These days, money launderers have one more avenue to channel their proceeds through: cryptocurrencies like Bitcoin.

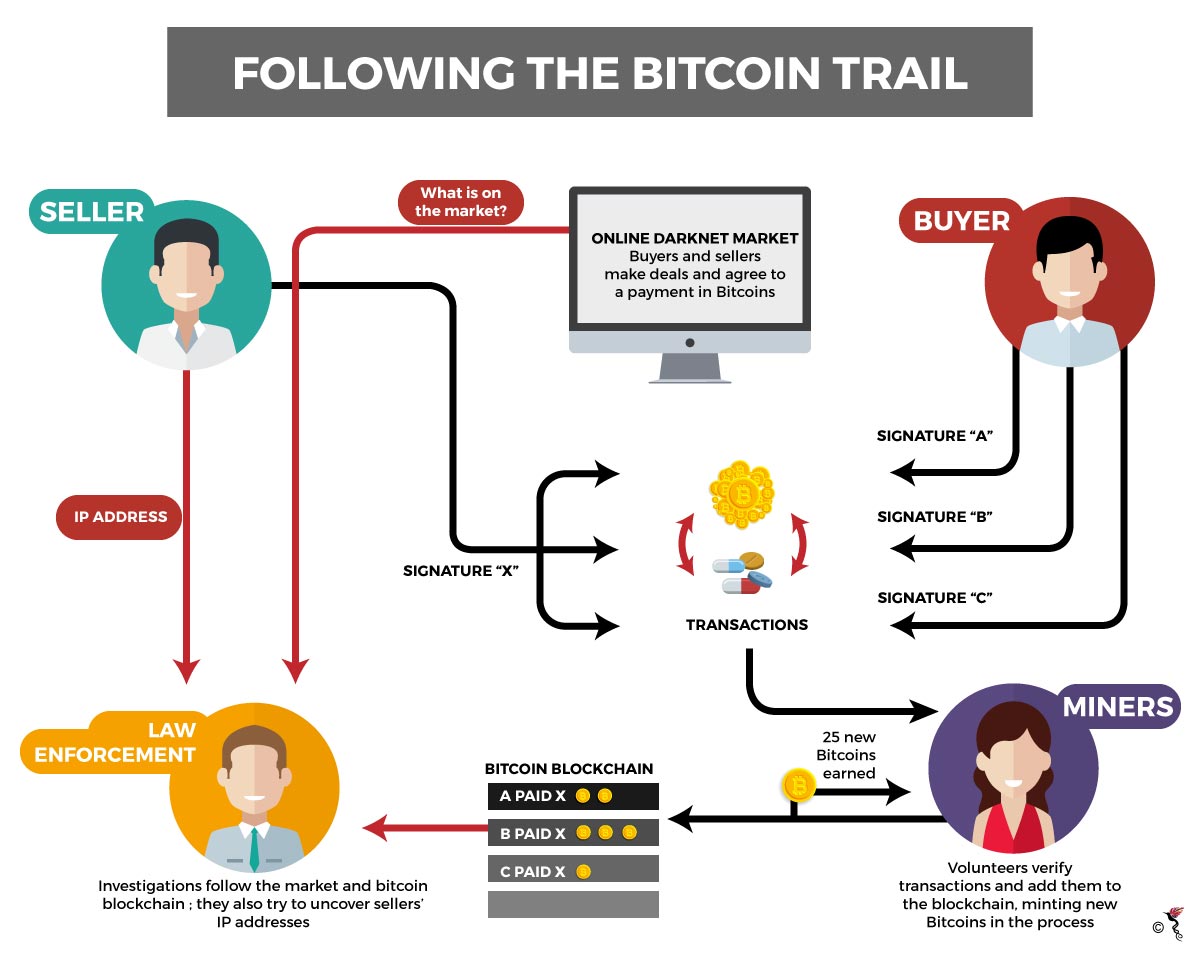

Money launderers use Bitcoin because of the anonymity factor, whereupon users are simply identified by a 30-character alphanumeric code, or address which links them to the transactions they perform. No other identification is required to obtain a Bitcoin address. Meanwhile, the blockchain technology it is based on also requires no central regulating authority, while also enabling Bitcoin transactions to be authorised almost anonymously.

