With a few exceptions, most minor tropical fruits like rambutans, mangosteens, lychees, longans and durians remain a secret only known to the people who live in the areas where they are grown. Unlike their temperate counterparts - apples, pears, grapes, strawberries and kiwi - and major tropical fruits - mangoes, pineapples, papayas and avocados - minor tropical fruits are not widely traded and you will be hard pressed to find them in markets outside the areas where they are grown. However, this trend is changing and minor tropical fruits are slowly gaining the recognition they deserve globally.

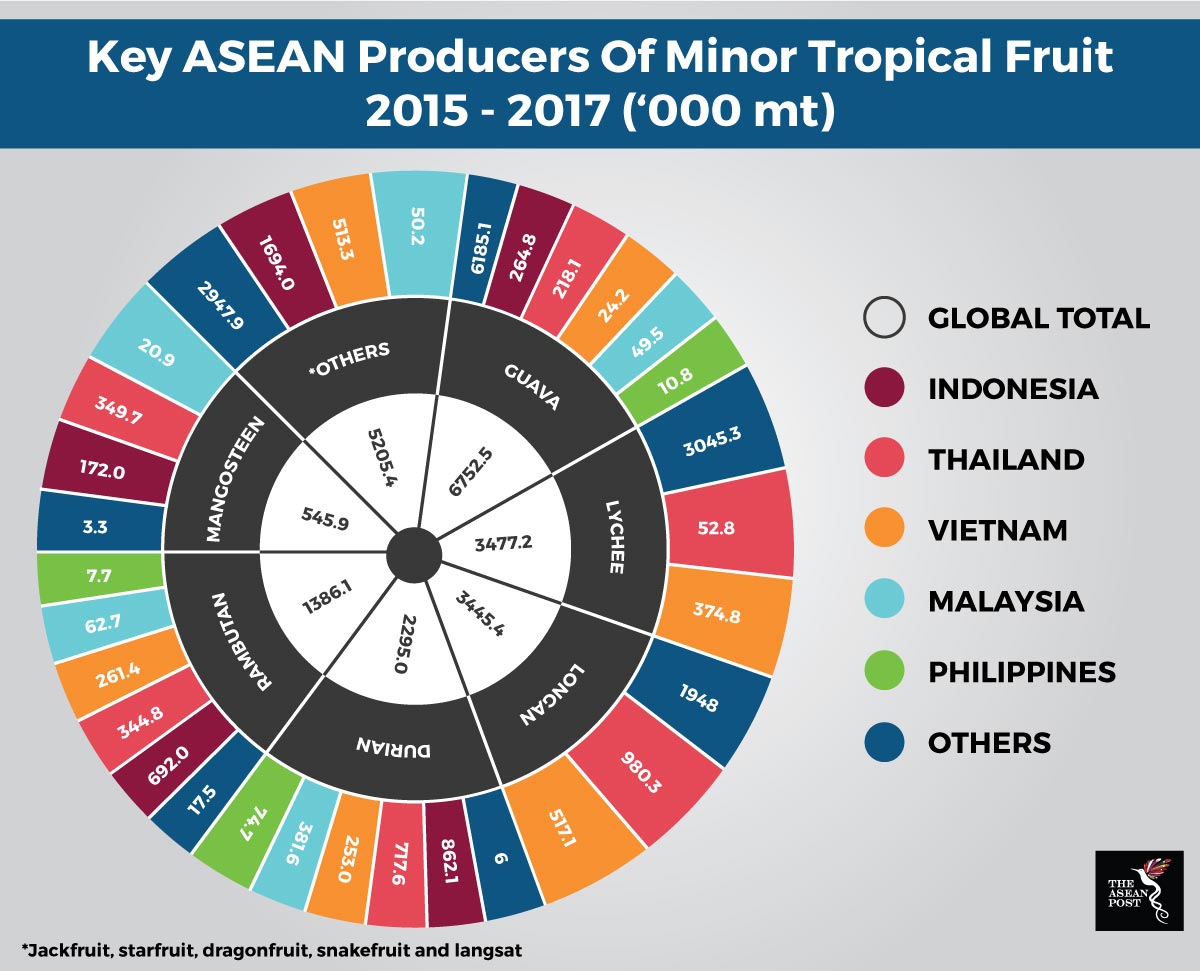

Source: FAO

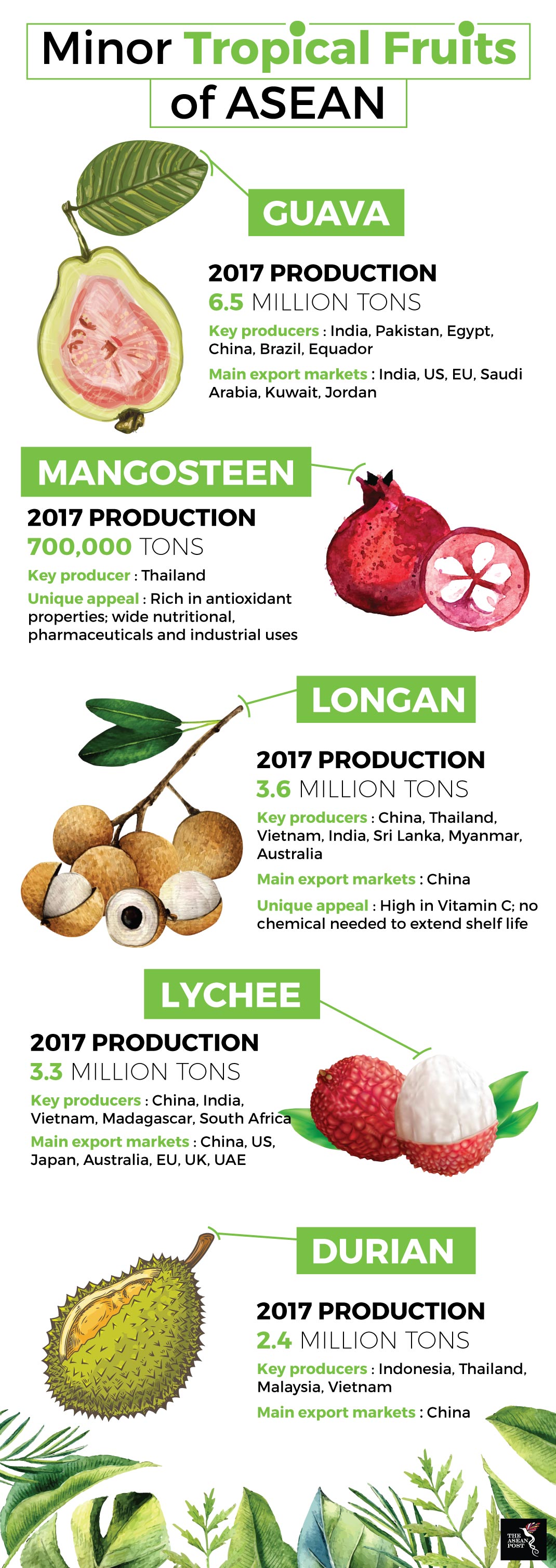

The trade in minor tropical fruits lags far behind that of its counterparts. The few minor tropical fruits that make it to the global marketplace are mostly considered novelties. However, the global response to minor tropical fruits has been favourable. Market opportunities for minor tropical fruits is growing rapidly in China and in other emerging markets on the back of income growth and urbanisation. At the same time, demand is also set on an upward trajectory in key developed markets like the United States (US) and the European Union (EU).

The increased interest is driven not only by consumption preferences of migrant communities for familiar foods from home, but also by increased health awareness on the part of consumers about the nutritional value of these fruits. Another driver is the fad surrounding superfood-boosted diets that utilize fruits with exotic-sounding names. Some minor tropical fruits that have received superfood accolade include jackfruit, starfruit, dragon fruit, mangosteen, durian dan rambutan.

According to the United Nations Food and Agriculture Organization (FAO) in its biannual Food Outlook publication released on 10 July, Asian countries were responsible for 86 percent of minor tropical fruit production between 2015 to 2017. The largest producers are agricultural heavyweights, India and China, accounting for 24 percent and 22 percent of global production, respectively. They are followed by key Southeast Asian producers like Thailand, Indonesia and Vietnam, who are accountable for approximately one third of global output, while Brazil held an estimated share of seven percent. However, most of the production in India, China and Brazil is for local consumption.

Source: Various sources

