The telecommunications industry in Southeast Asia is fast evolving. The average revenue per user (ARPU) from voice calls is on a freefall giving way to increased usage of mobile data which is required to access a variety of applications like video and music streaming, e-hailing and social media.

Consumers are increasingly becoming more affluent as the middle-class household segment continues to grow in Southeast Asia. A younger population where more than half are below the age of 45 is also contributing to the growth of the digital telecommunications ecosystem.

The rise of video on demand

Subscription-based fixed cable television is fast losing traction to the burgeoning number of over the top (OTT) content providers that distribute streaming media like Netflix and Spotify. Coupled with an uptick in interest for the competitive online gaming industry, telecommunications providers must contend with having to provide more bandwidth for mobile as well as fixed household broadband.

This opens up a lucrative opportunity for partnership between telecommunications and OTT service providers. According to Digital TV Research, OTT services in the Asia-Pacific region generated US$8.27 billion in 2016, and this figure is set to triple to US$24 billion by 2022.

Two of the highest video viewing shares in the ASEAN region are live TV and smartphone. Current trends indicate that the smartphone share is set to increase at a breakneck pace as a younger society drives consumption demand giving telecommunications players significant room to take advantage of.

Digital services

The number of voice calls made is also fast decreasing. Digital alternatives which are mobile data-based like WhatsApp and Viber are changing the call behaviours of Southeast Asians and driving up mobile data usage. The same can be seen for messaging where most people are moving away from short messaging service (SMS) and opting for mobile data driven applications.

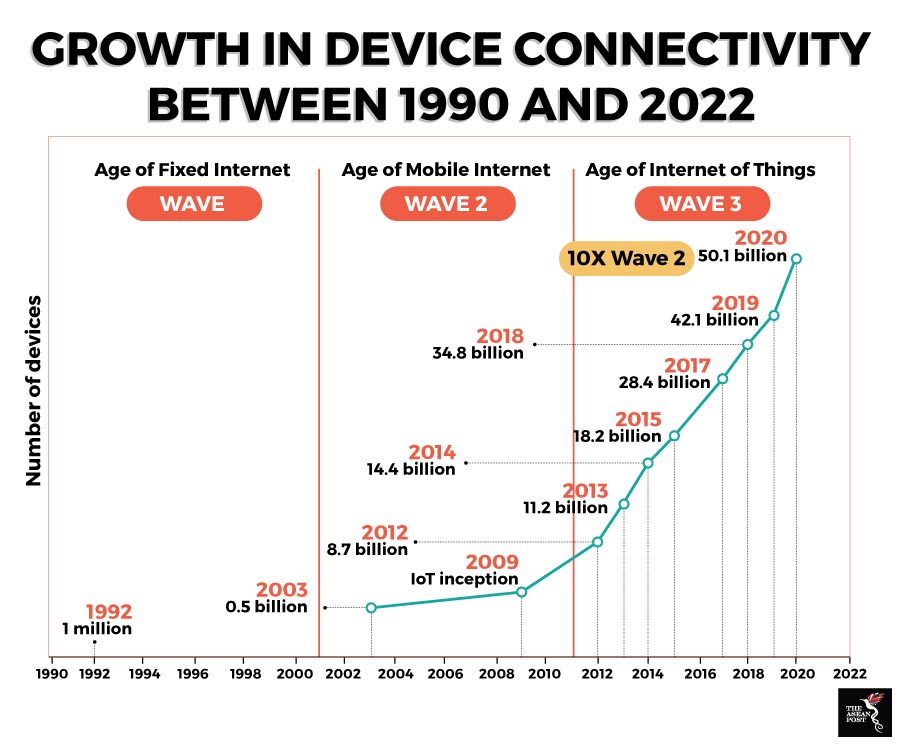

Social media penetration within the ASEAN region stands at 55 percent – 13 percent higher than the global average. As more areas in the region are connected to the internet, the need for mobile data is set to increase exponentially. In the Asia-Pacific region alone, the need for mobile data is expected to increase by a compound annual growth rate (CAGR) of 73 percent.

Source: PricewaterhouseCoopers

eSIM adoption

With the launch of the Apple Watch Series 3, eSIMs are gaining immense popularity and could be as common as white bread in the next few years. The eSIM is an integrated digital SIM that is embedded in an electronic product, like the Apple Watch Series 3. The information stored on an eSIM is rewritable by operators which means that a user would be able to change operators by a mere call instead of having to physically replace a SIM card.

The aggressive introduction of eSIM-enabled devices into the ASEAN market over the next two years would lead to a change in distribution patterns as mobile operators will need lesser shelf space for SIM cards. This translates to a more level playing field for smaller mobile network operators and the possibility of virtual mobile operators in the future.

eKYC regulations

Cybersecurity will always be a concern for the region especially as the telecommunications industry evolves to become a fully digital sector. Most ASEAN states are introducing stringent Electronic Know Your Customer (eKYC) regulations because of this.

Most regulations involve the capturing of key biometric data which is perceived as a cost to the operator. However, it can be turned into a lucrative revenue stream if it can be safely and securely used by other service providers like banks as a method of secure verification.

Privacy concerns may accompany such a shift. Most countries in the region are not yet open to liberal data localisation laws. However, in the right hands, responsible handling of such sensitive data in a cross-border scenario could give regional alliances an advantage over potential cyberattacks.

The demands of tomorrow’s digital consumer will probably be in a constant state of evolution. As a result, industry players – in this case from the telecommunications industry – must be able to understand and cater to the needs of the future telco customer.

Related stories:

Gaming: A lucrative profession