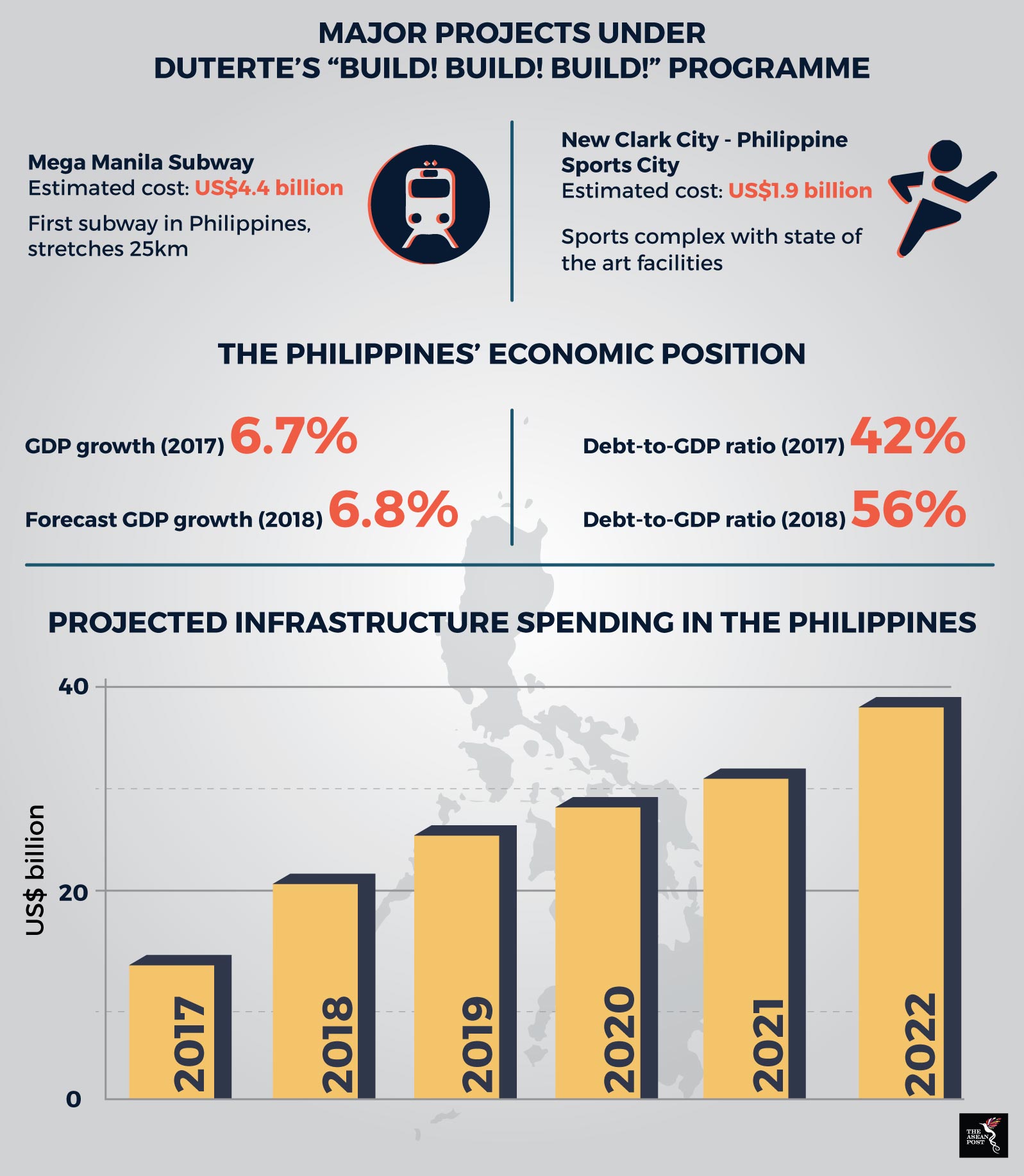

Philippines is on the cusp of transformation. When President Rodrigo Duterte assumed power, he initiated the “Build! Build! Build!” project to usher in a “golden age of infrastructure” for the Philippines.

The ambitious Build! Build! Build! project is estimated to cost the country US$180 billion, with over 70 projects planned nationwide. Among the planned projects is a new Manila airport terminal, Manila’s first subway system, and a 102-kilometre railway in Mindanao. Most of the infrastructure works planned involve an upgrading of the country’s transport systems. Duterte has claimed that one of his main aims for the infrastructure projects is to improve mobility and connectivity in the country, hoping that this would spur economic activity in the Philippines.

Duterte’s Build! Build! Build! is part of a larger economic plan affectionately labeled “DuterteNomics.” DuterteNomics is a 10-point agenda which aims to improve the socioeconomic condition of the Philippines.

Heavy borrowing

Many critics have pointed out that for Duterte to fund his infrastructure projects, the government would have to increase its spending or resort to more loans, both of which would increase the country’s external and government debt. An external debt, is the total debt a country owes to foreign creditors such as commercial banks, foreign governments or international financial institutions. Meanwhile a government debt is when government spending exceeds government receipts.

Recently, local media reported that the Philippines is raising US$2 billion from foreign borrowings to fund its infrastructure initiatives. According to the country’s Bureau of Treasury, it plans to raise the US$2 billion through the sale of offshore commercial bonds, including samurai and global bonds.

The increase in foreign borrowing would most likely increase the Philippines’ already growing external debt. The government is slated to borrow US$17 billion in 2018 alone to fund its infrastructure programme. Many of these projects are currently financed by Chinese and Japanese firms.

