Following a regulatory framework which went into effect last month, Thailand’s central bank has announced a set of rules governing cryptocurrency activities in the country. The rules which apply to financial institutions and their subsidiaries are the latest in a concerted effort by the Thai government to regulate the use of cryptocurrency within its borders.

A circular issued February this year, which disallows financial institutions from engaging in crypto-related activities has been revoked. Thailand joins a handful of nations in the world to have a regulatory framework for cryptocurrencies including digital token offerings.

What are the rules?

In a fresh circular, the Bank of Thailand (BOT) outlined two broad categories which the new cryptocurrency rules will now apply to - financial institutions and their subsidiaries.

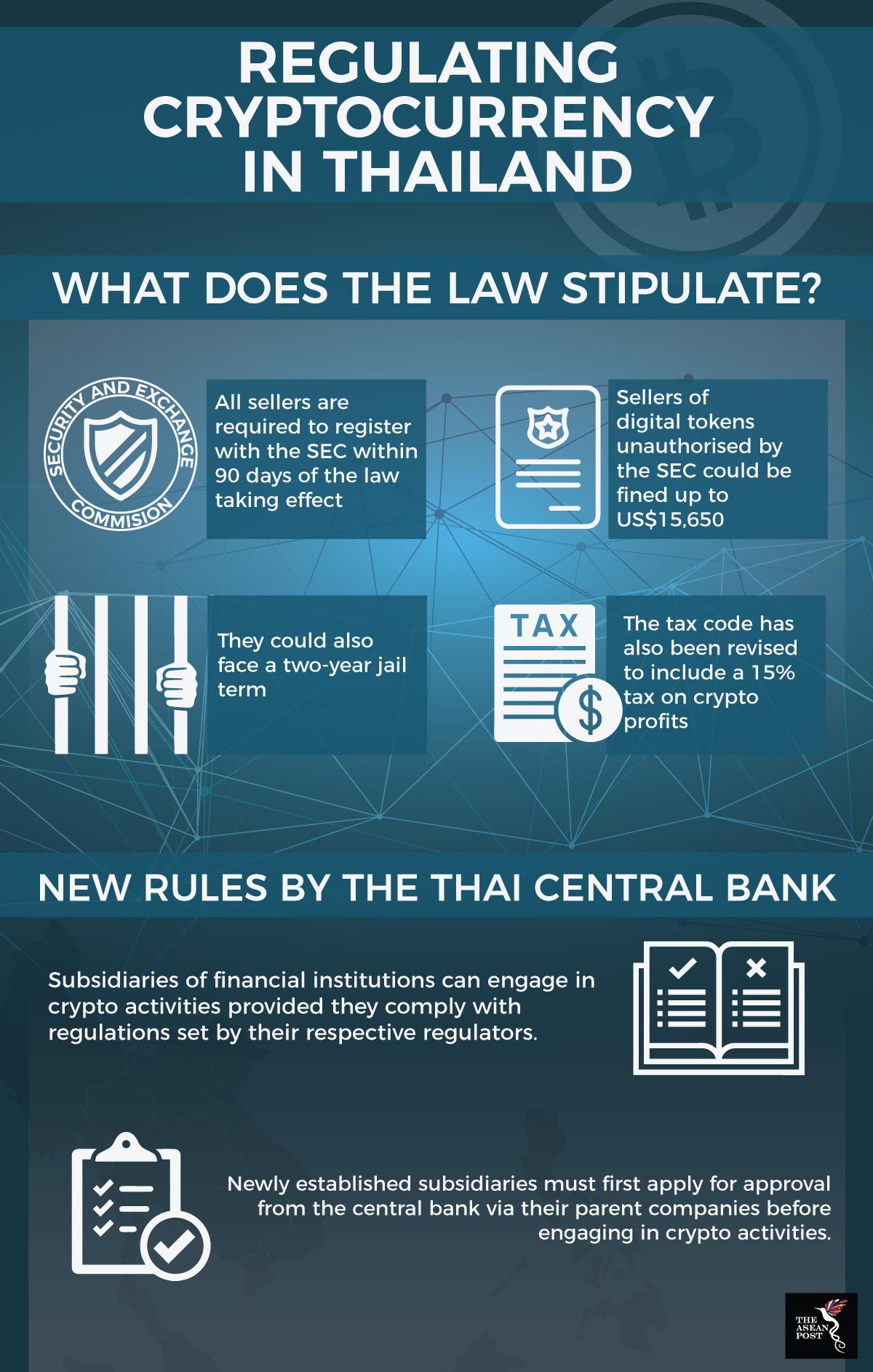

Subsidiaries of financial institutions are permitted to engage in crypto-related activities like token issuances and investing in cryptocurrencies, provided they comply with regulations set by their respective regulators. This is in reference to subsidiaries of financial companies that offer other financial products like insurance, brokerage and asset management.

For example, if a subsidiary brokerage firm offers cryptocurrency investment products to its investors, it must comply with the rules set by the Thai Securities and Exchange Commission (SEC). Likewise, insurance firms looking to do the same must adhere to the rules stipulated by the Thai Office of Insurance Commission (OIC).

However, the BOT doesn’t allow for newly established subsidiaries to immediately engage in crypto activities. Such subsidiaries must apply for approval from the central bank via their parent companies and these applications would be considered on a case-by-case basis.

Moreover, parent companies are responsible for oversight and overall risk management associated with the crypto-related activities of the entire group and its subsidiaries. They must ensure adequate regulatory guidelines are followed in accordance to Thai law.

Source: Various sources

For financial institutions however, the rules are relatively stricter given the BOT’s position that the nascence of the crypto industry could affect consumer confidence and have a ripple effect on the nation’s financial system. As such, there are four areas within the cryptosphere that financial institutions must refrain from engaging in.

Firstly, they cannot issue or provide any service that sells digital tokens. They aren’t allowed to invest in digital assets including tokens and cryptocurrencies. Next, they can’t engage in crypto businesses as brokers, dealers or as exchanges. Finally, they cannot solicit or provide advise on crypto-related investments to non-institutional investors who aren’t accredited by the Thai SEC.

Regulation not ban

Thailand’s continued steps to regulate its cryptocurrency industry comes on the heels of increased interest in decentralised currencies and digital token issuances by the general public. Three out of five initial coin offering (ICO) portals have already filed for licences with the relevant authorities and another 20 companies have applied for authorisation to operate as digital assets exchanges.

In May this year, the government there introduced a new legislation governing cryptocurrencies. According to the government, the new laws serve to regulate such digital assets and tokens while protecting investors from the uncertainties of the cryptocurrency market.

This new piece of legislation comes down hard on the illicit use of cryptocurrency, especially for money laundering, tax evasion and unauthorised transactions. Fraudulent filings could see a convicted perpetrator facing a five-year jail term. Those involved in unauthorised digital token transactions could also face a fine of up to US$16,000 or two years in jail. Allowing other individuals to carry out transactions using one’s own accounts is also punishable under the new law with a jail term of up to a year and a fine of up to US$3,100.

As cryptocurrencies continue to gain prominence in the financial sector, Thailand has demonstrated that it can chart a middle path with regards to regulation and not have to resort to an outright blanket ban. Investor sentiment for the industry may remain cagey for now but if adequate rules are put in place, it would serve as a much-needed brake on the prevailing cryptocurrency hype and prevent unnecessary market panic.