In an effort to stimulate economic growth, Brunei’s monarch and leader Sultan Hassanal Bolkiah launched “Wawasan Brunei 2035” also known as “Vision 2035”. Wawasan Brunei 2035 was first formulated in 2004, when Sultan Hassanal oversaw the formation of a Council for Long Term Development Planning who were tasked to articulate a future vision of Brunei and the strategies getting there. The recommendations drawn up by the council was then published in 2007 with the Sultan coining the term Wawasan Brunei 2035.

Wawasan Brunei 2035 outlines an ambitious future for Brunei. The three main targets of Wawasan Brunei 2035 is recognition on the world stage for the accomplishments of its highly educated and skilled people, having a quality of life that is among the top 10 in the world and a sustainable economy with an income per capita that is among the top 10 in the world.

One of the biggest drivers of Brunei’s economy is its oil industry. In fact, Brunei’s wealth and prosperity can be attributed mainly to its oil exports. Brunei is the third-largest oil producer in Southeast Asia and the ninth-largest liquified natural gas (LNG) producer in the world. Revenue from the oil and gas sector makes up about half of the country’s gross domestic product (GDP). Due to the high revenue Brunei generates from the oil and gas sector and its tiny population, Brunei’s GDP per capita is one of the highest in the world, ranked 4th on the International Monetary Fund rankings.

As the oil and gas industry has played a major role in the development of Brunei, the government has outlined three strategic goals under Wawasan Brunei 2035 to ensure growth in the energy sector - strengthen and grow oil and gas upstream and downstream activities, ensure safe, secure, reliable and efficient supply and use of energy and maximise economic spin-offs from the energy industry.

While it is understandable that Brunei would continue banking on its largest and most profitable resource to fund its economy, it could be unsustainable in the long run. Since Brunei’s economy is largely dependent on oil, any uptick in the oil market could have an effect on its economy.

In an analysis by Paul Pryce of UPH Analytics, Brunei’s government revenue declined by 70% from 2014 to 2016 largely due to the fall in oil prices. According to Brunei’s Department of Economic Planning and Development in 2016, Brunei recorded negative growth that year, with a GDP decline of 2.5%. The International Monetary Fund (IMF) has forecasted that while Brunei’s economy contracted to -1.3% in 2017, it will finally chart positive growth in 2018 with an increase of 0.7%.

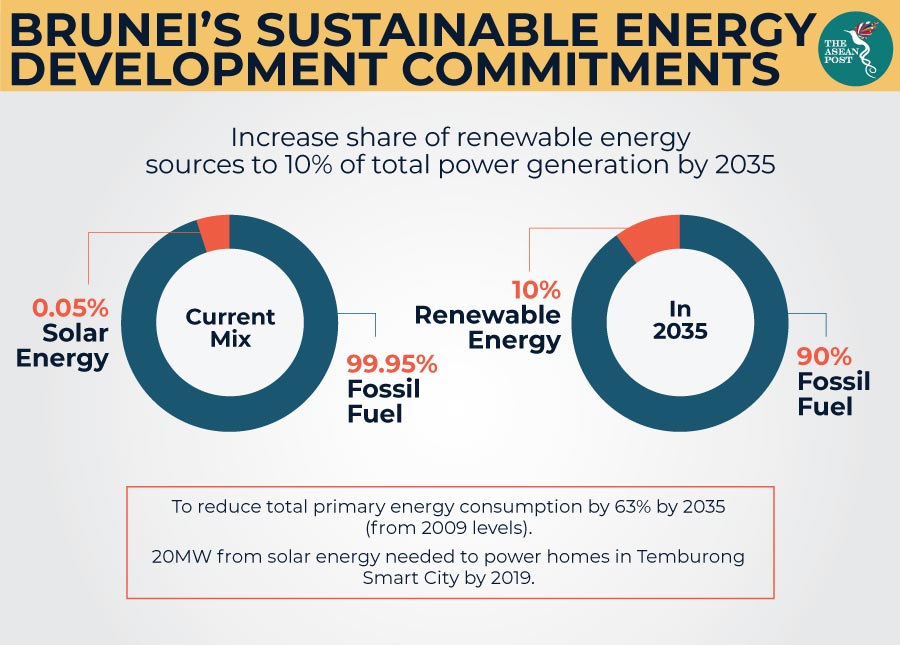

Furthermore, increased consolidation of the oil and gas industry could have an effect on the environment. In this regard, the government has increased efforts in integrating renewables in the country. In an Energy White Paper released by the Energy Department, Brunei is targeting to increase the share of renewable energy in its total power generation mix by 10% or 954,000 MWh by 2035.

The white paper also outlines several initiatives to develop renewable energy in the country like establishing a renewable energy policy and a regulatory framework. Aside from that, other steps like scaling-up the market deployment of solar PV and promoting waste-to-energy technologies will also be carried out.

Another step in the right direction includes plans for the development of the Temburong Smart City project. The project is done in collaboration with the Economic Research Institute of ASEAN (ERIA) and will be carried out in two phases. The first phase would introduce energy efficiency technology on existing infrastructures like buildings and roads as well as smart grid technologies. The subsequent phase would use a computer simulation to determine the suitable capacity of power sources to provide electricity to the area.

While these efforts should be applauded, Brunei needs to step up its efforts in reducing its dependency on oil and gas. Not only would it benefit the environment but will also prevent a crisis in the country’s economy if any external factors should jeopardise the oil market.