FAO analyst, Sabine Altendorf said that the bulk of trade takes place within Asia, where demand for premium fruits is strongest in countries experiencing rapid income growth, which particularly applies to demand from China.

“In developed markets, import demand has evolved with migration, with consumers of Asian origin tending to maintain their dietary preferences. Higher health consciousness among Western consumers and the growing awareness of the nutritional benefits of minor tropical fruits are adding to demand for these fruits in developed markets.

Retailers in the US and EU have started to routinely stock a growing array of minor tropical fruits, most importantly the better-known fruits such as lychee, guava and passion fruit,” Altendorf added.

Only around 10 percent of production is traded across borders, mostly within the Asian region. However, robust wholesale prices in developed countries point to ample commercial potential for exporters in low-income countries. For low-income producing countries, the budding global interest represents economic opportunity, especially for the producing households. Surveys showed that revenue from minor tropical fruits can account for up to 75 percent of entire household income in small rural growing areas in Cambodia, Thailand and Vietnam.

“With wholesale unit prices in the US ranging from around US$4/kg for guavas and lychees, to around US$13/kg for durian, passion fruit and mangosteen, cultivating minor tropical fruits could be more lucrative to smallholder farmers than staple crops, provided post-harvest handling and transportation of these highly perishable fruits are managed efficiently and cost-effectively,” explained Altendorf.

The jump of minor tropical fruits from niche to mainstream is not without its challenges, on both the supply and demand sides. The challenges on the supply side include low quality or productivity in small-scale farming, perishability, the seasonal nature of minor fruits with short harvesting periods resulting in irregular market supply and large price fluctuations, vulnerability to weather-induced shocks and climate change, and erratic supply quantity and quality.

On the demand side, issues faced by the market include seasonal variations, varying transport costs, lack of consumer awareness, high unit prices, increasing concerns about ‘food miles’, as well as phytosanitary certification requirements and stringent private standards in markets within developed region.