With the aviation industry’s strong growth and the shortening of travel times to almost any point on the globe, the world has become a much smaller place. Journeys which just a generation ago would have taken weeks can now be achieved in a day or even less.

As for passengers, commercial flight has provided much more than just time-savings. It has also grown individual horizons, expanding exponentially the places, people, cultures and experiences that travellers can access with just a few clicks when they book their flights.

As one of the biggest players in the global aviation industry, Airbus has come a long way. Airbus began in 1970 as a consortium of European aviation firms formed to compete with American companies such as Boeing, McDonnell Douglas, and Lockheed. Over a period of time, Airbus has seen great development not only in terms of science and technology, but also through market expansion.

Asia-Pacific Leads The Way In Aircraft Demand

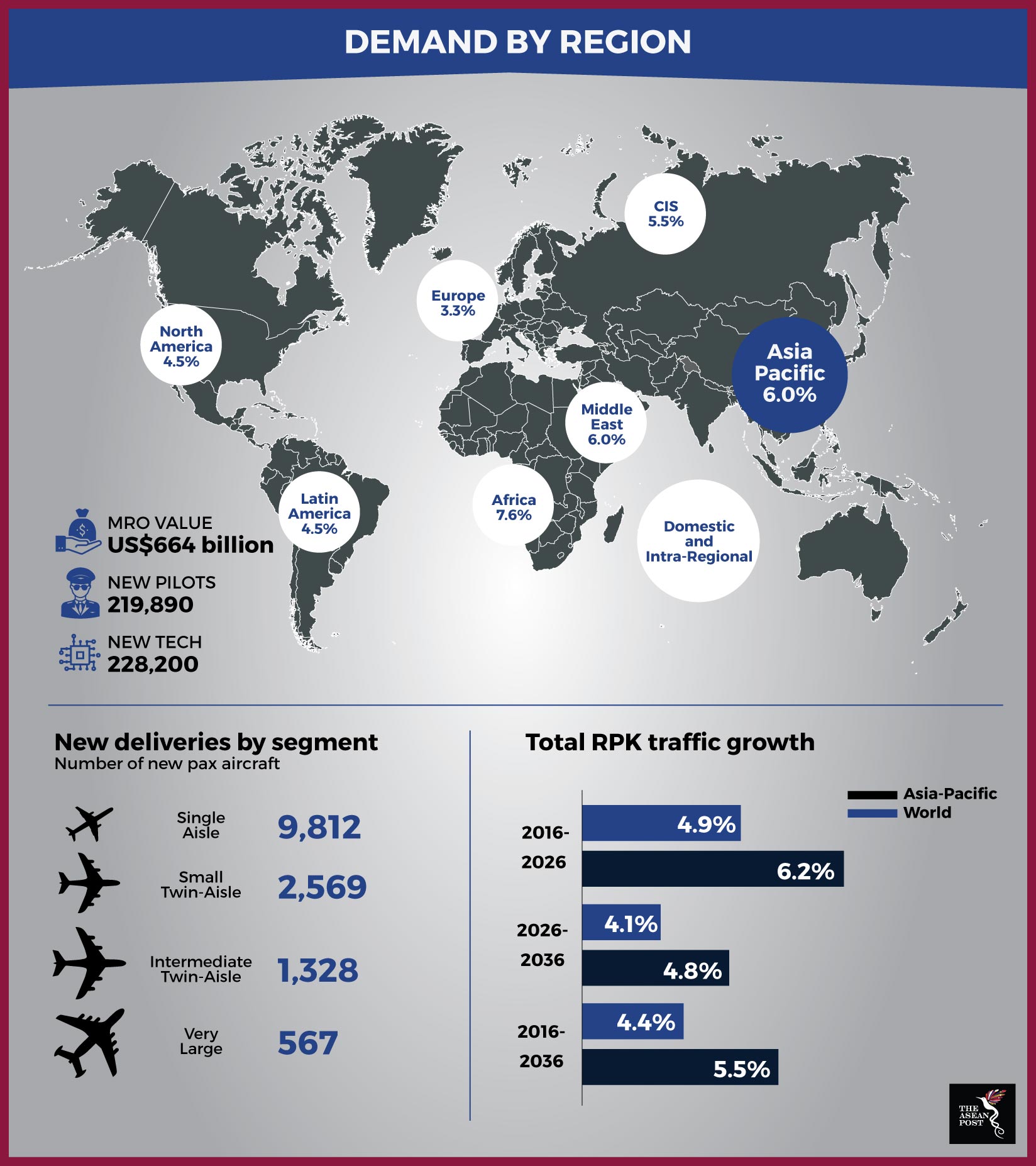

In its latest Global Market Forecast 2017-2036 report, Airbus has reinforced its market lead in the Asia-Pacific region whereby there is a forecast demand for more than 14,000 new aircraft over the next 20 years.

Airbus has further consolidated its market lead in Asia-Pacific in 2017, delivering 367 new aircraft to 50 operators across the region. This accounted for over half of Airbus’ total deliveries worldwide – which were 718 aircraft in total - during the year, reflecting the importance of the region for the manufacturer. Deliveries to the region included almost 100 new widebody aircraft and marked the arrival of the long-range A350 XWB with three new Asian operators.

“Our customers recognise the superiority of the A350 XWB in terms of design, fuel efficiency and cost efficiency,” said Jean-Francois Laval, Executive Vice President Asia of Airbus.

According to Airbus, the A350 XWB’s all-new efficient design includes the latest and unique technologies for improving performance in operation. The aircraft’s intelligent airframe uses the right materials in the right places for weight savings with up to 40% less maintenance.

Apart from that, the A350 XWB offers a 25% step change in fuel efficiency and a 25% lower seat-mile cost compared to previous generation competitor aircraft. More importantly, it produces 25% lower carbon emissions, making it the most eco-efficient aircraft.

In terms of cabin design, the A350 XWB provides passengers and crews the best in comfort, well-being and technology all while also being the quietest twin-aisle airplanes.

“We believe that the combination of range capability, the highest levels of passenger comfort and unrivalled efficiency will see the A350 XWB become the mainstay of long haul fleets in the region over the coming years, replacing the older 777,” added Laval.

Source: Airbus Global Market Forecast 2017-2036

Increase In Demand For Aircraft In The Region – What Is The Driving Force?

Airbus has forecasted a demand of almost 35,000 aircraft over the next 20 years. In the same period of time, air transport growth in China, India, the Middle East and the rest of Asia is forecasted to be the highest.

With cheaper airfares and the added convenience of getting around the region, more and more people are stepping out of their comfort zones by travelling more frequently. Tourists and business travellers from Asia are either flying within the region itself, or out to other continents due to a boom in the travel and tourism sectors.

Apart from that, other infrastructure developments throughout Asia such as the Belt-Road Initiative (BRI) also seem to play a role in this boom.

“We believe that China’s Belt and Road initiative will underscore and add to an already robust demand,” noted Laval.

Undoubtedly, the increased air travel activity would require new airports around the region as well. However, this would be a decision that has to be made by the respective countries’ governments. Laval explained that some governments may decide on new airports while others may choose to simply upgrade current ones to suit their needs.

“There is however a limitation on what can be done, especially at the biggest hubs in the Asia Pacific region. Capacity and slot constraints will therefore see a rise in aircraft for all the various categories, including the very largest types where the A380 is the only solution available to meet the demand on the most heavily travelled routes,” explained Laval.

Airbus’ Presence In Southeast Asia

Since Airbus’ market projections are based on the main regions as defined by the International Air Transport Association (IATA) which include Europe, North America, Latin America, the Middle East and Asia-Pacific, they are not able to provide specific projections for the Southeast Asian market. Nonetheless, Southeast Asia is an important region for Airbus given that Asia-Pacific as a whole is a core market for the company.

“We consolidated our market lead in Asia-Pacific in 2017, delivering 367 new aircraft to 50 operators across the region, either directly to airlines or via lessors. This accounted for over half of Airbus’ total deliveries worldwide (718 aircraft) during the year, reflecting the importance of the region for the manufacturer.”

“Airbus had an excellent year in Asia-Pacific in 2017 and we see more potential in the coming years, in particular in the widebody market, where the region will account for 46% of total worldwide demand,” Laval enthused.

There has also been assurance that Airbus is perfectly poised to meet this demand, already holding 60% of the widebody backlog in the region and offering the most modern and complete widebody product line, with the A330neo, A350 XWB and of course the refined A380.

When asked about Airbus’ plans to open up a production facility in the Asia-Pacific region, Jean -Francois highlighted that they already have production facilities in China as well as industrial partnerships with over 600 suppliers in 15 different countries. The partners are involved in producing a wide range of parts for Airbus’ complete product line as part of an extended enterprise.

Source: Airbus Global Market Forecast 2017-2036

However, they do have plans to develop their Services business in the region, covering maintenance, engineering and training. In Malaysia, for instance, Airbus’ subsidiary, Sepang Aircraft Engineering (SAE), is an European Aviation Safety Agency (EASA)-approved independent aircraft Maintenance, Repair and Overhaul (MRO) service provider specialising in the maintenance and overhaul of Airbus single-aisle aircraft. SAE has two hangars with a combined floor area of 50,000 square metres.

“We are progressively expanding our training network to support fleet growth worldwide and to support our customers by extending our training capabilities locally. In the last 3 years, we have moved from 5 to 15 training locations. We will continue to extend our network and move closer to our customers by proposing local, pragmatic and tailored training solutions. These solutions cover the entire pilot and technician carrier paths, from cadets to their operational environment,” explained Laval.

Currently, in Singapore, there is an Airbus Asia Training Centre (AATC) located at the Seletar Aerospace Park. Other Airbus-operated flight crew training centres are located in Toulouse, Miami and Beijing. The centre offers type rating and recurrent training courses for all in-production Airbus types and is expected to become the largest Airbus-operated flight crew training centre in the world, with six simulators already in service and another two currently being installed.

Soaring Ahead

Airbus has chosen Shenzhen - widely considered to be the Silicon Valley of China - to establish the Airbus China Innovation Centre (ACIC). This new Airbus China Innovation Centre will serve to strengthen Airbus’ extended worldwide innovation ecosystem which already includes a Silicon Valley innovation centre, A3.

“Looking ahead, we are working on projects to reboot and digitalise the MRO business,” Jean- Francois stated.

Through further technological developments, the new generation aircraft are able to communicate in real time through datalink systems up to 400,000 separate parameters, enabling predictive maintenance to begin to play a key role in aircraft operation and support.

To keep soaring ahead with the times, in 2017 Airbus launched its new aviation data platform, Skywise in collaboration with Palantir Technologies - pioneers in big-data integration and advanced analytics.

Skywise aims to become the platform of reference used by all major aviation players to improve their operational performance and business results and to support their own digital transformation. Some big Asian airlines names such as AirAsia, Asiana Airlines and Etihad Airways have become some of the first to utilise the platform.

It is clear that Airbus’ significant presence in Southeast Asia and Asia-Pacific is growing in tandem with the region’s burgeoning population and economic growth. As the Industrial Revolution 4.0 also comes to realisation, developments in the aviation industry will continue to grow, making everyone’s flying dream, including Airbus’, a reality.