Ever since Uber sold its Southeast Asia-based businesses to rival Grab, social media has been abuzz with complaints against Grab. Complaints against the ride-hailing company were mostly about how fare prices have gone up since the merger. Many are saying that since Grab has now established a monopoly over ride-hailing in the region, it is engaging in price-gouging tactics. Grab on the other hand, have categorically denied this, maintaining that prices are determined according to their algorithm which is based on demand and supply.

While the jury is still out on whether Grab is spiking prices after the departure of Uber from the region, it is still a legitimate concern for many who depend on ride-hailing apps to get around. Uber’s exit from the region means that Grab is the largest ride-hailing company in the region, effectively giving them a monopoly.

A company with a monopoly has great powers – more often than not, at the detriment of consumers. Among the dangers of a monopoly is that it gives them the power to set prices. Prices are usually decided by the market, and since Grab doesn’t have any major competitor in the market right now, Grab doesn’t have to follow the market to set its prices. Eventually, consumers will lose out if Grab ever decides to spike prices up.

Aside from that, workers will also lose out if a monopoly is established. Without enough firms competing with Grab, drivers will have little option to go anywhere else if work conditions get worse. In places where Uber has a monopoly over ride-hailing, drivers have reported that they are forced to work long hours – some even sleep in their car – to make a living.

However, in the world of ride-hailing, the creation of a monopoly is usually the end goal. Uber pioneered this business model, where a firm enters the market with prices so low that other businesses would go out of business trying to compete with it. This explains the resentment many taxi drivers have against e-hailing companies.

With this business model in mind and Grab’s grip on the region’s e-hailing market getting stronger, experts have said that the logical step for Grab would be to raise prices. With it’s biggest competitor eliminated, Grab needs to recoup the losses made when it was charging customers lower prices.

This was what happened when Uber left the Chinese market in 2016. According to media reports, fares by Chinese e-hailing app Didi Chuxing rose by 20%.

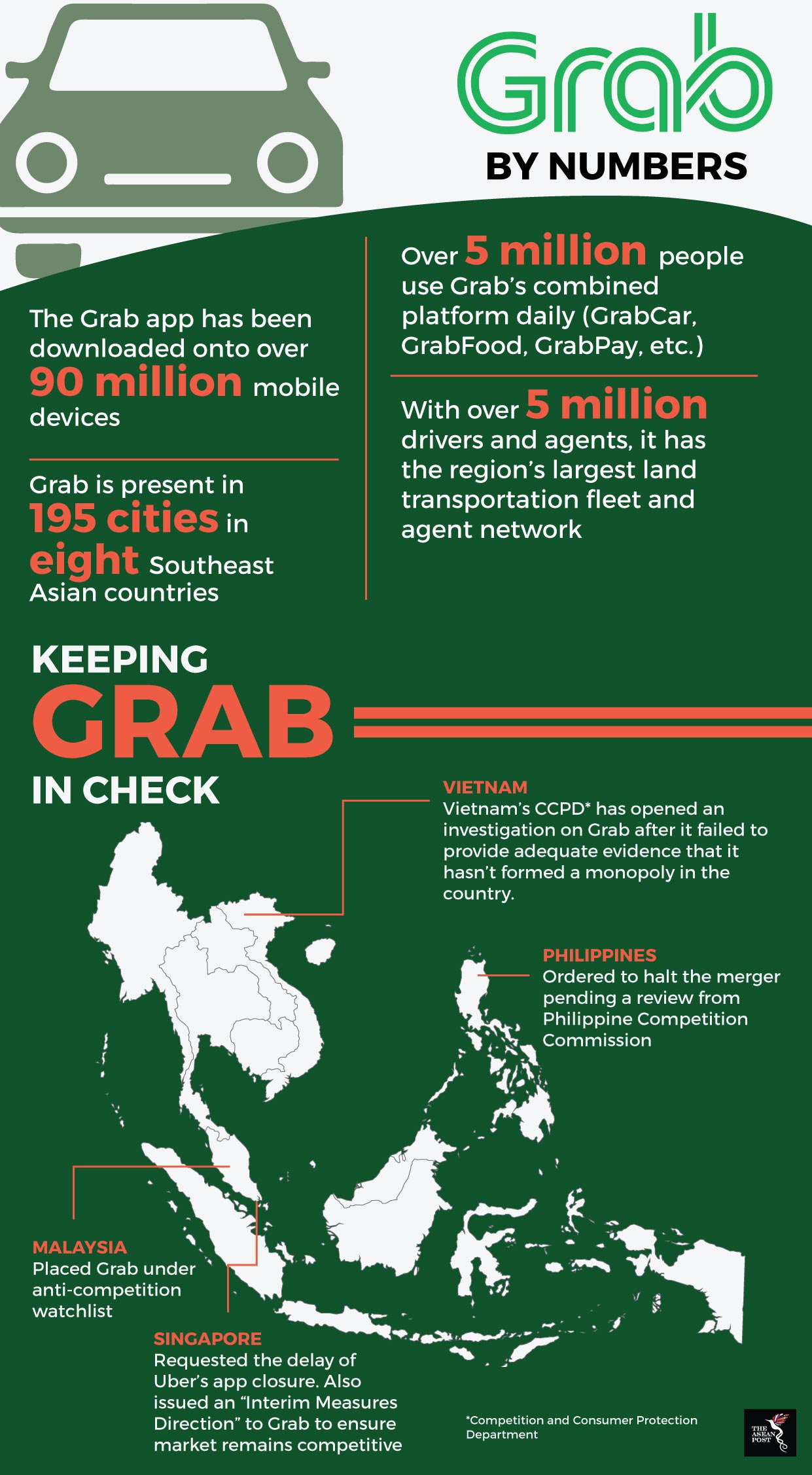

The potential issues arising from a Grab monopoly has caused authorities to look into the matter. The Competition and Consumer Commission of Singapore (CCCS) has requested Grab to delay the removal of Uber’s app in Singapore as the CCCS is currently investigating the merger deal. The Uber app was initially scheduled to close on 8 April but because of the CCCS investigation, the app will only close on 8 May instead.

The CCCS also issued an ‘Interim Measures Directions’ to Grab to make sure Grab cannot establish a complete monopoly. The directives include measures that prevent Grab from taking Uber’s data on customers and their trip history. Grab also needs to ensure that new drivers joining the company are not locked in to exclusivity agreements that prevent them from driving for other firms.

Besides Singapore, other countries in the region are also wary of Grab’s acquisition of Uber. Vietnam’s Competition and Consumer Protection Department (CCPD) has opened an investigation on Grab after it failed to provide evidence that it hasn’t formed a monopoly in the county. On 7 April, the Philippine Competition Commission ordered the two companies to halt the merger and continue their operations as usual pending a review. Meanwhile, Malaysia has put Grab under an anti-competition watchlist.

With Uber’s exit, many smaller and local e-hailing apps have emerged but none so far have the capital nor resources to challenge Grab. Many are also hoping Go-Jek, Grab’s biggest rival in Indonesia would begin operations in other countries in Southeast Asia.

The authorities have a major role in preventing any unfair practices coming out of Uber’s exit. They may not be able to stop Uber from leaving, but they need to make sure the market remains a level-playing field and also keep Grab accountable for its practices.