The two titans of ride-sharing, home-grown Grab and American import Uber, have been doing battle for a few years. They have become fierce rivals and though Grab has taken a lead in Southeast Asia, Uber will likely not go down without a fight.

There’s a good reason to stay and fight. The ride-sharing market in Southeast Asia is projected to be worth 13.1 billion dollars by 2025. While that is already a large market, it is only a small portion of the region’s internet economy, which could reach up to 200 billion dollars in the same period. That is why both companies are aggressively trying to expand their portfolios by entering other sections of the market.

Going beyond ride-sharing

Grab has recently joined the payment solutions market and have rolled out their GrabPay service to third-party vendors – with a plan to roll out to at least 1,000 partners in Singapore before 2018. Grab also has its GrabFood delivery service in Indonesia.

Uber has taken aim at mature markets like Singapore with services like UberEATS in a bid to take on established food delivery services like Deliveroo and FoodPanda. They’ve also started experimenting with other ride-sharing services like UberPet.

Another player: Go-Jek

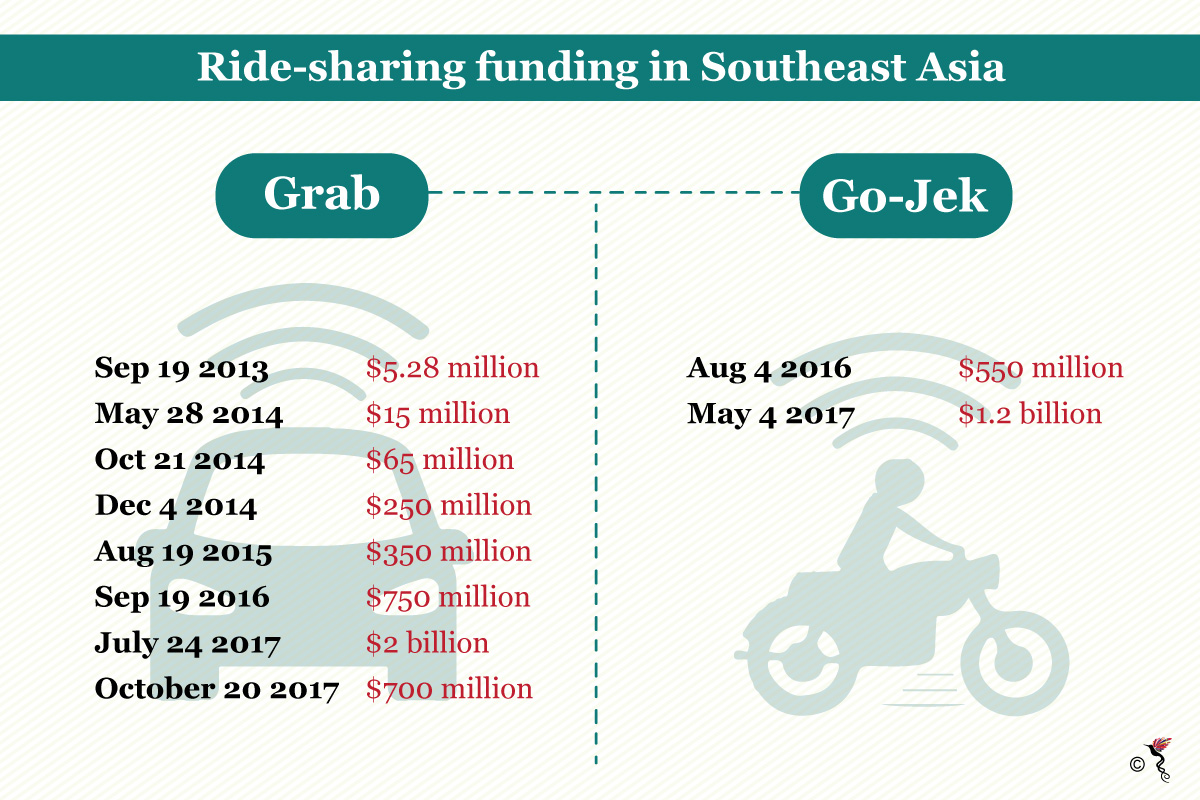

Though Grab and Uber certainly have a large presence in Southeast Asia, their current attempts to diversify services are not as mature as Indonesia’s unicorn, Go-Jek.

Go-Jek’s available services include food delivery, grocery delivery, courier and large cargo delivery services, event and movie ticket sales, medicine delivery and medicine delivery. Their Go-Life division also allows users to order a masseuse, a home cleaner, auto care and emergency towing, and beauty services such as a mani-pedi. They also have their own cashless payment solution, Go-Pay, which also allows third-party merchants to use the services.

Of course, one should not compare Grab, Uber and Go-Jek at face value, because the two companies have taken different routes to get where they are today.

Grab and Uber have certainly taken the lion’s share of the funding and media attention. However, they have had to expand to other countries aggressively to continue increasing their business.

Go-Jek, on the other hand, has focused solely on expanding their business within Indonesia, thanks to its massive population of 264 million people.

Go-Jek’s founder, Nadiem Makarim, seems ready to get in the trenches. Though his company has traditionally been on the defensive in Indonesia, it was revealed in October of this year that they plan to mount their own counter-offensive by offering their own ride-sharing services to three or four other countries in Southeast Asia.

It certainly makes sense for them, since they have already created a viable product that is rich with services in their home country. Entering the Philippines, Vietnam, and Thailand will give them access to another 270 million people.

The battle for Southeast Asia has just begun

It will not be easy for anyone to win the ride-sharing war in Southeast Asia, and it looks like the battle has just begun. Go-Jek’s expansion into the regional market will be worth watching.

If Go-Jek are able to enter the markets and then bring the same quality and selection of services that they’ve created in Indonesia, then the other ‘big two’ will need to watch out.

What remains to be seen is how much of the 200 billion dollar Southeast Asian internet economy will be taken by each company. What we can be certain of is that all three will continue to scale and try to expand their business to as many areas as possible.

Recommended stories: