SMEs contribute 50% of ASEAN countries' gross domestic products (GDP) and drive 30% of ASEAN countries' exports, according to a joint 2018 report by the United Overseas Bank (UOB) and Dun & Bradstreet released in February 2018.

1,235 SMEs across Singapore, Malaysia, Thailand, the Philippines, Indonesia and Vietnam were surveyed in a bid to better understand how SMEs in these countries were positioning themselves within an evolving business landscape.

According to the survey, ASEAN countries that see the highest need to invest in tech are Malaysia and Singapore, with 65% and 63% of the SMEs in these countries surveyed stating that they placed priority on technological investments.

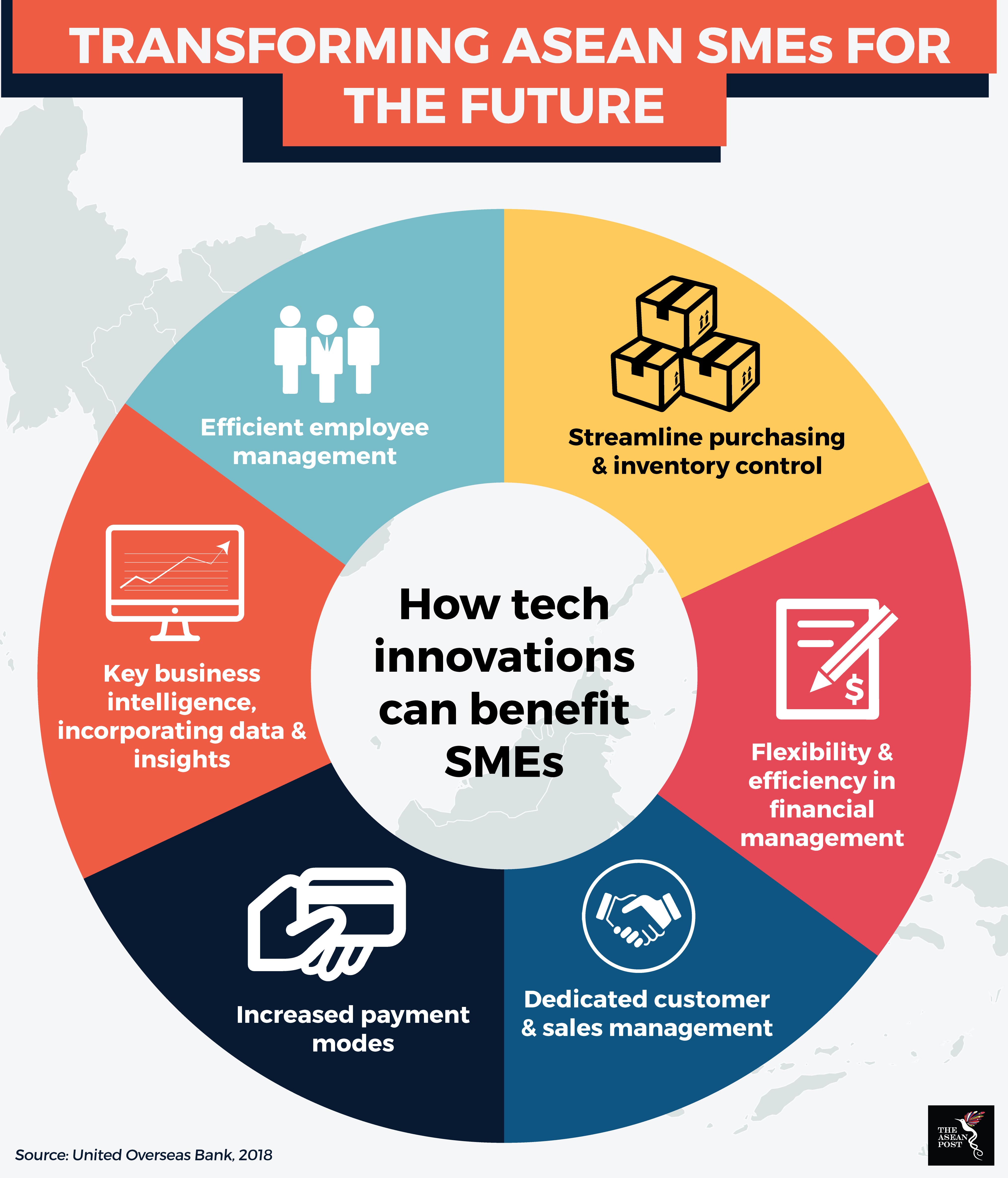

Overall, around 60% of respondents were said to be keen to invest in technology solutions in order to drive business performance, seeing the urgency on IT spending over conventional fixed asset spending.

Optimising technology spending

78% of ASEAN SMEs surveyed stated that they were keen to invest in software and services, while just 65% prioritised investments in the underpinning hardware and infrastructure.

SMEs were also less aware of Software-as-a-Service (SaaS) capabilities and still preferred conventional applications on-site. SaaS refers to cloud programs that SMEs would be able to access from a remote server rather than have them installed directly on computers, according to financial education website, Investopedia. Such programs are usually utilised for the purposes of human resource management, payroll and client retention management, for example.

"The findings of the study indicate that many small businesses may not be optimising their technology spend," commented Lawrence Loh, head of business group banking at UOB to The Edge Singapore recently.

In fact, in order to fully optimise technology spend, SMEs would need to match technological investments with targeted capabilities, according to analysis by Price Waterhouse Coopers (PWC). Adequate account of the executional, transitional and operational risks needed to be taken when determining the total value of revenue technological investments were likely to generate.

Investments in software, for example, could contemplate the use of data analytics and social media for business tools to create an effective digital marketing strategy. Yet to begin with, this would depend on how much digital marketing the company currently employs, and whether their digital marketing strategy is currently effective. ASEAN SMEs can also expand payment modes to include digital payments as a way to facilitate more efficient transactions, but this may not have much impact on the business if it does not translate into lower operational costs or higher sales volumes.

SMEs would also need to employ technical know-how to operate new technology capabilities. Currently, about one-third of SMEs invest in digital expertise, but are expected to hire data analysts, digital marketers, and interface designers in the future as they advance further into technological innovation, the survey findings showed.

Government support may also be necessary at the beginning stages, although it cannot propel SMEs all the way.

Currently, with the positive business outlook in Malaysia, the government there has increased programs to enhance employee productivity and to increase SME competitiveness, among other aims. Malaysia’s ministry of science, technology and innovation (MOSTI), for example, provides funding grants such as the SMART fund, Innofund and Facilitation fund to assist SMEs with research and development, innovation and commercialisation, according to the MOSTI website.

Meanwhile, Singapore is increasing efforts to nurture homegrown tech talent. It recently set aside SG$145 million to expand the reach of its Tech Skills Accelerator to new sectors, including manufacturing and professional services.

“Training programs in skills such as artificial intelligence, cybersecurity and the Internet of Things will also be increased,” said Heng Swee Keat, Singapore’s finance minister, during the unveiling of the new measures in February 2018.

Technological investments are especially crucial for SMEs with a view towards overseas expansion. According to the survey, about 37% of SMEs currently have an overseas presence but a larger percentage had ambitions to expand globally in the near future. For example, enhanced brand recognition would require SMEs to invest in strategy development, brand management and advertising, all of which require some degree of technological investment in order to reach global audiences.

While technology investments are important, they will only form the next stage of ASEAN SMEs’ business positioning. Market conditions, as well as access to financing are in fact some of the fundamentals SMEs should consider first. SMEs will have to work out the right business strategy before joining the technological fray full throttle ahead.