We often hear that "cash is king". While it is undeniable that cash has been the preferred mode of payment in the past, the 21st century has introduced an array of cashless payment methods – also known as e-payment – to consumers all over the world. All across the globe, people are divided into those who prefer the more conventional mode of payment as others take a more progressive approach by supporting cashless transactions. There is no right or wrong answer in this debate as it all comes down to personal preference. In order to understand the argument between cash and e-payment better, one must look at the rise of e-commerce and its trajectory.

With a total population of over 630 million people and an internet penetration rate of only 53 percent, Southeast Asia has quickly become the battleground for e-commerce companies from all over the world. Several months ago, Chinese giant Alibaba Group Holding announced its plan of making a major investment in Indonesia’s Tokopedia to accelerate its expansion into Southeast Asia. The group already has control over Lazada Group, which is the region's number one online shopping and selling destination. Marc Woo, Google’s head of e-commerce, travel, and financial services also told the Bangkok Post that Southeast Asia will be the next major boom market for e-commerce in Asia-Pacific – it accounted for 40 percent of global e-commerce sales in the first quarter of 2017. Frost & Sullivan has echoed the optimistic sentiment towards the potential of e-commerce in Southeast Asia and expects e-commerce revenues to surpass 25 billion dollars by 2020.

In Indonesia alone, the e-commerce market is targeted to grow from 19 billion dollars in 2016 to 130 billion dollars in 2020, according to the data obtained from Indonesia’s ICT (Information and Communications Technology) Ministry. Meanwhile, Thailand has seen an explosion of internet shopping in recent years as consumers become increasingly familiar and comfortable with technology. Online retail sales in Thailand of everything from washing machines and televisions to fish sauce are growing more than 100 percent, which is outpacing traditional stores where sales are rising about 10 percent. Due to the drastic increase in online shopping, many retailers have also decided to enhance their competitiveness by supplementing their business with e-commerce platforms.

Along with the rise of e-commerce in the region, consumers are now exposed to the choice of paying for their purchases through e-payment methods. These e-payment options in Southeast Asia include Line Pay, Doku Wallet, T-Cash, Smart Money, Globe GCash, MOLWallet, Alipay, NETS, TrueMoney Wallet, Samsung Pay, Codapay, Singtel mWallet, as well as the more commonly used debit and credit cards.

However, the clash between cash and cashless is not a one-sided battle. In a research conducted by the RBR (Retail Banking Research), the Asia-Pacifc is home to more than half of the world's ATMs (automated teller machines). Between 2015 and 2017, the number of ATMs in Asia-Pacific increased from 1.55 million to 1.72 million and are projected to reach two million by end of 2022. The growth is mainly contributed by Southeast Asia nations and China.

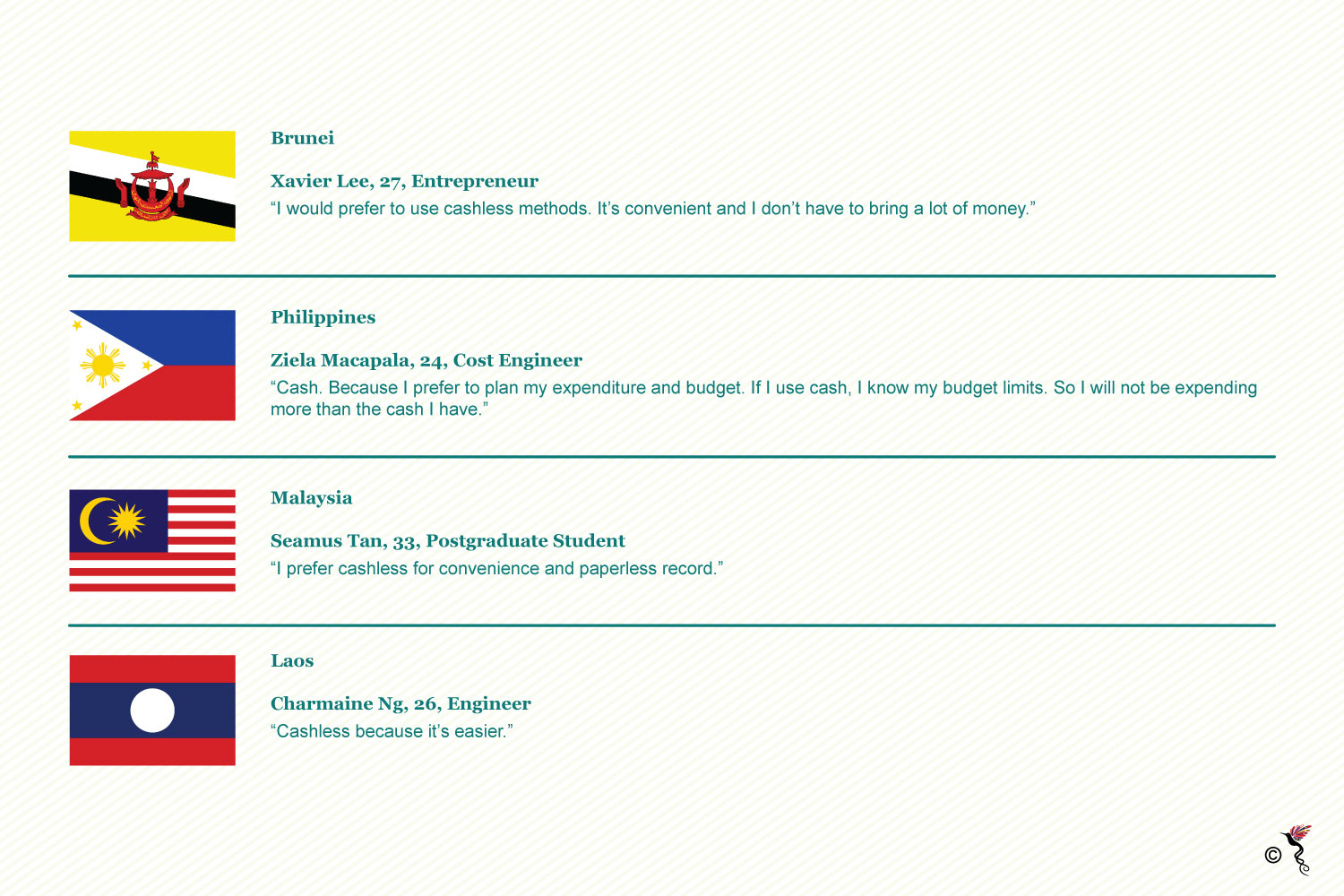

Comments from consumers across the Southeast Asian region.

In an interesting development, Bloomberg reported on September 5, 2017 that Singaporeans – citizens of the arguably the most developed and tech savvy country within Southeast Asia – still prefer to pay for everyday transactions with cold hard cash. It is hard to imagine that a country where almost everyone owns a smartphone would still pay by cash, but many commented that food owners in the country do not accept any other mode of payment as preference for cash in Singapore is still higher than the 88 percent average across Asia Pacific, according to a recent report from Paypal Holdings. The ability to control one's spendings better is another main reason why cash is still a popular choice among consumers. When contacted by The ASEAN Post about her favourite mode of payment, 27-year-old producer from Singapore, Nivitra D. Hari said: "Cash, because I want to keep track of my money".

Contrastingly in the Philippines, the Visa’s Consumer Payment Attitudes Survey revealed that over half of Filipinos favours e-payment methods over cash. In the 2016 study, there was a 43 percent drop in Filipinos who preferred cash in 2016. At the same time, 49 percent of Filipinos have more cards in their wallets compared to five years ago, while 29 percent carry less cash.

Convenience also plays a huge role in dictating the mode of payment one chooses. Mutiara, a 24-year-old Indonesian college student told The ASEAN Post: "I prefer cash! Because it takes no more than one minute to settle, unlike cards transactions where we have to secretly hope that edc machines are working fine".

Singaporean Prime Minister, Lee Hsien Loong also said in his National Day speech, "In Singapore, we too have e-payments, but we have too many different schemes and systems that do not talk to one another. So people have to carry multiple cards, and businesses have to install multiple readers. It is inconvenient for consumers, it is costly for businesses. And the result is, most of us still prefer cash and cheques”. He urged Singaporeans and businesses alike to embrace new technologies.

While it is good to preserve traditions as they are a part of our unique cultural identity, the Southeast Asian region and the ASEAN (Association of Southeast Asian Nations) governments should seriously consider the economic potential of e-commerce businesses and e-payment methods in creating an economically integrated region that would pave the way for further growth within the region. For now, the decade-old debate of cash versus cashless transactions shall continue to be decided by the everyday consumers.