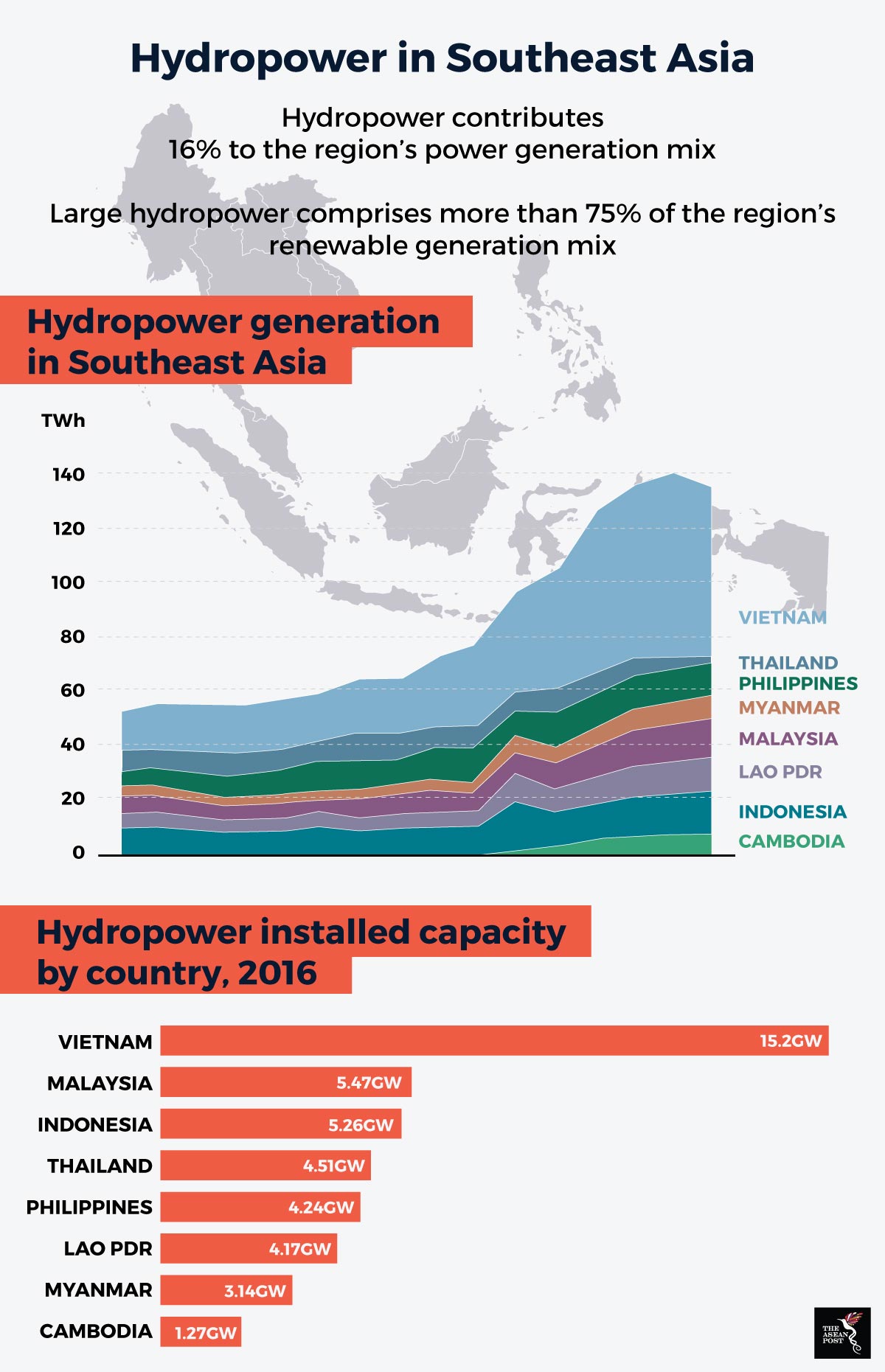

Hydropower in Southeast Asia holds much promise. According to the International Renewable Energy Agency (IRENA), hydropower capacity in the region grew almost threefold from 16 GW to 44 GW between 2000 and 2016.

The major users of hydropower technology are Association of Southeast Asian Nations’ (ASEAN) members in the Indochinese region and the Philippines. Numbers by the World Energy Council indicate that in terms of installed capacity, Vietnam leads the way in Southeast Asia with 15,211 megawatts (MW).

Investment opportunities

According to a study by the United Nations and Singapore financial services provider, DBS, the market for investments in hydropower in the region is valued at US$90 billion. Places like Lao PDR and Myanmar are a treasure trove of hydropower potential thanks to their unique geography. The Laotian Ministry of Energy and Mines, estimates that the country has a theoretical hydroelectric potential of about 18,000 MW excluding the mainstream of the Mekong. Furthermore, the Masterplan on ASEAN Connectivity 2025, projects that Myanmar’s potential hydropower capacity is 108 GW.

Hydropower projects come in different sizes, from large scale ones to smaller scale off grid projects. Large hydro projects are normally taken on by large independent power producers (IPPs). It can take upwards of 10 years to just plan and conduct the necessary assessments before actual financing starts.

On the other hand, small and micro hydro projects can be developed with lower capital start-up costs. Indonesia is looking to utilise small hydro to power off grid systems in its rural areas which would help increase the electrification rate. In the Philippines, most such projects with an average capacity of below 1 MW only take six months to complete. They require financing of between US$1 million to US$2 million but because such projects are only to support rural communities, they are perceived as less bankable. Nevertheless, off grid projects like these are where the investment opportunities are most abundant.

Small hydropower projects are less risky when compared to large hydropower projects due to the immense costs and regulations involved with the latter. A small hydro between 6 MW and 7 MW could fetch a capital cost of US$30 million for a project which would take two or more years to complete. To help such financing, multilateral development banks (MDBs) may be roped in. For example, to finance off grid micro hydropower projects in rural Lao PDR, the Lao Institute of Renewable Energy Promotion (IREP) elicited the financial help of the International Finance Cooperation (IFC).

Risks involved

Like any investment, there will always be accompanying risks that investors should be wary about. The most worrying risks political and social risk. Hydropower has long been perceived as the pariah of renewables due to its construction process which in some cases could harm the very environment it attempts to protect.

Besides that, large hydro projects often involve damming which some experts claim could harm the biodiversity and ecology of waters in question. Such dams could potentially destroy natural habitats, obstruct fish migration paths and tamper with the salinity of the water. Inadvertently, these implications have affected the livelihood of fishermen and farmers dependent on rivers as their main source of income.

Another risk to be mindful of is credit risk due to social and technical issues which may lengthen the project cycle. It is important that any investor in hydropower projects especially in small hydro off grids in rural areas, enlist the support of the local community before proceeding with the development.

For example, small hydro projects sometimes necessitate the diversion of water and this could mean sediments will be diverted along with the water thus shifting the areas of fertile land. However, if the community which relies on fertile soil for farming is helped to adapt to such situations, a backlash to the hydro project can be negated.

Ultimately, in reaping the benefits of investing in hydropower, one must be mindful not only of the monetary benefits but the social costs as well. When a balance can be found between the two, not only will such endeavours help save the environment, and bring benefit to the local community but also help investors make an honest profit too.