The negative sentiments stemming from the European Union’s (EU) ban on palm oil is exerting pressure on the crude palm oil (CPO) price. In January 2018, members of the European parliament passed votes to amend a draft law on renewable energy. Although the bill is subject to further debate by the European Council, its call-for-action towards the reduction of palm oil derived biofuels and bioliquids, is adversely affecting the price of CPO. The EU proposes a ban on using any vegetable oil in the production of biodiesel with sights on ethanol as a replacement.

According to the Malaysian Palm Oil Council (MPOC), the current price of CPO has faced a steady decline in recent weeks from RM2,559 per tonne closing February 2018 to RM2,443 per tonne closing 7 March, 2018. In addition to the EU’s planned ban on palm oil in motor fuels from 2021 onwards, recent waning CPO demand in China and India’s higher import tariffs on CPO shipments have also inflicted negative pressures on CPO prices. Nonetheless, the depth and breath of the impending EU ban could be the root of these latter implications.

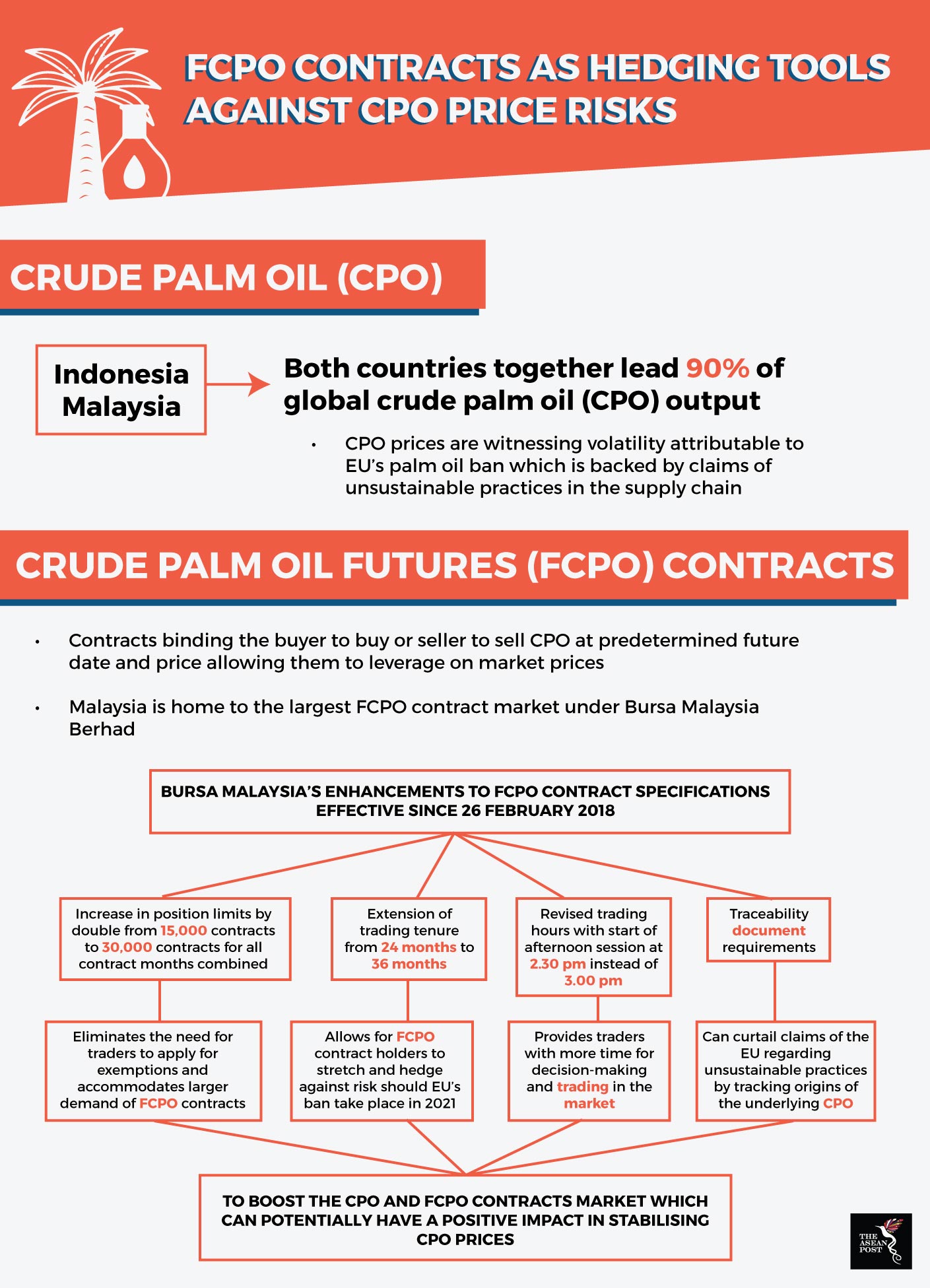

The EU’s imminent ban on palm oil in motor fuels is attributed to questionable palm oil harvesting practices and the resultant greenhouse gas emissions. The EU alludes to the ban as being part of their climate change goals as well as questionable sustainable practices within the crude palm oil industry which the EU is not part of. Indonesia and Malaysia make up almost 90 percent of global palm oil output. The ASEAN duo have voiced their dissatisfaction against the ban by claiming an economic colonisation attitude from the EU. Additionally, Malaysia is also home to the largest market of crude palm oil futures (FCPO) contracts. FCPO are financial contracts binding the buyer to buy or seller to sell crude palm oil at a predetermined future date and price.

Malaysia’s Minister of Plantation Industries and Commodities, Datuk Seri Mah Siew Keong has encouraged companies to hedge on FCPO contracts as an effort to strengthen CPO prices in the market. In view that Bursa Malaysia’s FCPO contracts are the most liquid futures contract for the pricing of CPO, hedging would facilitate management against unfavourable price risks. The pricing mechanism of CPO is reliant on factors such as the quantity of supply in the market. The planned EU ban may result in dwindling demand of CPO giving rise to price risk.

