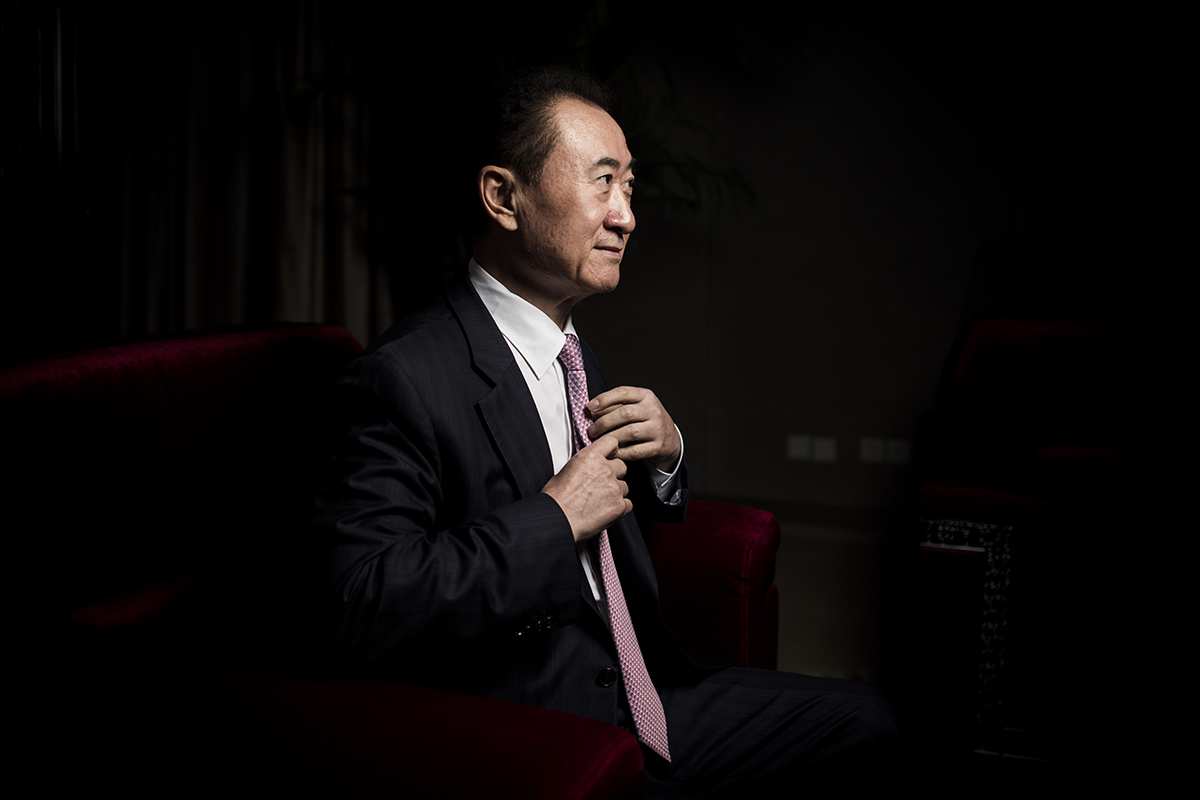

A hare can be outrun by a tortoise. Dalian Wanda Group Co.'s Wang Jianlin should have heeded the ancient wisdom and stuck with real estate.

The conglomerate's fall from grace has been swift. As recently as 2015, Wanda was the fourth-largest property developer in China, generating 151 billion yuan (23.2 billion dollars) in sales, according to data from China Real Estate Information Corp. By 2017, it had tumbled to 22nd place, with 89 billion yuan in sales.

By comparison, Country Garden Holdings Co., a second-tier real estate firm just two years ago, soared through the ranks to become China's largest developer with 550 billion yuan in sales in 2017 -- up 650 percent from 2015. Analysts are forecasting another 39 percent gain in Country Garden's top line for 2018. Not surprisingly, investors joined the party, sending Country Garden's shares 240 percent higher in 2017.

Wang miscalculated badly. Going for an "asset-light" strategy, he wanted to build fewer apartments and spend more time managing shopping malls and theme parks, while hunting for what he deemed more lucrative media assets. At one point, he pledged that his parks would beat Walt Disney Co., while he consolidated several of the world's biggest cinema chains and bought Legendary Entertainment LLC, the studio behind the Godzilla franchise.

As early as 2012, when China's property market was going through a downturn, Wang began building his media empire with the purchase of AMC Entertainment Holdings Inc., the movie-theater chain. More deals followed: In late 2015 and early 2016, he bought World Triathlon Corp. and Carmike Cinemas Inc. -- just as Chinese real estate took off.

Now Wang is unwinding a lot of that debt-fueled expansion, having sold most of his hotels and theme parks to real estate rivals Guangzhou R&F Properties Co. and Sunac China Holdings Ltd.

Wang has tumbled to fourth place among China's wealthiest, according to the Bloomberg Billionaires Index. He now trails two tech titans and is sandwiched between a pair of real estate rivals he once overshadowed: Hui Ka Yan of China Evergrande Group and Country Garden's Yang Huiyan.

Wang's net worth may actually be short of that estimated 28.6 billion dollars. Dalian Wanda Commercial Properties Co., repository of the bulk of his wealth, is now in limbo. The company has been taken private by Wang but is nowhere close to relisting in China.

It may be too late for Wang to regain the top seat at the billionaires' table, even if he manages to repay the debt piled up to accomplish the expansion he's now unwinding.

That's because China's property market is well on the way to consolidation, with the winners buying out distressed players. In 2015, the top 10 developers had 17 percent of the market; now the 10 -- with Wang's firm a notable absence -- control 24.1 percent. By 2020, those dominant companies will have 40 percent of the market, Citigroup's Oscar Choi, the No. 1-ranked analyst in the field, predicts.

Patience and persistence often win the day. – Bloomberg

Recommended stories: