Agriculture is the backbone of Indonesia’s development, contributing 13.1 percent to the country’s gross domestic product (GDP) in 2017. Although its share of the GDP is contracting, the sector remains the second biggest employer for Indonesia, especially in rural areas. The United Nations Food and Agriculture Organization (FAO) estimates that around 33 percent of Indonesia’s labour force is employed in this sector.

The majority of Indonesia’s farmers – 93 percent of them – belong to small family farms with an average size of 0.6 hectares. Despite this, securing the working capital needed to produce food is one of the major issues for them. As a former chilli, mushroom and poultry farmer himself, Yohanes Sugihtononugroho fully understood the challenges faced by small farmers.

After his poultry farm in Bogor faced financial ruin following mass culling by bigger farms that led to the flooding of markets which triggered plummeting prices, Yohanes created a mobile crowdfunding application to help improve small farmers’ access to funding. Through his platform, anyone can invest as little as US$1 in thousands of farms across Indonesia.

Speaking from experience

“We were a small player fighting tooth and nail every day. When it all came crashing down, I was really depressed and didn’t know what I then wanted to do with my life. Instead of turning my back on farming, I decided to help other farmers struggling financially by setting up CROWDE.

“Working capital is also one of the major issues in Indonesia. Instead of getting a loan from the bank, most farmers get their working capital from middleman and loan sharks because those are the only feasible options for them. Unfortunately, middlemen and loan sharks offer undeniably high rates and farmers become the victims, crippled and trapped in this situation for years,” he said.

According to Yohanes, if left unaddressed, the insurmountable challenge of securing funds for smaller farmers can pose a threat to food security in the country. The number of farmers in Indonesia keeps decreasing due to the perception that being farmers sets you on the path to a life of poverty. Even farmers discourage their children from becoming farmers.

The conditions are worse for women farmers, said Yohanes, stressing the huge income gap between day-to-day farmers or field workers and landowners. While workload and working hours are similar, women sometimes only get half the pay of their male counterparts, as male workers get the additional “privilege” to buy cigarettes.

