Against the backdrop of the Fourth Industrial Revolution, Southeast Asia is slowly but surely turning into a battleground for international tech companies to flex their financial muscles and impart their data-driven dominance. From Apple to Samsung, Alibaba to Uber, a plethora of other entities have made their mark in this highly robust region. It must be said that China’s influence in the area is second to none. However, Southeast Asia is a market that is neither completely Occidental or Oriental, which makes it a level playing field for foreign investment. As such, the region’s application of e-commerce is relatively established, which means that both, digital economies and smartphone penetration rates will drive interest as ASEAN undergoes a significant economic shift.

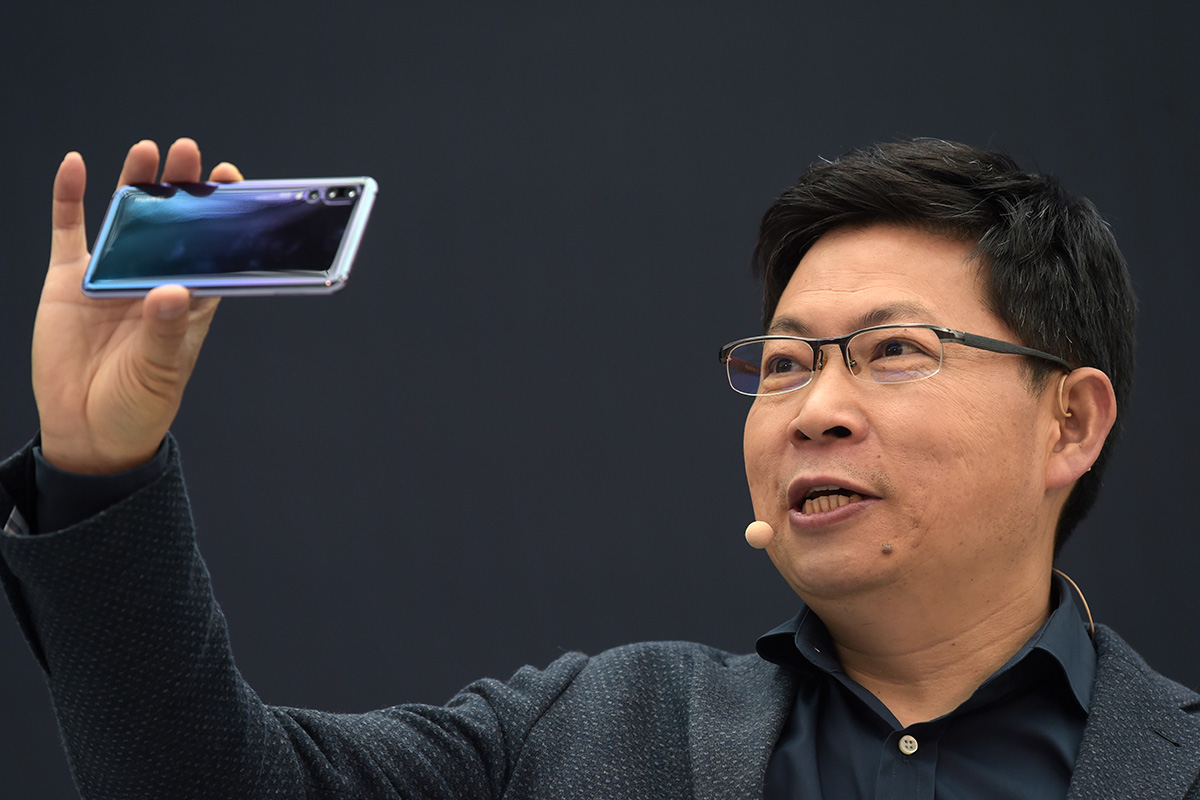

China has a massive geographical advantage when it comes to economic domination in Southeast Asia. Through its gargantuan Belt and Road Initiative (BRI), numerous channels of investment into the region have been established. Being a huge plurilateral arrangement spanning across 65 countries, the BRI will bring about mutual benefits for participating countries, which include the exchange of technology. E-commerce companies are rushing to carve out empires in an untapped part of Asia that offers similarly captivating prospects of growth as the mainland. This transfer of technology takes the form of smartphone sales in Southeast Asia, with Huawei, Oppo, and Vivo among the Chinese brands that enjoy a firm stranglehold in the ASEAN tech market.

According to the International Data Corporation (IDC) Quarterly Mobile Phone Tracker, Chinese smartphone vendors now account for one-fifth of the total Southeast Asian smartphone market over the past 3 years. Such penetration into the regional market does not look like it will cease anytime soon.

“The majority of ASEAN’s technology deals in (the) recent past are still at the seed-stage, and while e-commerce is growing rapidly in ASEAN, the penetration rate remains relatively low at between 2 percent and 5 percent compared with more established markets like China at 19 percent,” said Datuk John Chong, CEO of Malaysia’s Maybank Kim Eng in a recent interview. This is telling of ASEAN’s potential in the tech ecosystem.

A Huawei sales data released in January this year showed that Honor, its sub-brand, had attained a 2.645 million-unit sales volume. Since the second half of last year, Honor had penetrated the Southeast Asian market, specifically in Myanmar, Malaysia, and Vietnam.

On the other hand, Oppo, being half a decade old in the region, has become one of the leading vendors by investing heavily in its marketing initiatives. Its marketing approach is standardised across countries, mainly relying on local celebrities as brand ambassadors to promote itself as an ‘aspirational/trendy’ brand which mainly targets the millennial market. In Malaysia for example, local celebrities, Fattah Amin and Nora Danish were signed to represent the brand, given their strong pull factor, especially on social media.

Source: TechInAsia, 2018

In November last year, Chinese business tycoon Jack Ma opened the doors to a Digital Free Trade Zone (DFTZ) in Malaysia that was designed to tap into the region’s economic boom. First announced in March, the DFTZ is now open for trade, with Putrajaya anticipating this joint venture (with Alibaba) in handling US$65 billion worth of goods, effectively creating 60,000 jobs by 2025. Once in full flow, the target is for small businesses to make use of the trading space as easily as large companies. As such, the influence of technology is not only limited to handheld devices that people constantly have with them but permeates a more substantial economic field.

With a population of approximately 620 million people, whichever global entity that can cultivate Southeast Asia through smartphone adoption, internet commerce, as well as other influential technologies will have prime access to one of the world’s most crucial generators of growth over the next two decades. From then on, a lot will depend on whether the region can maintain or even extend its economic strength and growth through various partnerships and collaborations with large, global players.