Bitcoin started the week badly, as prices for the popular cryptocurrency fell 7% to dip below US$8,000. The sudden sell-off follows from Twitter’s decision to ban advertising for cryptocurrencies.

Twitter is joined by Facebook and Google who have both banned advertisements for initial coin offerings and token sales on their respective platforms. Facebook, the world’s second-largest provider for online ads was the first to do so, barring advertisements in January followed by Google who announced that the ban would take effect in June. The decision by Facebook and Google has had a similar effect on Bitcoin as prices declined 12% in January after Facebook’s announcement.

Bitcoin is the first cryptocurrency to come into existence and remains one of the most popular cryptocurrencies in the world. According to estimates by the University of Cambdrige, there are 2.9 to 5.8 million unique users with cryptocurrency wallets that use Bitcoin.

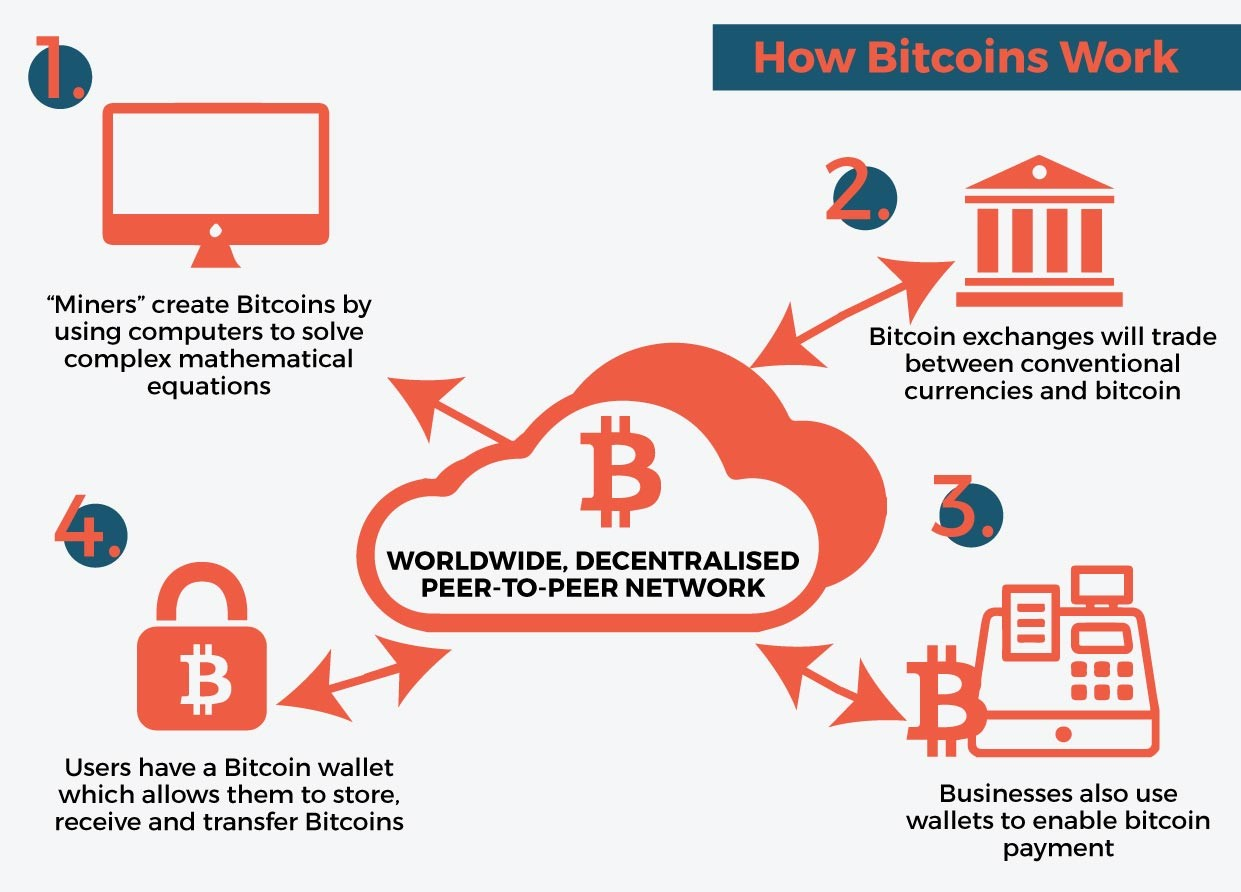

Cryptocurrency became the buzzword that took the tech and finance worlds last year by storm when Bitcoin’s value reached an all-time high of US$19,783. Cryptocurrencies are digital currencies that work through a blockchain. Unlike normal currencies, cryptocurrencies are completely decentralised and aren’t issued by a central bank authority. However, similar to normal currencies, the value of a bitcoin is determined in the exchange market. They are bought and traded but everything else is done through a digital marketplace.

One of the biggest reasons for the sudden increase in prices last year was due to speculation that prices would only keep going up, leading to many people wanting to cash in on the trend. However, history has shown that every bubble has to burst eventually. When Bitcoin’s value spiked in 2011 and 2013, the spikes were followed by huge crashes too. It looks like the same could be happening once again.

The cryptocurrency buzz last year caught the attention of many and has led to a mushrooming of finance and tech companies around the region. Despite more enterprises looking into cryptocurrency, the value of cryptocurrency has still remained extremely volatile.

