Air travel across Southeast Asia is expected to rise at an estimated compounded annual growth rate (CAGR) of 5.8 percent from 2016 to 2036. The International Air Transport Association (IATA) puts the projected number of passengers travelling in 2036 at 7.8 billion people. The Asia Pacific region will be a key driver of this demand, accounting for almost 45 percent of travellers by 2036.

These impressive numbers are due to rising consumer affluence thanks to a growing middle class in the region as well as continuous efforts to liberalise air traffic regulations. Southeast Asia’s middle class will be a critical segment of society, acting as a vital engine of growth. It is expected that the middle class will rise from 29 percent in 2010 to 65 percent of the population by 2030. This means, almost half a billion people would have sufficient disposable income to travel.

In line with this, supply has also been boosted by intergovernmental efforts within the Association of Southeast Asian Nations (ASEAN) to liberalise air traffic. The ASEAN Open Skies Agreement aims to gradually do away with certain key aviation barriers like restrictions on capacity and competition. This policy will supersede any existing bilateral or multilateral aviation policy structure and further allow ASEAN countries and airlines operating in the region to benefit from the growth of air travel around the world.

The increase in supply goes hand in hand with the increase in price competition between airline carriers. This in turn puts downward pressure on airfares and opens up more travel destinations for consumers to choose from. The creation of denser air traffic networks is welcome news for consumers who will then be able to enjoy more affordable air travel to different destinations.

Source: Various sources

Air travel potential

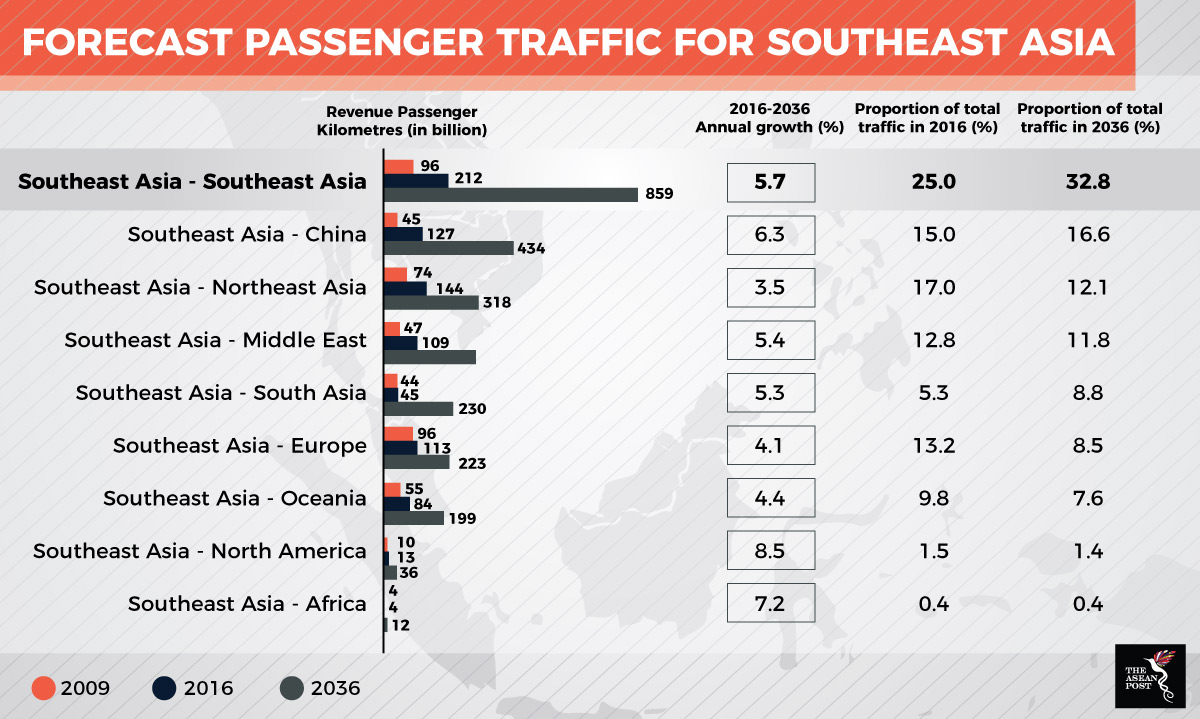

As countries within the region continue to grow and develop, air travel is bound to increase organically. Along this vein, intra-ASEAN air travel is slated to contribute to a third of air traffic by 2036. Particularly with the burgeoning of Tier Two cities – besides the country’s capital city – air traffic between these cities is estimated to grow at a CAGR of 5.7 percent. This will grow the share of total ASEAN traffic to 32.8 percent in 2036 compared to 25 percent in 2016.

Besides that, ASEAN-China flight routes are also seeing an upward trend primarily due to increased travel demand encouraged by large tourist arrivals from China. Traffic from routes between the region and China is expected to grow at a CAGR of 6.3 percent between 2016 and 2036. Thus, increasing its share of total air traffic from 15 percent to 16.6 percent.

On top of that, there is plenty of other opportunities within ASEAN markets due to a rise in religious air tourism. Indonesia, for example, benefits from domestic air travel most noticeably during religious holidays like Eid Mubarak. During this holiday in 2016, approximately 4.6 million people undertook mudik (homecoming). Besides that, the number of passengers will only continue to grow as airfares continue to become more affordable.

According to Bayu Sutanto, Head of Scheduled Flight Division at the Indonesian National Air Carriers Association, the estimated growth of the aviation industry is typically 2.5 times that of economic growth. This points to the immense growth potential of the industry in tandem with the economy. Hence, it is expected that by 2035, 310 million air passengers will contribute to approximately US$50 billion in Indonesian gross domestic product (GDP).

Thailand on the other hand, is on a road towards recovery after the 2014 political coup dealt a heavy blow to the nation’s tourism and airline industries. 32.6 million international tourists visited the country in 2016, representing an 8.9 percent year-on-year increase. The main driving force of this surge came from Chinese tourists who accounted for 27.2 percent of total international arrivals in 2016. Similar to the ASEAN region, China’s growing middle class is a reason why Chinese nationals are gaining affluence and the ability to travel internationally. Moreover, political tensions between China and South Korea in 2017 may have resulted in more Chinese tourists choosing to go to Thailand instead.

Air travel in the region will only trend upwards given rising consumer affluence and more affordable air fares. With more and more travel destinations being offered yearly by both, premium and low-cost carriers, suffice to say, the aviation industry in the region is set to soar.