Since its inception on the 8 August 1967, ASEAN has made tremendous strides in promoting peace and stability in the region. This is carried out through abiding by the rule of law and adherence to the principles of the United Nations (UN) Charter, which allows for all member states to subscribe to its respective aims, principles, and purposes under the banner of a united regional association.

As such, economic cooperation is fundamental to the progress of this collective. Regional gross domestic product (GDP) has more than doubled from US$1.3 trillion in 2007 to US$2.8 trillion in 2017 within the span of a decade. ASEAN is the seventh largest economy in the world and is projected to make the jump to fourth spot in 2050.

The creation and implementation of the ASEAN Economic Community (AEC) in 2015 was a crucial initiative to integrate the 10-member countries as a single market and production base, with investments, services, free movement of goods, skilled labour, and flow of capital among its key underpinnings. Its extension is the ASEAN Economic Community Blueprint 2025 which strives to build a regional monolith that has the ability to compete with other blocs across the globe.

Integration thus far

An apparent positive outcome of ASEAN integration is the gradual increase of cumulative GDP within the region. Through the implementation of the ASEAN Economic Blueprint 2025, an ASEAN-wide Self-Certification Scheme has been created. This scheme helps facilitate the utilisation of the ASEAN Trade in Goods Agreement by allowing exporters to issue origin declaration which will cut transaction costs.

