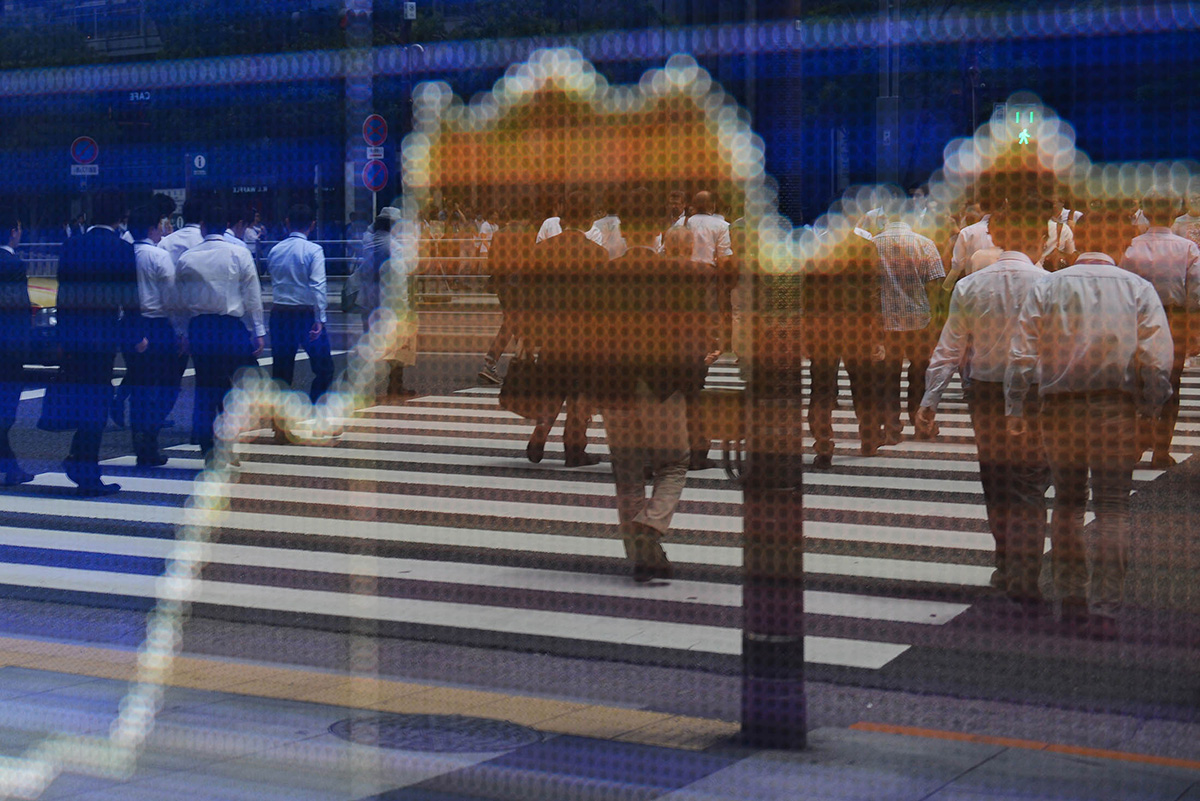

Asian stocks advanced after President Donald Trump’s measured response to North Korean missile launches and comments from Kim Jong Un suggested geopolitical tensions will ease off. The yen fell for a second day.

Equity indexes in Japan, South Korea and Australia opened higher after U.S. stocks rebounded from losses initially sparked when Kim’s regime fired a missile over Japan. The yen rallied on Tuesday as safe havens advanced, only to more than give up those gains as investors speculated the event won’t flare up. Bond yields rose as risk assets came back in favour and gold held at the highest level this year. Gasoline advanced for a seventh day as Tropical Storm Harvey picked up strength again.

Asian markets were roiled on Tuesday after North Korea fired a ballistic missile over Japan in an act the latter called an “unprecedented, grave and serious threat.” Trump said the U.S. will consider “all options” in its response. Kim said Wednesday the missile was in protest at annual military exercises between the U.S. and South Korea. That suggests the standoff is unlikely to intensify and, coupled with Trump’s tempered remarks, helped underpin risk assets.

“We’ve seen the typical reaction that you would expect yesterday, with the safe haven assets like the yen gaining and the Korean won obviously weakening and equity markets in this region selling off,” Khoon Goh, Australia & New Zealand Banking Group Ltd.’s head of Asia research, said in a Bloomberg Television interview. “What’s interesting is that the reaction has been fairly muted and a lot of the moves have largely reversed and I think it’s a case now where what’s happening with North Korea is not necessarily new.” – Bloomberg