Ubin is an island located northeast of the Singapore mainland, close to the border between the island republic and the Malaysian state of Johor. Famous for its rustic roads, immaculate beaches and shady nature trails, it is the only place where one could go to relive the Singapore of the 60s, immersed in the simple joys of life, away from the hustle and bustle of a modern-day city lifestyle.

However, Ubin has assumed a different character to its name. While the island remains an untouched escapade for nearby city slickers, the name has been adopted for a project which is set to revolutionise the Singaporean – and perhaps even the global – financial ecosystem in the coming years.

Changing the financial world

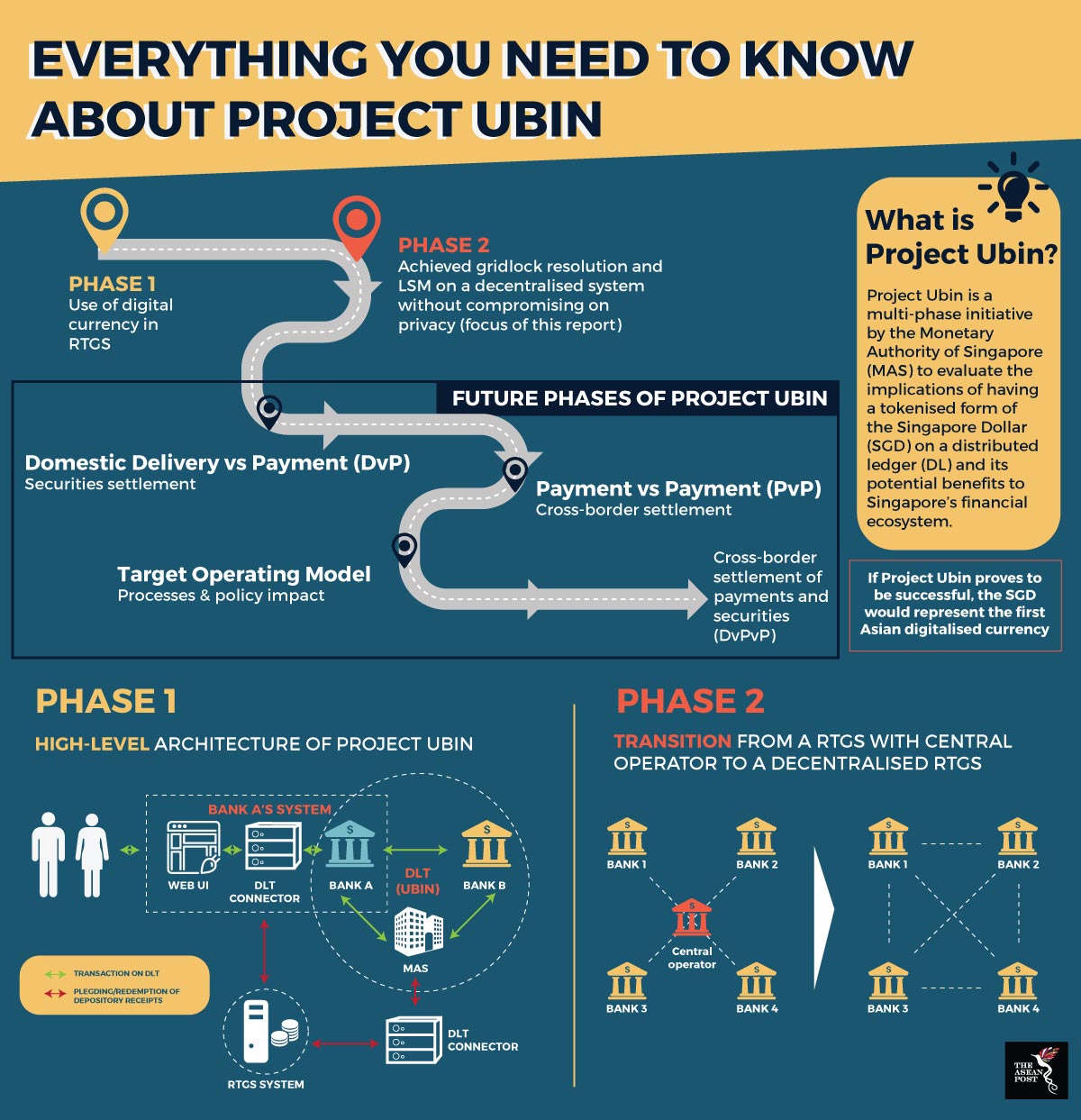

Project Ubin as it is called, is a multi-phase initiative by the Monetary Authority of Singapore (MAS) to explore the possibility of using Distributed Ledger Technology (DLT) commonly referred to as blockchain technology for the clearing and settlement of payments and securities. Together with leading blockchain firm, R3 alongside a consortium of 11 globally renowned financial institutions including the likes of Credit Suisse, J.P. Morgan and Bank of America Merrill Lynch, Project Ubin if proven successful, would make the Singapore Dollar (SGD) the first Asian digitalised currency.

DLT has immense potential in ensuring financial transactions and its accompanying processes are transparent, more resilient towards malicious attacks and is low in cost. The project would help MAS and relevant industries better understand the technology and after a vigorous experimentation process, develop it for practical, everyday use. This would greatly simplify existing systems and make them more efficient alternatives that are based on digital central bank issued tokens.

The first phase of Project Ubin took six weeks and ran from 14 November to 23 December, 2016. In the report by Deloitte documenting the findings of this phase, the project was said to have been successful in accomplishing its objective of producing a digital representation of the SGD that can be used for interbank settlement, testing ways bank systems can be connected to DLT, and harmonising the MAS Electronic Payment System (MEPS+) and the DLT to ensure interoperability for automated collateral management.

This has led to two spin-off projects. The first is to be spearheaded by the Singapore Exchange (SGX) to focus on integrating trading and settlement cycles with DLT and the second would focus on innovative ways of conducting cross-border payments using central bank digital currency.

Phase two of the project was led by MAS and the Association of Banks Singapore (ABS) alongside the aforementioned consortium of 11 financial service providers and five technology companies. The 13-week project explored the feasibility of using DLT for specific Real Time Gross Settlement (RTGS) functionalities, specifically on the viability of decentralising Liquidity Saving Mechanisms (LSM), while maintaining privacy of banking transactions. It discovered that RTGS functions could be decentralised without compromising privacy, marking a significant breakthrough in practical usage for blockchain in the financial sector.

Three prototype models were developed by three workstreams on three separate DLT platforms, namely, Corda, Hyperledger Fabric and Quorum. All three workstream designs successfully demonstrated the feasibility of removing a central infrastructure operator in a DLT based RTGS system, warranting a reassessment of the role of MAS as an infrastructure operator in facilitating interbank payments.

The findings of the second phase which were published by Accenture were made public for use by central banks and financial institutions the world over - in effect, stamping Singapore at the forefront of disruption in the financial services sector globally.

“We are sharing our learning and knowledge from Project Ubin to encourage greater experimentation amongst central banks and financial institutions. We look forward to working with other central banks on the use of DLT for cross-border applications,” said Sopnendu Mohanty, Chief FinTech Officer, MAS in a statement.

The tiny island republic never fails to surprise when it comes to innovation and technological advances. With the world reeling from the possibilities of malicious attacks on digital based financial systems, it looks like Singapore has taken the bull by the horns and is determined to find a solution to this pervasive conundrum.