Donald Trump’s inherently protectionist “America First” policy is a far cry from what many have grown to perceive the United States in the international arena – as a bastion of free trade.

But with Trump at the helm, the superpower has rescinded its global leadership in trade and has dented its reputation further by way of imposing tariffs. The recent tariffs which affected industries in Asia – specifically Southeast Asia – was the imposition of tariffs on solar panels and modules.

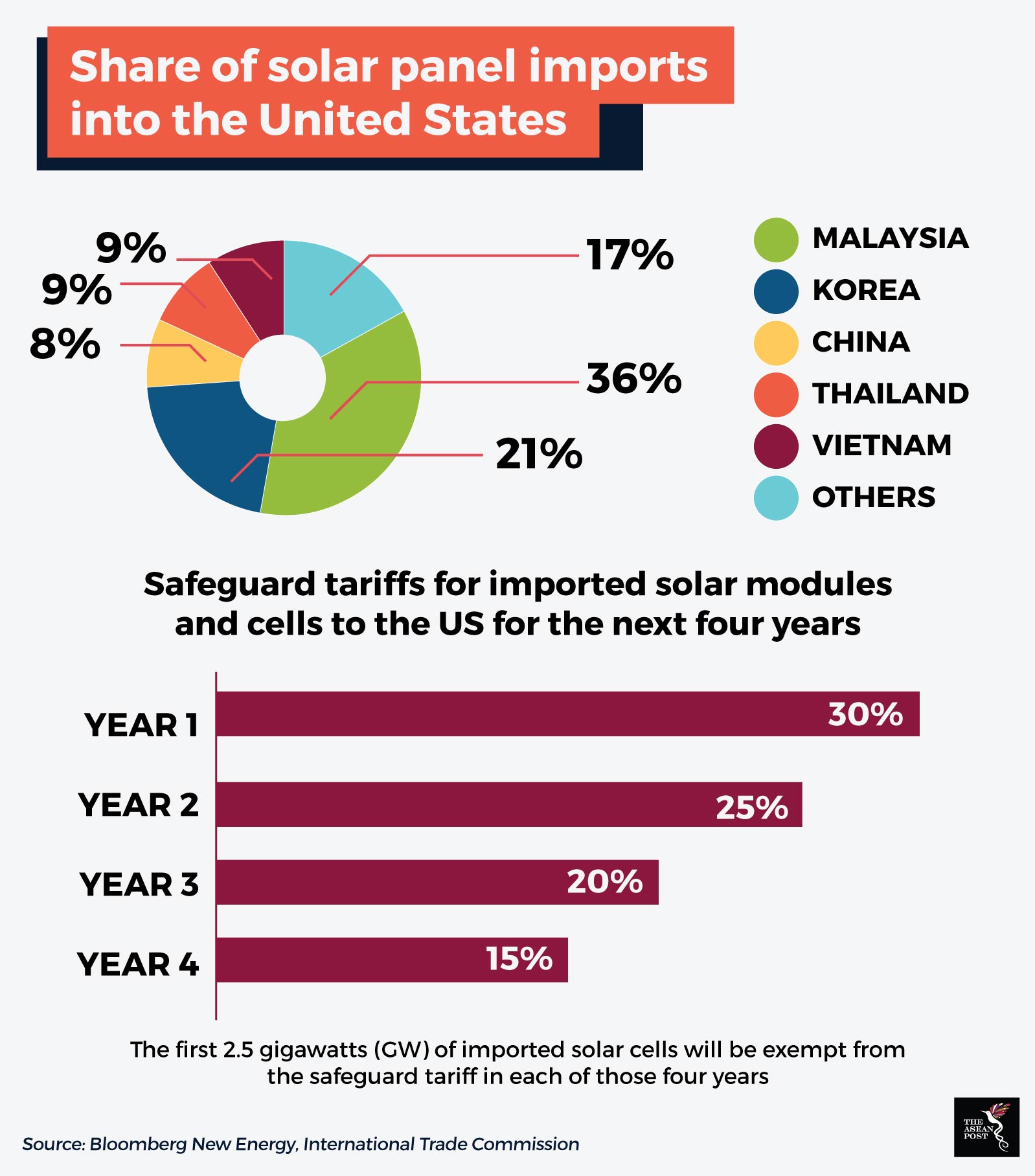

According to Bloomberg New Energy Finance (BNEF), the US imports 80 percent of solar panels for domestic installation from Asia. 54 percent of its imports come from Southeast Asia, namely Malaysia (36 percent), Thailand (9 percent) and Vietnam (9 percent).

The tariffs came into effect after a US International Trade Committee (ITC) finding which concluded that foreign imports of solar cells severely hurt domestic US manufacturers. It will be imposed over a period of four years, starting at 30 percent in the first year, moderating to 25 percent in the second year, 20 percent in the third year and 15 percent in the fourth year. However, for all years, the tariffs won’t be applied to the first 2.5 gigawatts (GW) of imports.

“The President’s action makes clear again that the Trump Administration will always defend American workers, farmers, ranchers, and businesses in this regard,” stressed US Trade Representative, Robert Lighthizer.

Curbing Chinese solar imports

The US tariffs came as a tit-for-tat reaction to China flooding its markets with artificially low priced solar modules. China is a powerhouse when it comes to the solar industry – producing 60 percent of the world’s solar cells and 71 percent of solar modules, according to the US International Trade Commission.

From 2012 to 2016, the volume of annual solar generation installed capacity, tripled in the US due to cheap solar cells imported from China. By 2017, the US solar industry almost ceased to exist with 26 solar producers closing shop and only one remaining.

The US did impose antidumping and countervailing duty measures on China in 2012 and 2013. However, Chinese companies have managed to evade such measures by relocating their production abroad to Malaysia, Singapore and South Korea. This recent spate of tariffs is likely aimed at closing such loopholes in the tariff structure.

In doing so, Trump hopes to save American jobs by forcing companies to build plants that produce solar modules and cells on American soil. However, according to Solar Energy Industries Association (SEIA) – the national trade association for the US solar industry – this move is expected to cost 23,000 American jobs.

Impact on Southeast Asian players

According to market intelligence provider, TrendForce, manufacturing operations in Southeast Asia alongside South Korea will be most severely hit by the tariffs. Hence, solar producers have to pay very close attention to the distribution of the 2.5 GW quota of imports which won’t be levied any tariffs.

The biggest player in the Southeast Asian solar industry, Malaysia, is likely to take a hit from these tariffs. According to CIMB Economic Research, PV exports from Malaysia to the US accounted for 1.1 percent of Malaysia’s total exports in 2016.

The report iterated that while a complete halt in PV exports to the US is improbable, tariffs are likely to erode Malaysia’s market share in the solar industry. Furthermore, it may discourage the relocation of PV firms to Malaysia.

Nevertheless, the 30 percent tariff has led some solar producers to breathe a sigh of relief as they expected a higher tariff rate.

Jiang Yali, a Hong Kong-based BNEF analyst was quoted by Bloomberg as saying that the 30 percent tariff “isn’t that significant” and that producers are unlikely to relocate their plants from Southeast Asia.

“If you compare building a new plant in the US or in Southeast Asia, importing from Southeast Asia is still a better option,” she surmised.

Trump considers his actions as putting “America first” but the repercussions are far reaching. Protectionism has reared its ugly head multiple times throughout world history and if Trump fails to see the signs, global trade will continue to be hit hard by his actions.

Recommended stories: