The Southeast Asian region will continue to surprise analysts and pundits on the upside, as 2018 continues to unfold.

“The stars are aligned for the ASEAN region,” Manu Bhaskaran, Chief Executive Officer for Centennial Asia Advisors told an audience of 700 journalists, diplomats, academics and industry leaders during the 2018 Regional Outlook Forum in Singapore.

Bhaskaran pointed to a strong second half of 2017 that has spurred the global economy which will in turn create robust demand for Asian commodity and manufactured exports. Besides that, burgeoning global trade is fast surpassing global output, undoing the dismal trade performance seen during the 2015-2016 period. The major gainers from this trend would be exporting Asian nations like Southeast Asian economies.

Malaysia is a prime example as the Ringgit strengthens amid this trade revival. The country has seen its manufacturing sector gear towards electronics which will be good news to the nation’s economy as manufactured exports are slated to do well over the course of the year.

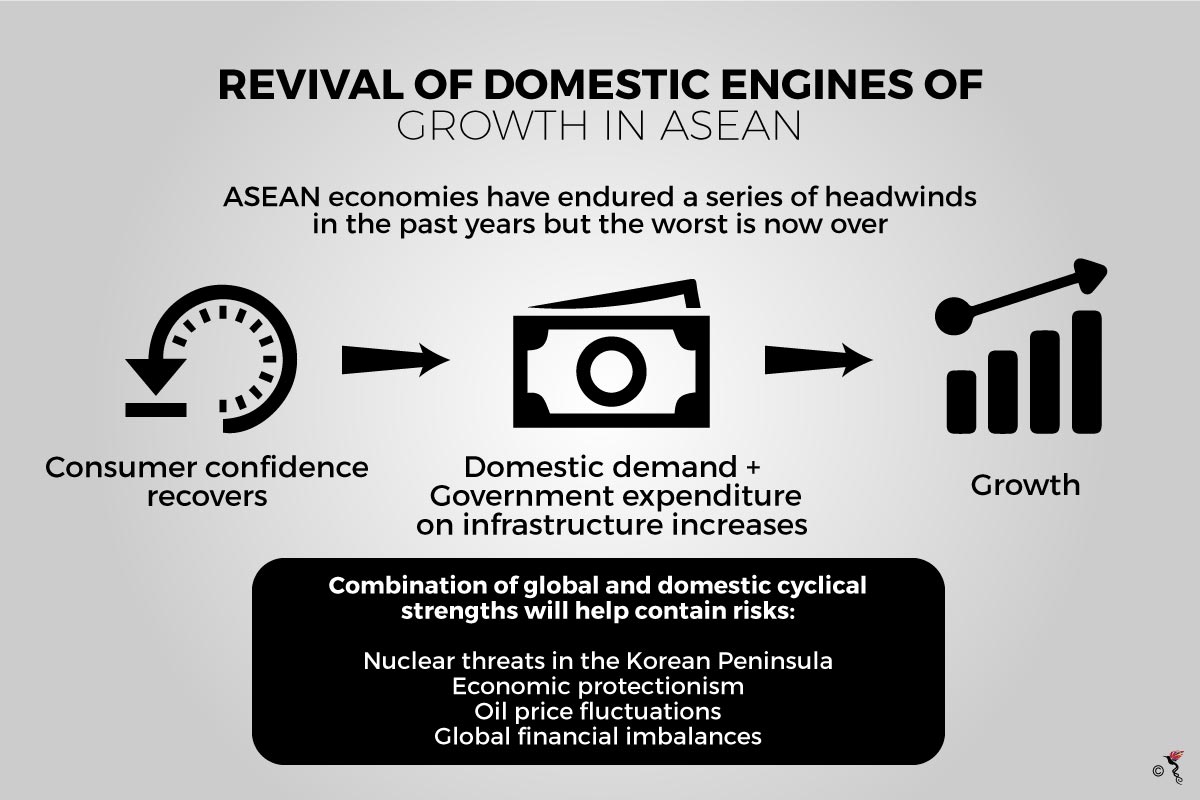

This bullish outlook on Southeast Asian economies was also down to recovering “domestic engines of growth” in the region. According to Bhaskaran, the difficulties that ASEAN economies have been enduring over the past two to three years are ending. Consumer confidence is beginning to slowly recover, coupled with increased government spending across the region in infrastructure development, an increase in growth would be the most probable outcome.

Indonesia, for example, is starting to see its consumer demands increase after poor economic performance for the past two years. This is also due in part to the delayed effects of rate cuts.

Nevertheless, he also warned of risks like oil price fluctuations and financial imbalances which may affect this positive economic momentum. He remained optimistic that ASEAN economies would weather these risks thanks to a combination of global and domestic cyclical strengths.