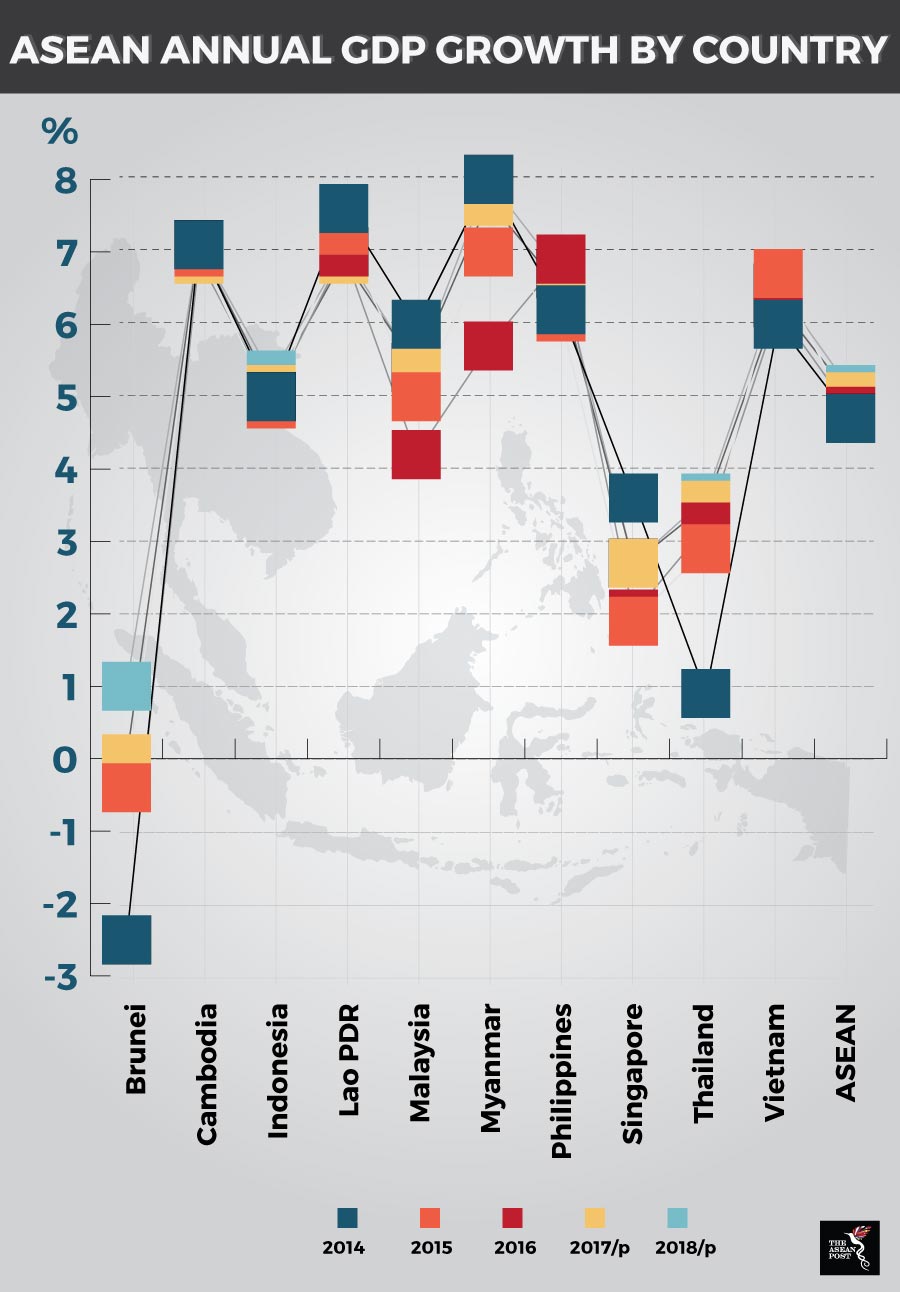

Source: 2014-2016 (ASEAN Secretariat, as of October 2017), 2017/p and 2018/p (Asian Development Bank, Asian Development Outlook, as of September 2017)

Source: 2014-2016 (ASEAN Secretariat, as of October 2017), 2017/p and 2018/p (Asian Development Bank, Asian Development Outlook, as of September 2017)

The development of infrastructure in the region, based on a mutual learning process from member states has seen numerous success stories. An example of this is the 225-megawatt gas-fired Myingyan power plant in Myanmar which is the nation’s first competitively tendered independent power producer. It has attracted world-class project developers and financing from leading multilateral development banks (MDBs), as well as commercial banks offering their first loans in Myanmar.

Challenges to be addressed

According to Victoria Kwakwa, the Vice President of the World Bank for East Asia and the Pacific, ASEAN’s infrastructure needs are projected to hit US$3.4 trillion between 2013 and 2030. ASEAN needs the aforementioned amount in the next five years to keep abreast with economic growth, and to meet the targets of eradicating extreme poverty as well as boosting shared prosperity.

Access to reliable and affordable infrastructure is important for any economy to facilitate job securement and promote sustainability in the long run. It is unfortunate to note that current development spending in Southeast Asia falls far short of what is needed to meet global goals by 2030.

Based on the 2nd ASEAN Economic Integration Brief, another downside risk is the heightened volatility in global financial markets due to faster-than-expected normalisation of monetary policy in the advanced economies, specifically in the United States of America (US) and the Eurozone. To add to this list is the problem of sharp capital flow reversals that have the potential to trigger substantial currency shifts and even prolonged currency depreciation. This might have an adverse effect on economies with relatively high foreign debt.

In order to first hit the trillion-dollar mark for the aforesaid infrastructure needs, the policy, regulatory, financial, and market conditions must be right. This implies that more effort is needed in upstream work to create a policy climate that promotes commercially viable projects.

According to Nena Stoiljkovic, the International Financial Corporation Vice President for Asia and the Pacific, MDBs like the World Bank Group and the Asian Development Bank (ADB), are already increasing efforts to harness private funds through funding packages, risk-mitigation tools and more efforts in upstream work to establish markets and set the conditions to get market forces moving in the right direction.

The challenges facing ASEAN integration might not be substantial enough to rub off the gloss from its successes so far. However, if the association seeks to achieve its goals by 2025 (or earlier), the measures pointed out have to be applied, with a concerted effort from all member states.

This article was first published by The ASEAN Post on 26 April 2018 and has been updated to reflect the latest data.

Related articles:

The key to greater ASEAN digital integration

Thailand leads cooperation and integration efforts in mainland Southeast Asia