Now everyone can invest

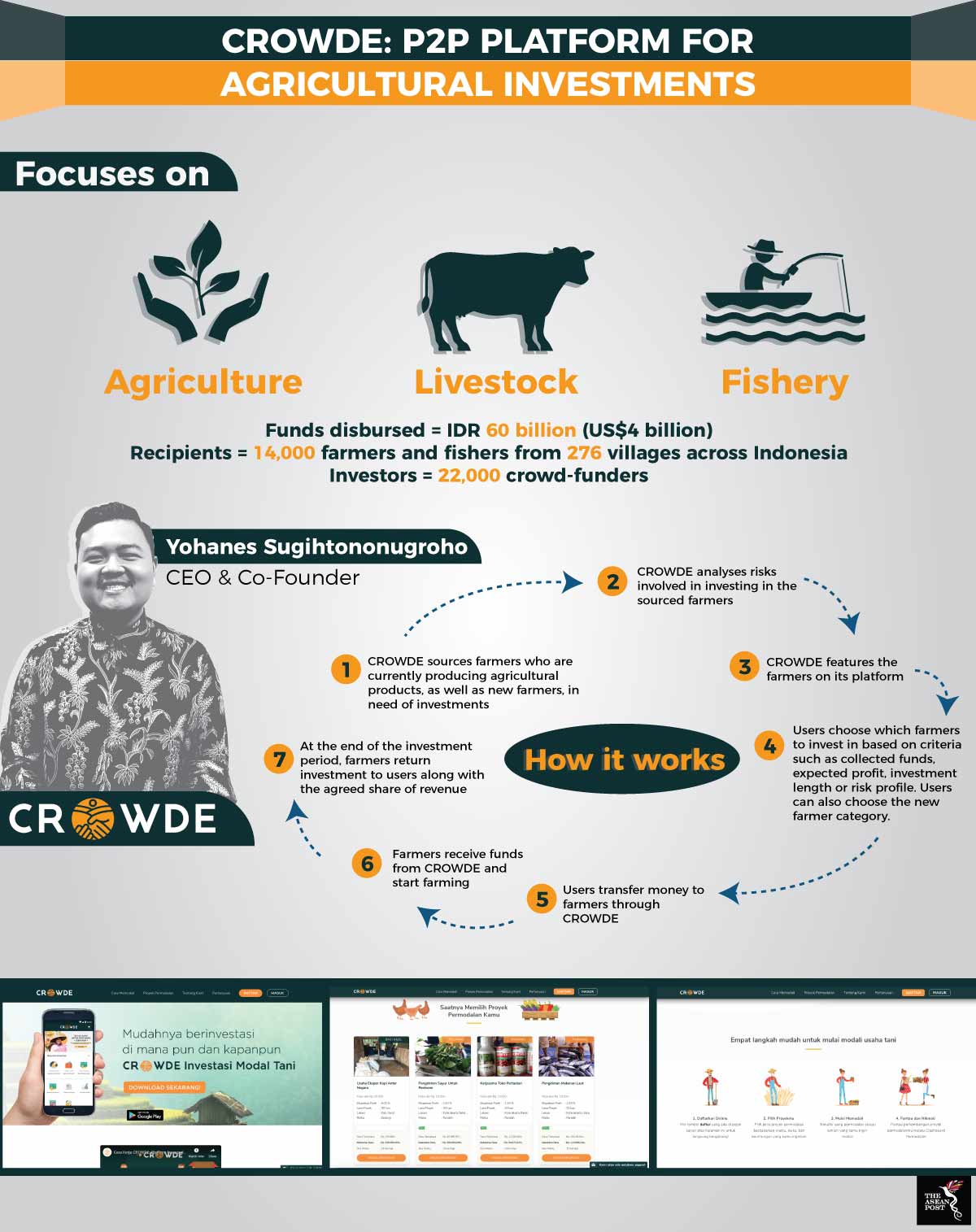

The CROWDE app offers access for people with funds to invest in Indonesia’s farmers who produce beef, poultry, fish, rice or chilli and share in the profits generated. CROWDE’s field agents across the sprawling Indonesian archipelago go into villages and persuade farmers to sign up. To date, CROWDE has been able to attract about 22,000 investors and has raised over US$4 million to help 14,000 small farm holders.

Instead of cash, CROWDE farmers get equipment like tools, seeds, fertilisers and pesticides, which are purchased in bulk by CROWDE at a lower rate from partnering agricultural supplier, Toko Tani. CROWDE also links farmers with buyers and suppliers to get them the best deals possible, including with major supermarkets.

“One of the obstacles is to educate the farmers. We want to empower farmers on-farm and off-farm. Besides giving them a platform to get funds, we also educate them about agriculture and financial management. We are still trying a few different approaches to get the best output based on different cultures across the country,” explained Yohanes, who says that CROWDE’s current risk-adjusted returns stands at about 60 percent since its inception.

Source: CROWDE.

Farming, Indonesia and beyond

However, CROWDE is not stopping at just farmers’ access to funding. The platform has also created small farmer groups, through which farmers are exposed to information on agronomy, finance and technology needed to scale up their businesses. In West Java, these farmer groups are known as Paguyuban and some members of the Paguyuban can now afford to buy pick-up trucks and motorcycles to transport their farm produce, have access to one of the biggest retail markets in Indonesia and expand their farming land.

“We are currently working on the development of the Toko Tani app that could help improve farmers’ market’s financial access, as well as store management in general,” said Yohanes.

CROWDE also has its sights set on a bigger horizon, both in terms of sector and geographic targeting. In a few year, CROWDE targets collaborations with up to 150,000 farmers from all over Indonesia, as well as more lenders and financial institutions or angel investors. It targets disbursement of more than US$50 million. Next stop: ASEAN.

"I wish that our mission to revolutionise Indonesia’s agriculture will become a reality so that we are able to increase farmers’ production and farmers’ prosperity, as a whole, along with helping Indonesia to be a food self-sufficient country,” he said.

Related articles:

Blockchain to help rice farmers

Financing Indonesia’s resilience building

Insuring farmers for food security