Crunching the numbers

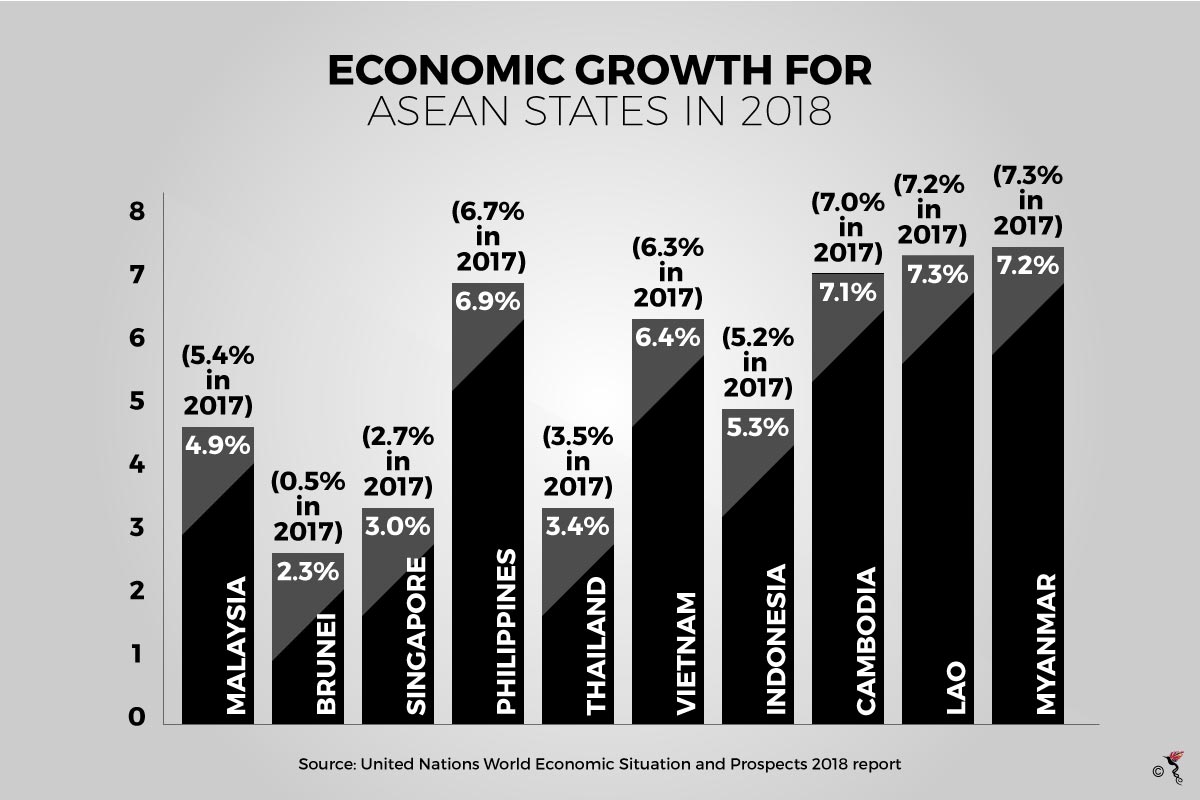

The World Economic Situations and Prospects 2018 report released by the United Nations has projected favourable growth digits for ASEAN economies.

Private consumption in the Philippines which makes up 70 percent of the country’s Gross Domestic Product (GDP) will continue to sustain – driven by remittance inflows and increased consumer confidence. Economic growth is expected to increase from 0.2 percent to 6.9 percent for 2018 compared to last year.

Malaysia’s economy is projected to grow at 4.9 percent this year compared to a higher than usual 5.4 percent in 2017. The relatively steady growth will be underpinned by a strong export momentum and consumer demand. Moreover, investment outlook in the country remains positive as the country is short of infrastructure development projects.

The Thai economy is slated to grow by 3.4 percent in 2018, bolstered mostly by public investment, equipoising the slump in private investment. However, political tensions will continue to shape investor sentiment – whether for better or for worse – as the public grows impatient with the prevailing junta government.

An expansion of export activities in the manufacturing and logistics sector continues to accelerate Singapore’s economic growth. A recovery in the housing market will boost consumption and investment activity, while enhanced external demand will likely spur investment in trade-oriented sectors like electronics and pharmaceuticals. This could translate to an uptick in growth from 2.7 percent in 2017 to 3 percent in 2018.

Indonesia’s growth outlook remains positive – with a projected increase of 0.1 percent from 5.2 percent in 2017 to 5.3 percent in 2018 – against growth in private consumption and government expenditure. A sound monetary policy and a series of policy reforms seem to have changed the investment landscape in the country for the better.

Growth in Vietnam remains positive as well, undergirded by optimistic foreign direct investment (FDI) inflows especially in the electronics sector. Besides that, strong revenue from tourism will also help the country reach the projected 6.4 percent growth rate for 2018 – a rise from 6.3 percent last year.

Cambodia, Lao and Myanmar, continue to enjoy growth projections in the 7 percent bracket as incomes continue to rise from relatively low bases. Besides that, aggressive growth in private consumption and infrastructure investment in energy and transport underpins these optimistic numbers. External demand from within the Asian region also feeds this vigorous growth.

Recommended stories: