Alibaba Group Holding Ltd recently announced that they will invest an additional US$2 billion into the Lazada Group. It is believed that this move by Alibaba is to counter Amazon’s plans of expanding its market to this region which has over 600 million potential customers.

The American e-commerce giant officially launched a membership programme named Prime in Singapore in December, 2017. This launch made Singapore the first country in Southeast Asia and the 16th country globally to enjoy the benefits associated with a Prime membership such as free shipping, videos streaming and e-books with just one payment.

To counter this, Alibaba took some progressive steps which included increasing its investment value in Lazada and changing its Chief Executive Officer from Max Bittner to Lucy Peng, one of the founders of Alibaba. From this we can understand that Alibaba is serious in wanting to secure its place as the “big boy” in Southeast Asia's burgeoning e-commerce sector.

Local e-commerce players

Established in 2012, Lazada started its operations in six ASEAN countries including Indonesia, the Philippines, Malaysia, Singapore, Thailand and Vietnam. Today, Lazada is dominating the e-commerce sector in all these countries, leaving all local e-commerce players far behind.

With Alibaba locking horns in Southeast Asia with Amazon for complete domination, what can local e-commerce players do to survive? Are they out of the game?

Let’s take a quick look across the region. Indonesians make up almost 40 percent of the population in Southeast Asia. Indonesia is one of the fastest growing countries in the world and smaller e-commerce players like Elevenia, Blibli and Blanja are finding it more challenging to compete with international giants like Lazada that continue to gobble up the e-commerce market share there.

Business to Customer (B2C) figures for February 2018 as analysed by ecommerceIQ shows that the number of visitors to Lazada has almost tripled to 111.8 million compared to second placed Blibli with 43.8 million visitors and Elevenia with 6.36 million visitors in third place.

According to ecommerceIQ, in Malaysia alone, Lazada had 44.98 million visitors which is almost four times the number of visitors to 11street (13.01 million) and Shopee (12.51 million) respectively, in February. The same goes for Thailand, where Lazada is roughly four times ahead of Shopee Thailand with 63 million visitors during the same period of time.

The emergence of social commerce

While Lazada is topping out in most parts of Southeast Asia, the Economic Intelligence Center (EIC) did an analysis in Thailand and found out that social commerce is gradually catching up with e-commerce.

Social commerce is the fusion of social media with e-commerce as explained by Dr. Paul Marsden from Syzygy Group, an international company which specialises in interactive marketing.

According to a survey conducted by EIC in February 2017, 51 percent of Thai respondents prefer to shop online through social media such as Facebook and Instagram, second only to Lazada that secured 65 percent of the survey.

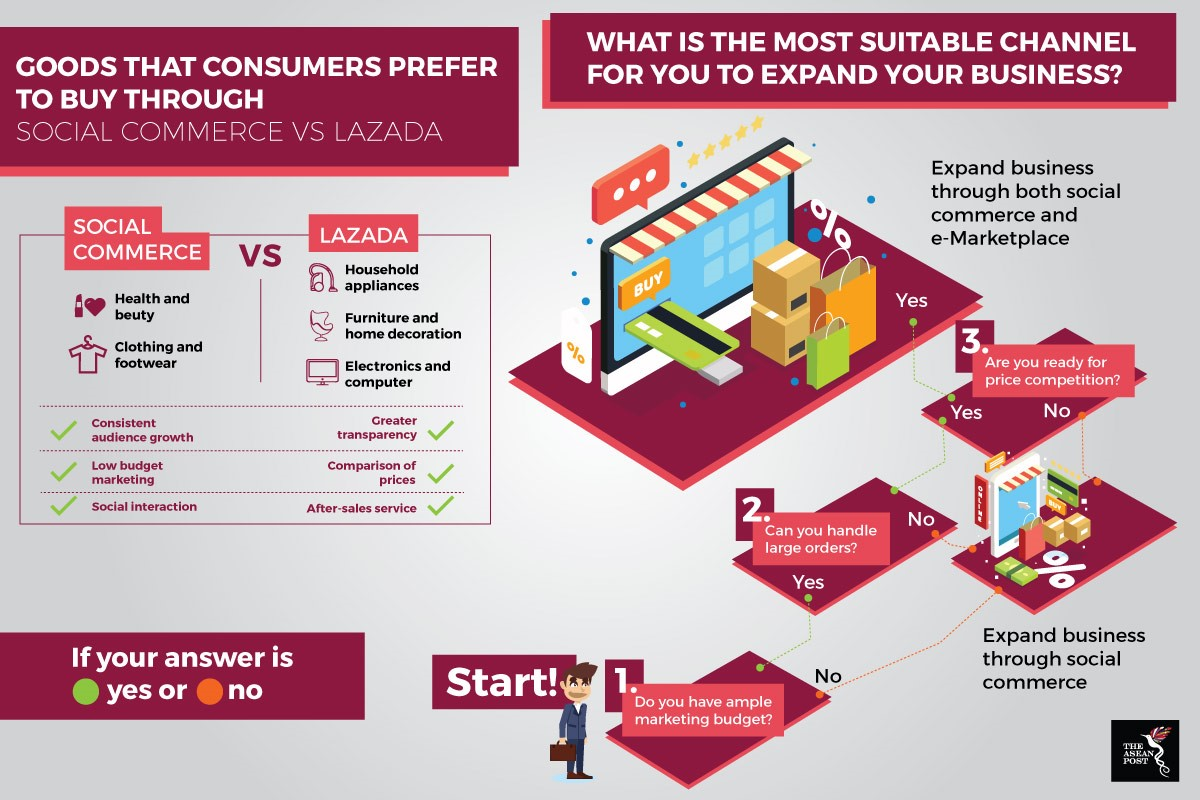

This was reflected in another survey done by EIC which states that Thai consumers prefer to purchase clothing & footwear (59 percent) and health & beauty products (55 percent) via social media compared to Lazada with only 36 percent and 44 percent, respectively.

Source: ecommerceIQ

This can be seen as an alternative pathway for local e-commerce players to remain relevant in the industry. In order to improve the online purchase experience, social commerce utilises social media and online media to support the social interaction and user contributions.

Local e-commerce players should really evaluate themselves in terms of financial support and manpower before “duplicating” or engaging any of the major players out there. First and foremost, local e-commerce players need to determine the demands and preferences of Southeast Asians. If they are not ready for a price competition or handling large orders, it is advisable for local e-commerce players to expand and look for possibilities through social commerce.

It is also understandable that very often local players lack sufficient marketing budgets. Hence, social media comes in handy with the idea of “modern word-of-mouth marketing”. Besides, one of the reasons an e-commerce giant like Lazada can thrive in this region is due to the after-sales services they offer. This is a crucial element that draws more customers in and captures their hearts.

In the era of social media, local e-commerce players must be innovative and courageous to take a leap from a traditional website business to multiplatform engagements. It is hoped that local e-commerce players can take up the challenge and create their own niche among the giants of e-commerce so set on total dominance of the region.