This month marks the third year of Rodrigo Duterte’s presidency. His presidency has been controversial to say the least, from being marred with criticisms from international institutions for his war on drugs to his various public outbursts. Most recently, the Filipino president called God “stupid” and vowed to resign if anyone could prove that God existed.

His penchant for outrageous headlines however has stolen the spotlight from his economic reforms, dubbed “DuterteNomics”. Policies under DuterteNomics include the development of infrastructure and industries which will help propel the Philippines into becoming a high-income nation. Among the key projects under Dutertenomics is the “Build! Build! Build!” programme.

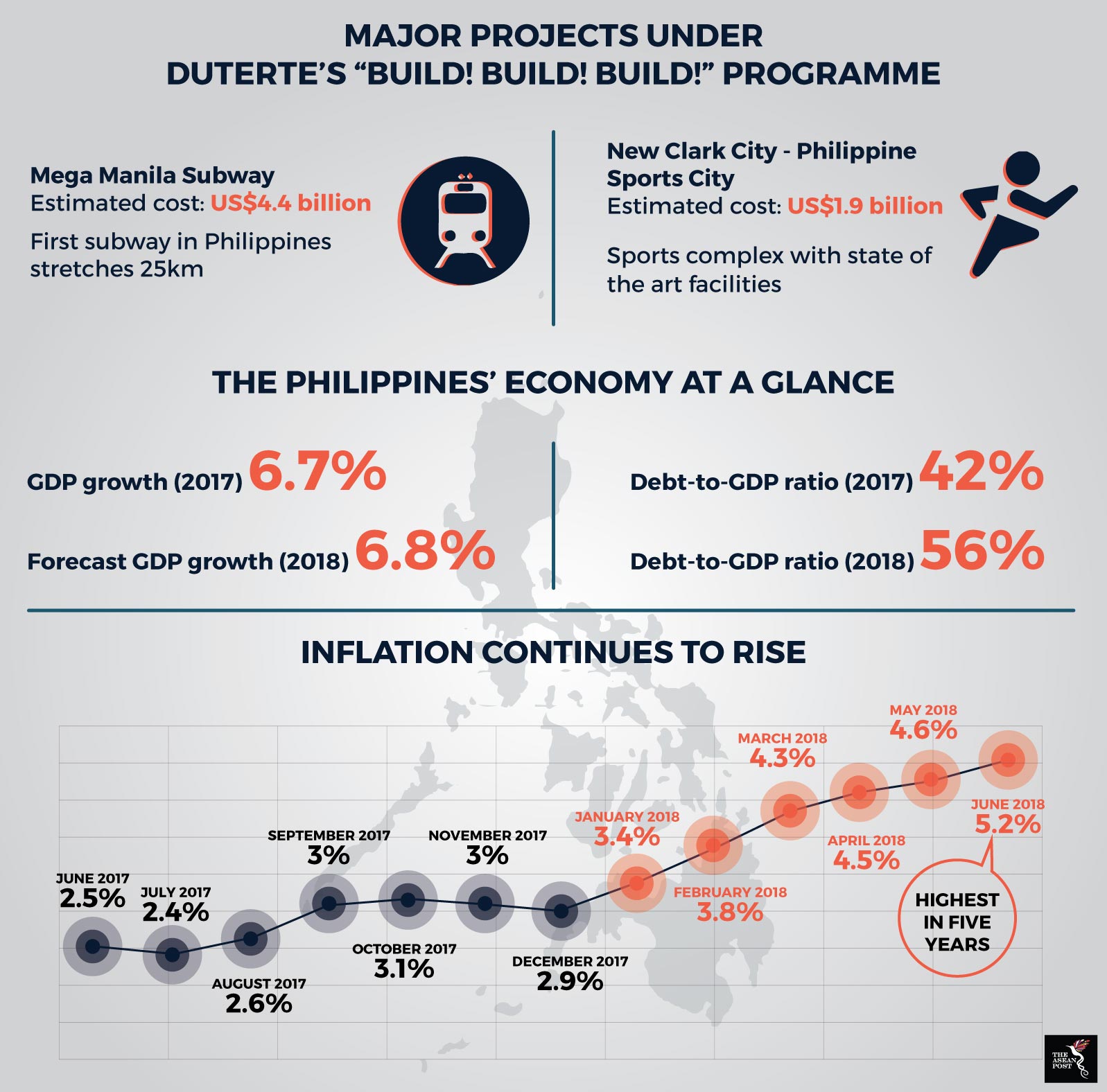

Duterte claims that Build! Build! Build! would usher in the Philippines’ “golden age of infrastructure”. Build! Build! Build! is estimated to cost US$180 billion, with 75 projects planned. These projects include a new Manila airport terminal, Manila’s first subway system and a 102-kilometre railway line in Mindanao. Most of the infrastructure in the pipeline relate to transport, which Duterte hopes will help enhance mobility and connectivity in the country.

These infrastructure projects are expected to provide a boost to the Philippine economy upon completion. Economists have said that these new infrastructure projects have the potential to boost growth in the country, with the government anticipating up to eight percent growth for the economy this year, according to Socioeconomic Planning Secretary Ernest M Pernia. Despite that, the country could still face difficulties in financing its projects. As it stands, the Philippines is spending about US$20 billion on infrastructure alone and this figure is projected to double by 2022.

Tax reform

Duterte plans to finance his infrastructure projects with a series of tax reforms called the Tax Reform Acceleration and Inclusion (TRAIN) bill.

The first package of the bill was signed in December last year. Under the bill, Filipinos will see a decrease in income tax rates, which will affect around 99 percent of income tax payers. On the other hand, taxes on certain goods and services were hiked. For example, taxes were raised for cars, fuel, tobacco, cosmetic surgery, tobacco, and some sweetened beverages. There were also tax hikes on other items such as passive income and estate tax.

The second package of tax reforms will include, among other things, a reduction in corporate income tax from 30 percent to 25 percent. The package will also amend rules on tax breaks, giving companies tighter criteria to fulfil if they want to enjoy tax holidays.

Duterte has urged congress to pass the second package of reforms under TRAIN, but there seems to be some pushback from local politicians as doubts are raised about the effectiveness of the bill.

Source: Various sources

In the past year, prices of goods in the Philippines have steadily increased and some parties are pointing to the passage of the first TRAIN bill as being responsible for this. Inflation hit a five-year high at 5.2 percent last year in the Philippines. Some politicians have even called for reforms implemented under the TRAIN bill to be suspended because of this.

Politicians are also resistant to pushing through this bill as it could be an unpopular move in the eyes of the voting public, which could later affect their respective positions in next year’s elections. Duterte, who is adamant that the reforms go through, also has to keep one eye on his declining approval rating in the country.

Whether TRAIN had anything to do with rising inflation rate in the Philippines is debatable, but it is for certain that the tax reforms do not help ordinary Filipinos make ends meet. To make matters worse, the second package of tax reforms include a tax break for corporations but offer none to the average Filipino.

The TRAIN bill was supposed to improve the economy of the Philippines but it looks like the results reveal otherwise. Local media have even reported that the government's revenue loss due to the new tax reform law is estimated at US$16.8 billion from 2018 to 2022. With lower tax revenue, government borrowing is also expected to rise. This begs the question of the purpose of the TRAIN bill in the first place.