Sources: Various sources

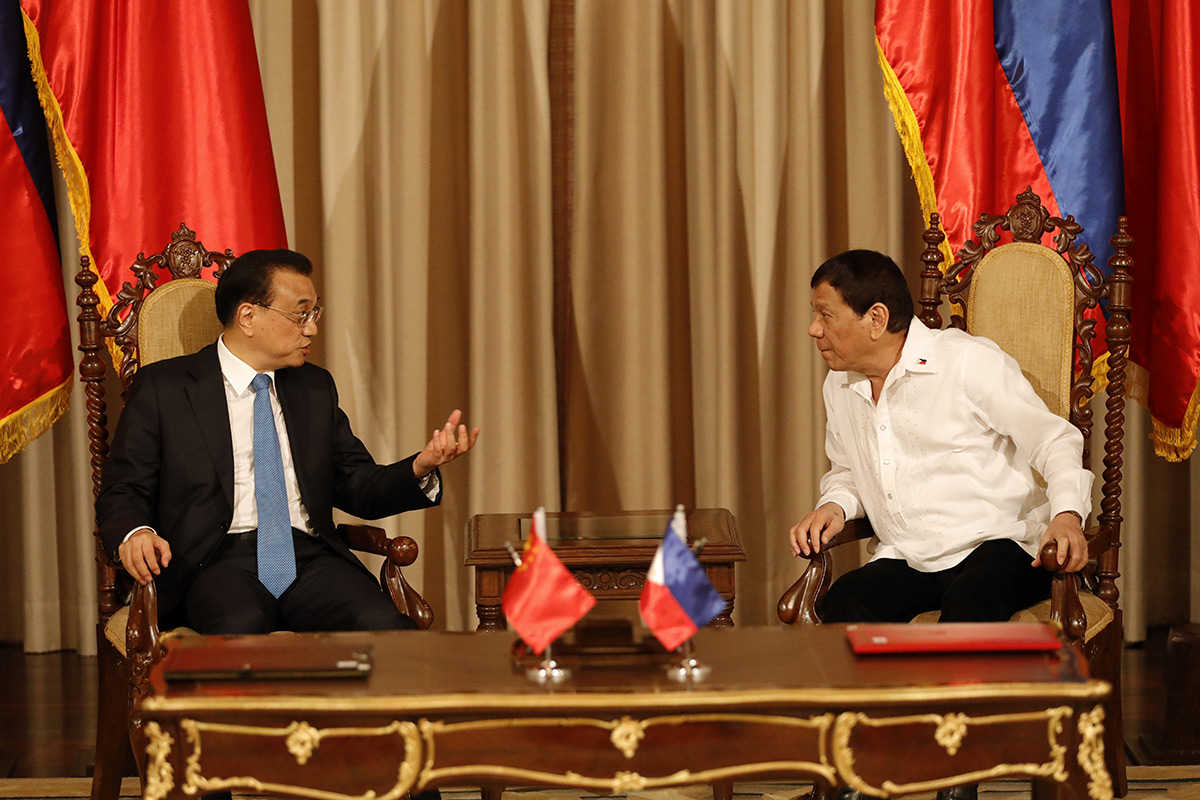

Filipinos are more worried about China in particular. In April, Duterte met with Chinese President Xi Jinping and signed several bilateral agreements. Among the business deals signed between the two countries includes a loan agreement with China agreeing to help fund the construction of the Chico Pump Irrigation Project in Northern Luzon. The Philippines Ministry of Finance said that this loan agreement was worth US$62 million. Besides that, the Philippine government also secured a US$4.36 million grant from China that aims to modernise the country’s hybrid rice centre. According to a Philippines daily, China has pledged about US$7.34 billion in soft loans and grants to support the Philippines infrastructure program.

There is also concern that the Philippines could fall into a debt trap. Local economists and politicians have criticised the government there for preferring Chinese loans over Japanese ones despite the Chinese loans having higher interest rates.

There is a fear that similar events that transpired in Sri Lanka could also happen to the Philippines. In December last year, Sri Lanka formally handed over its strategic port of Hambantota to China on a 99-year lease after failing to pay its debts to Chinese firms.

China has tried to allay these concerns by stating that its financing comes with no “strings attached”. The Department of Finance in the Philippines has also rubbished claims that it couldn’t pay the debt claiming, “We borrowed at three percent from the US, why can’t we borrow at two percent from China?”

Government debt

The worry isn’t just over external debt. The government there is also spending large amounts of public funds on projects which has increased government debt. In April, the Philippines government recorded a public debt of US$130 billion, the highest ever. The country’s Department of Budget and Management told the press recently that the government’s spending surged by 43 percent year-on-year in April.

Earlier this year, the Philippines government introduced sweeping tax reforms to increase government revenue. The new tax reforms saw a reduction in personal income tax but increases in taxes for cars, tobacco, sugar-sweetened beverages and fuel. This move has impacted badly on the people as data from April shows that inflation has reached a record high of 4.5%

Rodrigo Duterte has ambitious plans for his country but needs to be realistic. At the moment the country’s finances are still in good shape, with the World Bank projecting a positive outlook for its economy. Socioeconomic Planning Secretary Ernest M Pernia has said that GDP for the Philippines is expected to increase 1.4 percent annually due to the creation of new infrastructure projects. While the mood is still relatively optimistic on the ground, observers there are still keeping one eye on the nation’s debt.