Bitcoin prices have dropped more than 42% since the start of the year, from about US$13,000 to around US$8000. Things are even worse in the altcoin market (Bitcoin alternatives) with cryptocurrencies such as Ethereum and Ripple seeing a downward trend in their currency value. Meanwhile, Litecoin, the fifth-largest cryptocurrency, dropped 10% after failing to launch their payment processor.

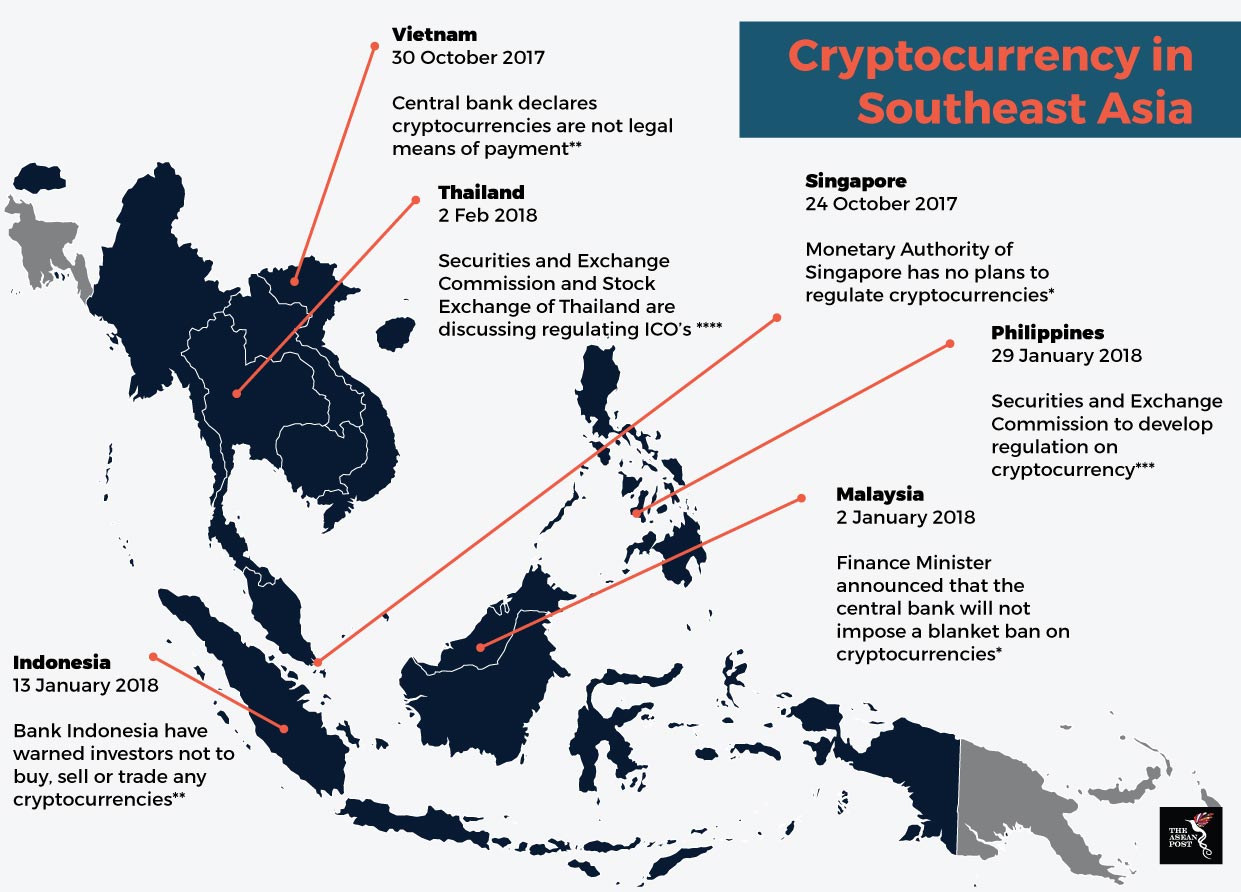

Aside from that, the value of these coins has also been affected by growing regulatory demands for cryptocurrency. Banks, especially those in Southeast Asia have shown concerns about the growing dangers of cryptocurrencies and have come down hard on them. For example, Thailand’s central bank has banned local banks from getting involved in cryptocurrency transactions. Bank Indonesia has also taken a firm stance, warning all parties to avoid owning and trading in cryptocurrencies.

There are also security concerns when it comes to cryptocurrencies. In January, hackers managed to steal US$440 million dollars’ worth of NEM coins from Coincheck, a cryptocurrency wallet and exchange service in Tokyo. Besides that, the trend of startups using initial coin offerings to raise funds has been exploited by certain parties to run pump and dump scams.

While many are criticising Southeast Asian banks for being hostile to cryptocurrencies initially, in hindsight it could turn out to be the right decision. Currently, more and more countries are discussing the possibility of cryptocurrency regulation. Most recently, the G20 set a deadline in July for discussions on cryptocurrency.

What remains to be seen is the future of cryptocurrency in the region and the world. Some have said that cryptocurrency has no future as an actual currency for buying and selling goods due to its proneness to bubbles. However, it cannot be denied that the technology has true potential.