN institute among the 28 founding banks of the UNEPFI’s Principles for Responsible Banking (PRB), a standardised framework for sustainable and responsible banking issued in July with the aim of aligning the banking sector to the Sustainable Development Goals (SDGs) and objectives of the Paris Agreement.

Awareness about the importance of maintaining ASEAN’s rich biodiversity, fertile soils and abundant oceans is the first step in promoting sustainable investment.

These natural resources are capital assets which not only produce ecosystem services such as climate and air quality regulation but also food, raw material and freshwater – valuable sources of economic and social wealth.

Not only will protecting and investing in sustainable development of these assets ensure economic security, it will also help mitigate climate change – a long-term issue which requires a long-term view from both banks and the broader public.

Related articles: