The COVID-19 pandemic that first emerged in the city of Wuhan in Hubei province, China, has severely affected local industries and livelihoods across the world. Some of the worst hit sectors include tourism and aviation as an estimated three billion people worldwide are under virus lockdowns. Other than that, to contain the deadly disease, travel curbs have also been implemented in numerous countries.

Another industry in Southeast Asia that has recently felt the hit from the new coronavirus is the garment business. The textile and garment industries of Vietnam and Cambodia have been developing strongly in recent years and play a vital role in the economic growth of both countries. According to a 2018 report titled ‘Vietnam’s textile and garment industry: An overview’ published by the Czech Technical University in Prague, more than 1.6 million people are employed in the textile and garment industry in Vietnam. This accounts for more than 12 percent of the country’s industrial workforce and nearly five percent of Vietnam’s total labour force.

Over in Cambodia, it was reported that more than half a million people are employed in the garment industry making it the biggest sector in the country. Media reports also state that the sector accounts for 16 percent of Cambodia’s gross domestic product (GDP) and 80 percent of its export earnings.

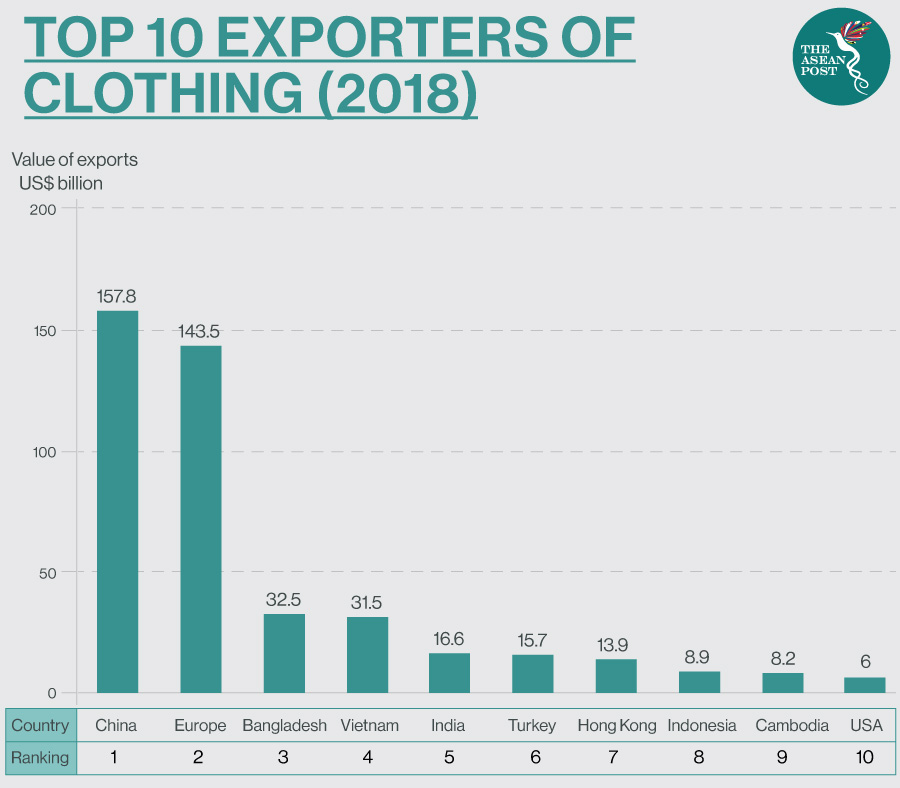

Unfortunately, operations in numerous factories are now being suspended across top garment producers in Cambodia, Vietnam, Bangladesh, Myanmar and Indonesia. This is because of disrupted supply chains in China as the country is the main provider of raw materials for many clothing manufacturers.

As China had imposed citywide lockdowns earlier this year, countries that are dependent on China for raw materials and supplies have faced challenges in operating some of their key industries. According to media reports, Cambodia is already feeling the pinch as the country’s garment sector relies on China for 60 percent of its raw materials. It was also reported that Cambodia’s authorities estimate that around 200 factories employing 160,000 workers might temporarily close their operations by the end of March if they run out of raw materials.

Vietnam, which is one of the largest textile exporters in the world, saw its garment exports dip by 1.7 percent (US$4.5 billion) in January and February.

In neighbouring Myanmar, it is said that China supplies up to about 90 percent of its raw materials. As of 1 April, Myanmar had officially reported 15 COVID-19 infections with one death. However, observers believe that the real figures could be much higher. The Myanmar Garment Manufacturers Association warned that if the crisis persists, around half of the country’s 500 factories could be shut. On 19 March, local media reported that at least 20 apparel factories in Myanmar had shuttered with 10,000 workers temporarily laid off.

Jacob Clere from SMART Myanmar – an organisation which aims to improve labour rights in the textile and garment industry in the country – told the media that “the Myanmar government has focused on boosting local businesses who are struggling, which is good, but direct support programmes for workers to get through this period will also be needed.”

Cancelled orders

China’s central Hubei province has lifted some of its curbs after two months of lockdown as the country claimed it is slowly recovering from the pandemic. According to media reports, China’s supply chains are now starting to reopen, however, Southeast Asia’s garment industry now faces another problem.

It was reported that global brands such as Primark, Marks & Spencer and Hennes & Mauritz (H&M) have cancelled or postponed on apparel orders due to low demand. This means that the garment and textile industry in Southeast Asia that manufactures products for these fashion brands will suffer bleaker consequences.

According to media reports, the situation is so critical that countries like Cambodia and India have made direct appeals to fashion brands to avoid cancellations and to work out payment plans. It was reported that Vietnamese officials believe that exports to European markets could decrease by eight percent in the first and second quarters of 2020.

Human Rights Watch (HRW) stated that some fashion brands and retailers have cancelled orders without assuming financial responsibility even when factories had completed their work. Activists are urging brands to take responsibility for the millions of workers in their supply chain.

“While it is understandable that companies are focusing on the needs of their local staff, clothing retailers must accept that if they choose a business model that relies on the labour of millions of garment workers overseas, then these people are their workers as well,” said Scott Nova, executive director at the Worker Rights Consortium, an independent labour rights organisation to the media.

Related articles: