Last week, Uber finally announced to nobody’s surprise that their Southeast Asian operations would be sold off to their biggest rival, ride-hailing giants, Grab. As part of the deal, Uber would get a 27.5% stake in Grab and its Chief Executive Officer (CEO), Dara Khosrowshahi will be given a seat on Grab’s board of directors.

The announcement comes after months of speculation and rumours of the takeover. The speculation was mostly sparked by Softbank’s deal with Uber in January, making Softbank Uber’s largest shareholder. Softbank are also backers of Grab, so many observers thought that Softbank would seek to reduce competition between the two and consolidate their assets.

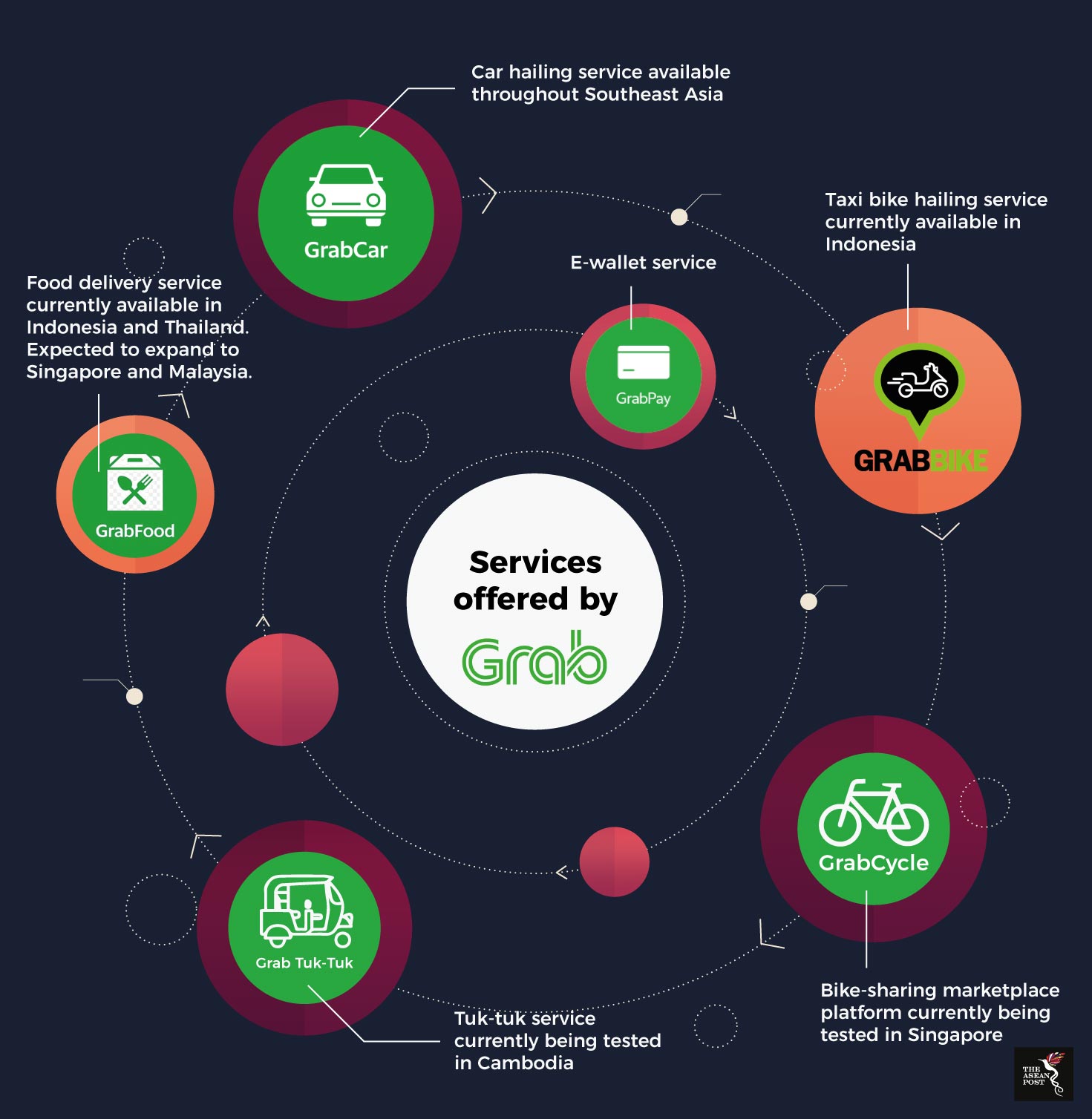

Ever since the announcement, Uber is slowly transitioning and merging their services into Grab. For now, the Uber app will continue to operate for the next two weeks until 8 April. In the meantime, Grab will assist Uber drivers in transitioning to Grab. Meanwhile, UberEats, Uber’s food delivery service will become GrabFood by the end of May. This would see GrabFood expand to Malaysia and Singapore aside from Thailand and Indonesia who already enjoy GrabFood services.

With Uber’s exit from Southeast Asia, Grab’s domination over ride-hailing in the region (barring Indonesia, where the dominant app is Go-Jek) is assured.

In February when word was getting out that Uber might exit the region, Khosrowshahi dismissed it.

“We expect to lose money in Southeast Asia and expect to invest aggressively in terms of marketing, and subsidies,” Khosrowshahi told the media in New Delhi.

Whether Khosrowshahi’s statements were merely made to try and quash rumours or that “investing aggressively” was Uber’s initial plans in the region, no one knows. However, it does indicate one thing, that Uber realized that they were fighting a losing battle in the region.

Uber’s arrival in the region came at a time when it was dominating headlines for disrupting the taxi industry. Uber became an emblem of the new gig economy, paving the way for a slew of other startups who tried to replicate Uber’s business model. Even MyTeksi, Grab’s first incarnation was modelled on Uber.

So how did Uber, the pioneers of ride-hailing lose out to Grab?

