Southeast Asia may have a burgeoning youth (15-34 years) population that’s expected to peak at around 220 million in 2038, up from 213 million in 2017. However, the region’s demographic clock continues to tick as the existing population continues to age.

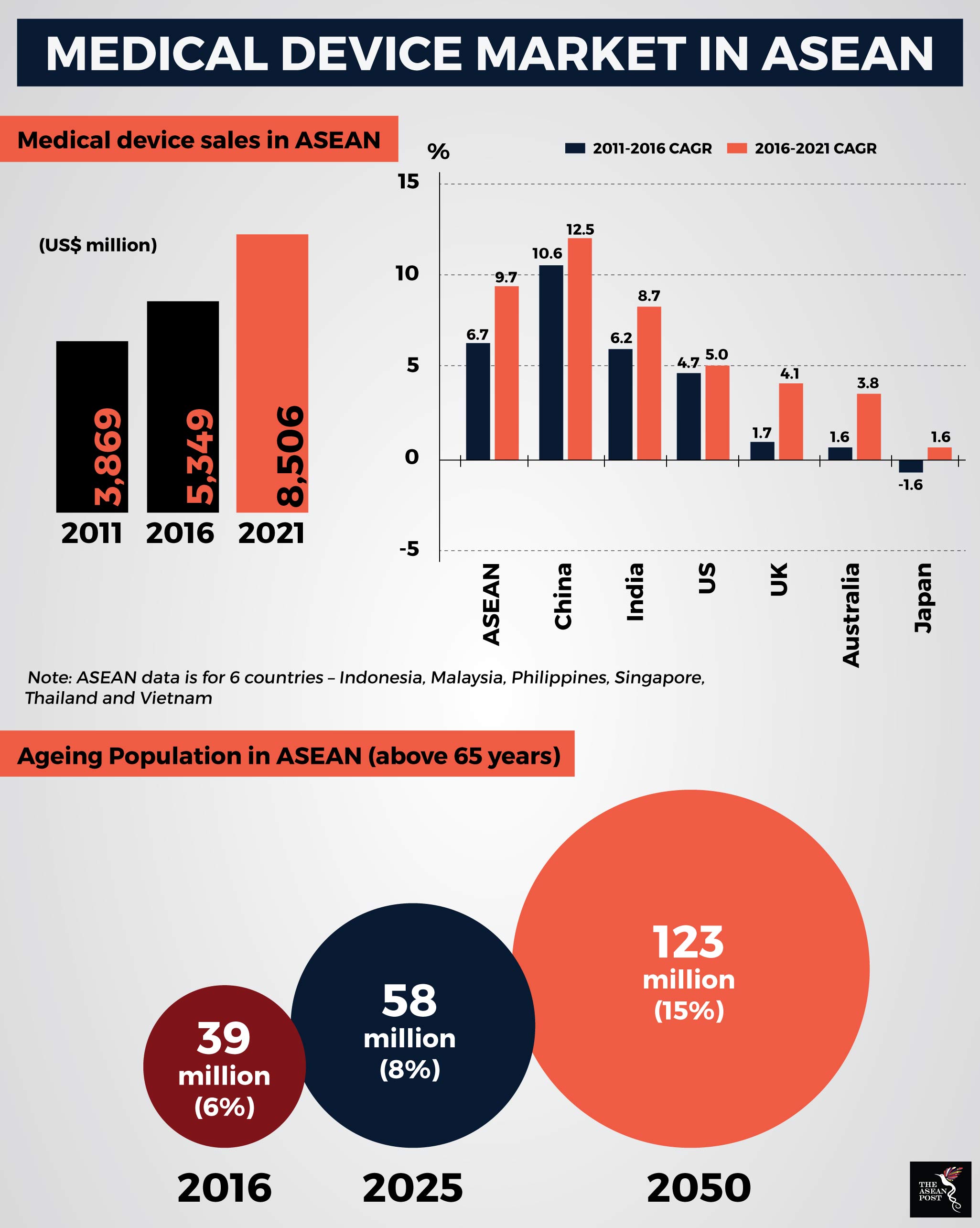

A rapidly ageing population within the Association of Southeast Asian Nations (ASEAN) member states will spur the demand for healthcare. By 2050, the percentage of those over the age of 65 is expected to triple to 123 million from 39 million in 2016.

Hence, the development of the medical device industry is crucial to meet and bridge this demand gap. Medical devices refer to a wide variety of products used to diagnose, monitor and treat diseases and conditions. They may range from inexpensive tools such as simple test kits to complex multimillion-dollar systems such as magnetic resonance imaging (MRI) systems and miniature robots that perform complex surgeries.

As it stands, the average per capita sales of medical devices within the ASEAN region is low compared to other emerging markets which indicates a significant opportunity for growth. Coupled with advancements in medical technology and the strong growth potential of economies in the region, companies and governments should rightly seize this opportunity.

Ageing population

Rapidly ageing populations in Southeast Asia will further burden healthcare systems as demand for eldercare services grows. According to a recent report, current trends indicate that the rapid growth of the elder segment of the population will alter the leading causes of death, from infections to chronic noncommunicable diseases such as diabetes, dementia, cardiovascular disease and cancer. Subsequently, this will increase the demand for medical devices in the region.

The medical device sector in the region has long been driven by increasing government expenditure on universal healthcare as well as reimbursement schemes. Nevertheless, private players also have an equal part to play in investing in the modernisation of hospitals and other relevant infrastructures.

Source: BMI Research

Source: BMI Research

According to Tobias Seyfarth, Managing Director and President of Siemens Healthineers ASEAN, typical services and products offered by vendors focus only on the bottom line – an area which most companies already excel in.

“I believe that anything that drives top-line growth is better value proposition and a real opportunity of growth for medical devices companies,” he said.

“Here in ASEAN there are opportunities for both – to increase penetration in the current segments as well as expand into new higher margin segments which however need to consider the local situation carefully,” added Seyfarth.

In mature economies like Singapore, Brunei and Thailand, healthcare demand is on the rise especially as these markets also cater to the burgeoning demand for medical tourism in the region. As a result, Singapore’s medical device sales grew on average by 8.25 percent annually from 2010 to 2016. Within the same period, medical device sales in the Philippines saw an average growth of 14.45 percent.

The medical device market within ASEAN is expected to be worth US$8.5 billion by 2020. This is representative of a compound annual growth rate (CAGR) of almost 10 percent. In view of this immense potential, a significant number of global medical device companies have embarked on expansion plans into this market by actively engaging local healthcare institutions and other key stakeholders.

Cultural effect

Society also has a part to play in the heightened demand for medical devices in the region. Within Southeast Asia, there is a strong tradition of caring for aged family members or relatives. Moreover, long-term care for geriatrics is bolstered by intrinsic cultural values like filial piety which places demands on children to care for their ageing parents or relatives.

Within the modern context, a child may not necessarily be actively partaking in the care of elderly members of the family. This burden may instead be transferred to professional caregivers as is the case in many urban ASEAN cities. These caregivers offer basic services like providing food, companionship and most importantly, healthcare.

Additionally, a growing middle class in ASEAN economies has seen an uptick in disposable income across segments of the population. This has resulted in greater spending power which increases demand for higher quality medical services which require better quality medical systems. As a result, the medical device industry will continue to grow, following expansions along the entire continuum of the healthcare sector from screening and diagnosis to treatment and monitoring and finally long-term care.