Southeast Asia is one of the most rapidly developing regions in the world with projected economic growth rates averaging 5.1 percent for member states of the Association of Southeast Asian Nations (ASEAN). However, the banking penetration numbers reveal something more striking – a vast majority of Southeast Asians do not have access to basic banking facilities let alone have a savings account or access to credit facilities.

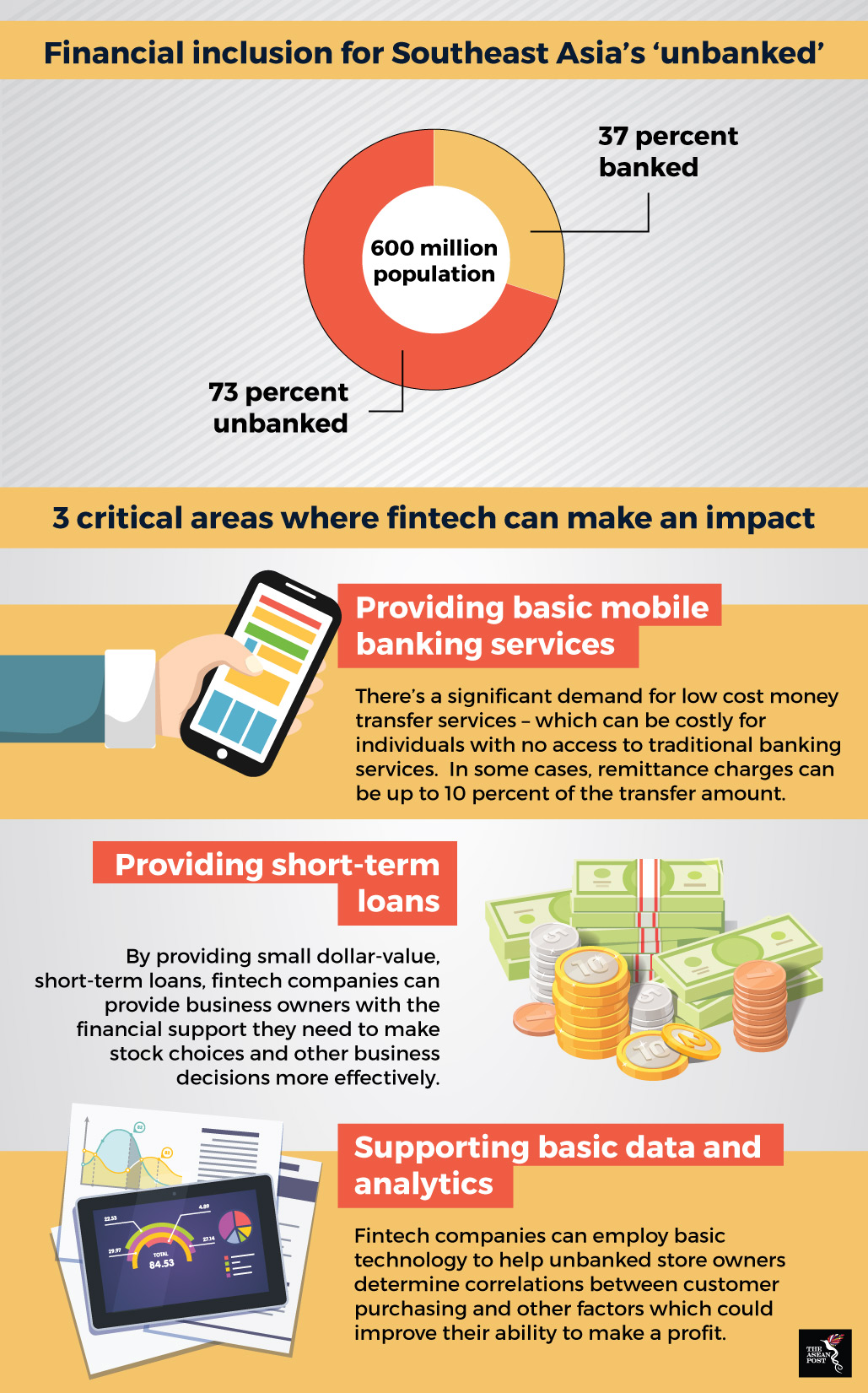

According to KPMG, only 27 percent of those living in Southeast Asia have a bank account. This leaves a huge gap in banking penetration with around 438 million unbanked individuals. In poorer countries like Cambodia, the numbers are even lower at just five percent.

This translates to opportunity – especially for fintech companies. Traditional banking and finance firms are starting to take note of the potential arising from incorporating technology into their business. With a tremendous injection of innovation from tech-heavy Chinese giants like Alibaba and Tencent, the landscape of banking in the region is set to shift radically.

Technology is already making waves in many parts of rural Southeast Asia where the majority of the unbanked reside. Much of the change there is driven by cheaper mobile phones and affordable data plans. In total, the number of active mobile connections across the region exceeds the total population by about 33 percent. Of that, 53 percent are connected via 3G and 4G connections.

Financial access should be a basic right

Suffice to say then, that the masses in the region are ready to adopt financial solutions via their mobile devices. As such, fintech has the potential to play a major role in extending financial services access to the unbanked in the foreseeable future.

Once given access to digital banking services, those who were previously unbanked would be exposed to a myriad of opportunities which will then help create a more inclusive banking ecosystem. One key area of focus is remittances. There is substantial demand in this region for low cost money transfer services. Companies like Grab – via their GrabPay fintech arm – and MoMo have employed mobile wallet technologies which enable those without regular bank accounts to remit money to their families at far lower costs than when using traditional banking.

Source: KPMG

Besides that, digital banking will also help plug the small and medium enterprise (SME) funding gap. Many SMEs today find it extremely difficult to secure loans because of prevailing difficulties when it comes to credit assessment.

Indonesian based Amartha, for example, is a peer-to-peer lending company which directly connects micro entrepreneurs with online financiers. Using psychometric and other credit scoring technologies, unbanked communities in the country have been transformed into credit-worthy recipients. They are kept in check by a credit rating which can then be used when applying for other modes of financing. Premier ride hailing company, Grab, also announced plans to roll out a similar micro-lending scheme which is said to be roughly based on its current driver assessment matrix.

Leveraging on digital technologies

Fintech companies also provide substantial forms of data analytics which can be useful to unbanked business owners in the region. Innovation in this aspect is scarce when it comes to the unbanked – but it is not without potential. Basic data analytics can be employed to help store owners determine correlations between customer demand and other purchasing factors like season and trends which in turn can improve the owner’s ability to turn a profit.

In a report by the Asian Development Bank, the effect of banking the unbanked by leveraging on digital technology, could boost gross domestic product (GDP) by 2 percent to 3 percent in markets such as Indonesia and the Philippines, and as much as 6 percent in Cambodia. Another study revealed that banking the unbanked in ASEAN could more than triple their economic contribution from US$17 billion to US$52 billion by 2030.

The potential of fintech to level the playing field for SMEs and the unbanked in Southeast Asia is immense. While some parties see it as being the cornerstone for economic change, its true impact lies in its ability to bring about true social change.