One of the main reasons why Grab is winning the hearts and minds of millions in the region is that they adapt better. When Uber first entered the market in this region, payments could only be made with a credit card. According to KPMG, only 27% of Southeast Asia’s population has a bank account. When Uber finally introduced a cash option in their payments, they had already lost a big chunk of customers who had already transitioned to Grab, which had the cash payment option from the start.

Furthermore, Grab is also privy to local traffic preferences. In cities such as Jakarta where traffic jams are notorious, Grab introduced GrabBike to overcome it. GrabBike services have also just been launched in Cambodia and Thailand. More recently, Grab started testing a tuk-tuk service called “Grab Tuk-Tuk” in Phnom Penh and Siem Reap. These are all localisation tactics which Uber refused to explore previously.

Besides that, Grab has diversified its business by offering other services. For example, realising the unbanked population of Southeast Asia, Grab introduced GrabPay, a mobile wallet service that allows users without bank accounts to buy top-up cards to put money into their accounts. Grab’s entrance into the e-wallets payment system was also timely, with other e-wallets such as Alipay and WeChatPay also taking the region by storm. GrabPay is also integrated into other Grab services such as their e-hailing and GrabFood services, making payment seamless and easy.

On the other hand, some have argued that the narrative that Uber have lost in the region could be wrong. The biggest losers might be the employees working in Southeast Asian Uber offices, although Uber’s sale to Grab in Southeast Asia could save the company billions. Uber are reportedly losing US$1 billion per quarter amid growing scandals ranging from sexual harassment allegations to aggressive business strategies. However, the 27% stake that Uber has in Grab could prove to be extremely profitable for them.

While it may seem that Grab has won the battle, consumers could lose out since a monopoly has now been established in the e-hailing industry. If Grab wants to maintain their domination over the region’s market they should remember to keep their consumers’ interests at heart, otherwise Grab could easily become what Uber was and lose the war in Southeast Asia.