The recently concluded global annual Palm & Laurics Price Outlook Conference & Exhibition (POC2018) from 5 – 7 March organised by Bursa Malaysia witnessed the announcement of new specification enhancements to FCPO contracts. The new enhancements effective 26 February 2018 include the revision of trading hours, increased position limits, extension of trading tenure and traceability document requirements aimed at further strengthening the FCPO contracts.

Source: Reuters, Bursa Malaysia

In light of the lengthened trading tenure allowing companies to hedge their prices up to 36 months compared to the previous 24 months, companies can constructively hedge against price volatility. By setting a favourable predetermined contract rate, palm oil companies can protect themselves against a potentially volatile market. If the EU ban goes ahead in 2021, holders of FCPO contracts today can have their worries of unfavourable CPO prices safely alleviated as a result of this newly implemented trading tenure. Bursa Malaysia’s increased position limits by double from 15,000 contracts to 30,000 contracts for all contract months combined and eliminates the need for traders to apply for exemptions to hold more contracts. Along with facilitating the ease of trade, this larger limit can boost the FCPO market thus effecting more stable CPO prices. The additional 30-minute extension to trading hours will also be a contributing factor in driving greater market activity since it accommodates more decision-making and trading time for market players.

The traceability document requirement introduced by Bursa Malaysia appears to be an implicit response to the Roundtable on Sustainable Palm Oil (RSPO) effort of making sustainable palm oil the norm. Since the EU’s planned ban, attention has been focussed upon the credibility and sustainability at the end of the supply chain. With claims of irresponsible deforestation in lieu of clearing land for palm plantations, Bursa Malaysia has initiated the requirement that sellers of FCPO contracts provide traceability details up to the palm oil mill and the quantity of underlying CPO. From a larger perspective, this initiative has the power to curtail unsustainable CPO practices within the region by establishing formal documentation. With a significant majority of CPO producers as well as the largest FCPO contract market being within the ASEAN region, the traceability document requirement may just prove to be a master-class in response to the EU’s proposed palm oil ban.