Microfinance is a service where financial institutions back small start-ups and would-be entrepreneurs with small loans, often times referred to as microloans. Such initiatives are most popular in the poorest parts of the world.

By distributing small loans and accepting small savings amounts, microfinancing empowers those below the poverty line to improve their livelihoods. It motivates them to create sustainable sources of income and also provides self-employment for their children and other family members. If followed through under specific guidelines, the potential to reduce poverty is immense.

In Southeast Asia, the biggest microfinance players currently include Asia Pacific-based LenddoEFL, Singapore's CredoLab and the Philippines’ Lendr.

Singapore’s e-hailing firm, Grab has also announced plans to form a joint venture with Japan’s Credit Saison to provide loans to consumers, micro-entrepreneurs and small-time entrepreneurs across Southeast Asia. The new joint venture will be known as Grab Financial Services Asia (GFSA) and will initially provide working capital loans and consumer goods financing to its existing pool of drivers, agents and merchants as well as other things.

Source: Various

The magic of big data

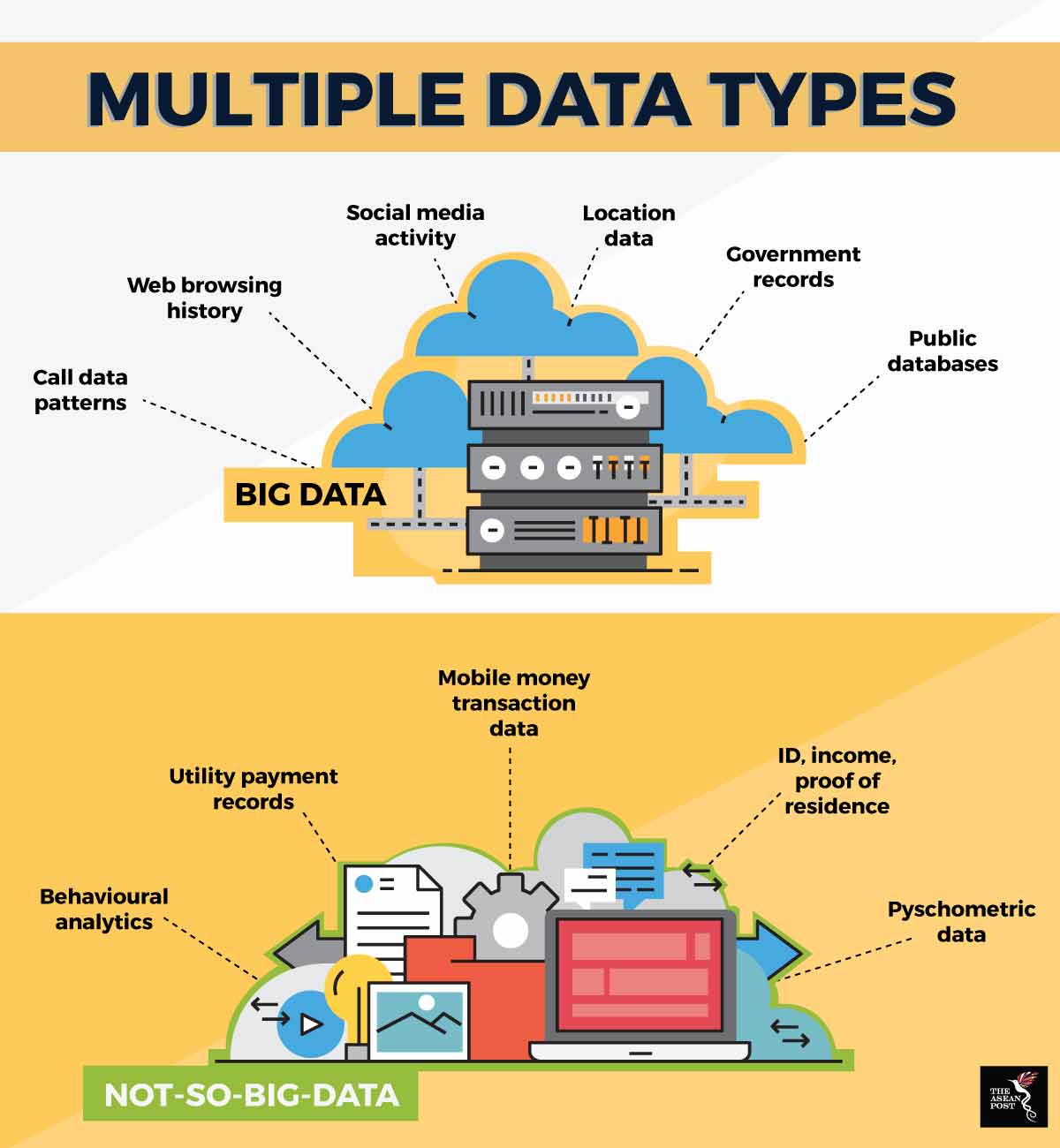

In this business model, big data, is used to assess a customer’s creditworthiness. Big data is defined as large volumes of structured and unstructured consumer data that can be gathered from a user’s entire profile of online activity, be it on social media platforms, product purchases or electronic check-ins.

Such data is usually collected from various data points, which varies according to the type of online activity performed. An example of this is phone usage data which includes call duration as well as frequency of calls.

It is this kind of data which will then be used to assess a customer’s ability to repay a loan provided via a microfinancing scheme. What is used is not the direct content of the data, but rather the behavioural patterns associated with the data collected.

Big data analytics is an increasingly integral part of the tech ecosystem and is fast disrupting the financial services industry as well. The ability to transform raw data into meaningful insights is the cornerstone of cross-industry development.

Assessing potential customer behaviour

LenddoEFL, for instance, uses smartphone data, email and banking transaction data to assess the creditworthiness of a potential customer. A higher level of predictability in a customer’s behaviour, based on data collected, points to an increased likelihood to repay a loan.

Even so, the key is the use of big data to augment traditional bank data models, rather than to undermine their purview completely. A combination of the two types of data provides a clearer credit profile for microfinanciers to work with.

Microfinancing in Southeast Asia is still largely nascent. However, there is plenty of potential for it to grow, due to the high levels of smartphone penetration here. This provides technology companies with large volumes of transaction data that they can funnel into alternative lending platforms.

Grab is one such technology company whose rapid expansion has been based on effective data leverage. So far it has used customer data to tailor its ride hailing and food delivery offerings to suit local needs in the eight Southeast Asian markets it currently operates in. The firm now has more than 86 million users across all these markets. Microfinancing services seem to be a natural next step for the company after the successful launch of its GrabPay e-wallet in November 2017.

Grab's rapid expansion into various market segments demonstrates the potential of big data to reach many different customer pain points, which can then guide it to create new products and services. Focusing on five key areas of data science, including markets, machine learning, optimisation, simulation and architecture has now allowed Grab to reach these niche markets more effectively.

Further technological developments in microfinancing may still be forthcoming, but much also depends on what the data is telling technology companies about the future. The future, as they say, lies in the potential of big data.

This article was first published by The ASEAN Post on 15 March 2018 and has been updated to reflect the latest data.

Related articles:

Philippines plays catch-up as more central banks tap `big data'

Alleviating poverty with microfinancing

Are Southeast Asia’s data centres ready for hyperscaling?