These transactions can be processed seamlessly across international borders and often are. Sometimes to avoid being tracked, users will often ‘mix’ the Bitcoin they own with that of other users in a common pool before redistributing it back to different owners. This makes it harder for transactions to be traced to any one particular account.

Of late, government regulators in China and South Korea have been cracking down on possible money laundering activities by either limiting Bitcoin mining altogether or possibly requiring Bitcoin traders to surrender their real identities before they can set up a trading account. Bitcoin regulation has been more fragmented on an international level because its legality status differs according to country.

“Effective regulation of virtual currencies would therefore only be achievable through the greatest possible international cooperation, because the regulatory power of nation states is obviously limited,” said Joachim Wuermeling, a director of Germany’s Bundesbank at an event in Frankfurt on 15 January.

At present, tracing money laundering activity through the Bitcoin medium is somewhat fragmented, and enforcement authorities across Europe and Asia are just getting started. So far, exposing money launderers has been possible with leads, the use of tools and publicly available surrounding information, such as Bitcoin addresses linked to known people. Such publicly available information also includes the public keys of Bitcoin wallets. These can then be traced back to geographical locations where money laundering activity has previously taken place.

Blockchain technology requires all Bitcoin transactions to be written on a publicly available digital ledger. Transactions once written are difficult to erase and therefore effectively permanent. As such there is an indelible record for authorities to refer to when going after criminals.

Source: Science Magazine

While Bitcoin users can disguise their identities, they can’t hide the information that surrounds the transactions they make.

What US enforcement agencies like the Federal Bureau of Investigation (FBI), US Internal Revenue Service and Drug Enforcement Administration have done is to use Bitcoin’s relatively transparent structure to map transactions that occur, including the IP addresses to which they are linked. Over time, repeated mapping will help produce a historical picture of all Bitcoin transactions that take place over the blockchain ledger. It would also be easier to track down illegal transactions.

Software, such as that developed by US anti-money laundering software company Chainalysis also works on this basis. It combines data available in the public domain, such as Bitcoin wallet public keys, with the analysis conducted by its tracking tools to identify an address, or an individual user. This includes for example, plain text which you can then paste into the tool to check if it is part of a Bitcoin address. If it is, the tool will immediately connect you to all the Bitcoin wallets it is linked with, along with the transactions conducted with them.

Bitcoin, once it flows into the currency system through a Bitcoin exchange is much easier to trace because every Bitcoin exchange requires some form of identification at the point when the exchange happens. A Bitcoin exchange refers to a digital marketplace where Bitcoins are bought and sold for fiat money or other cryptocurrencies.

This is also where laundering large sums of money becomes difficult, since not enough transactions take place in a day to hide the movement of large sums of Bitcoin, according to Sarah Meiklejohn in a research study she conducted in collaboration with the University of California in San Diego. This is because there are simply not enough transactions to ‘mix’ around.

The Bitcoin exchange is also where the real money trail starts. Money launderers shed their anonymity at this point, but remain affected by it. UK lenders require solid identification proof and audit trails before they approve mortgage applications. As such, Coventry Building Society, Skipton House & Holiday Home Mortgages have refused to accept such deposits altogether, thus demonstrating extra care in allowing funds generated from cryptocurrencies to flow into the currency system. This also helps money laundering via Bitcoin.

To avoid creating too many trails, money launderers may in future make all their operations through Bitcoin highly centralised. Proceeds from illegal drug trading are already being transferred in this centralised way, according to a report produced jointly by cryptocurrency firm Elliptic and the United States’ Center on Sanctions & Illicit Finance. Enforcement authorities, however, would have a field day, since clamping down on one operation would effectively stem the flow of such money laundering proceeds from many sources at once. This reinforces the point that money laundering via Bitcoin is anything but foolproof.

Recommended stories: