Islam has had firm roots in Southeast Asian history – from the Arabian who traded at the ports of Melaka, the Sufi mystics who spread their influence in Aceh and now, through developments in Islamic finance and banking.

What is Islamic finance?

While not exclusive to Muslims, Islamic finance offers an alternative to its Western alternatives and is regarded as scrupulous by those who use it. As a rule of thumb, Islamic banks are not allowed to charge any form of interest, risky investments are not permitted and investments are limited to shariah-compliant industries only.

Unlike conventional banks, Islamic banks operate without charging interest or riba. Essentially, under Islamic law, money cannot be used to generate more money and charging high interest rates – especially to those in need – is considered unethical and is therefore forbidden. Instead, banks share the risk of their investments with investors on a profit-loss basis. For example, rather than mobilising their customers’ deposits as loans and charging an interest rate on it, an Islamic bank would use the money from its depositors to acquire assets like property or precious metals. Then, they share the profits made off those assets with depositors.

Besides that, Islamic banks only invest in shariah-compliant industries and stay away from those that are prohibited under Islamic law like alcohol, pornography and gambling. This is another lure for investors who want their money to be invested in socially responsible causes.

On top of that, Islamic banks do not dabble in risky and speculative investments because of the high degree of uncertainty or gharar associated with such investments. One must own what one sells, hence, conventional derivatives like futures, swaps and forward contracts are not permissible. Instead, banks would have to be up front with their investors by identifying the risks involved beforehand and ensuring that investors understand what they’re investing their money in. This is largely the reason why the Islamic finance industry escaped the direct repercussions of the financial crisis of 2008.

Southeast Asia’s growing foothold in Islamic finance

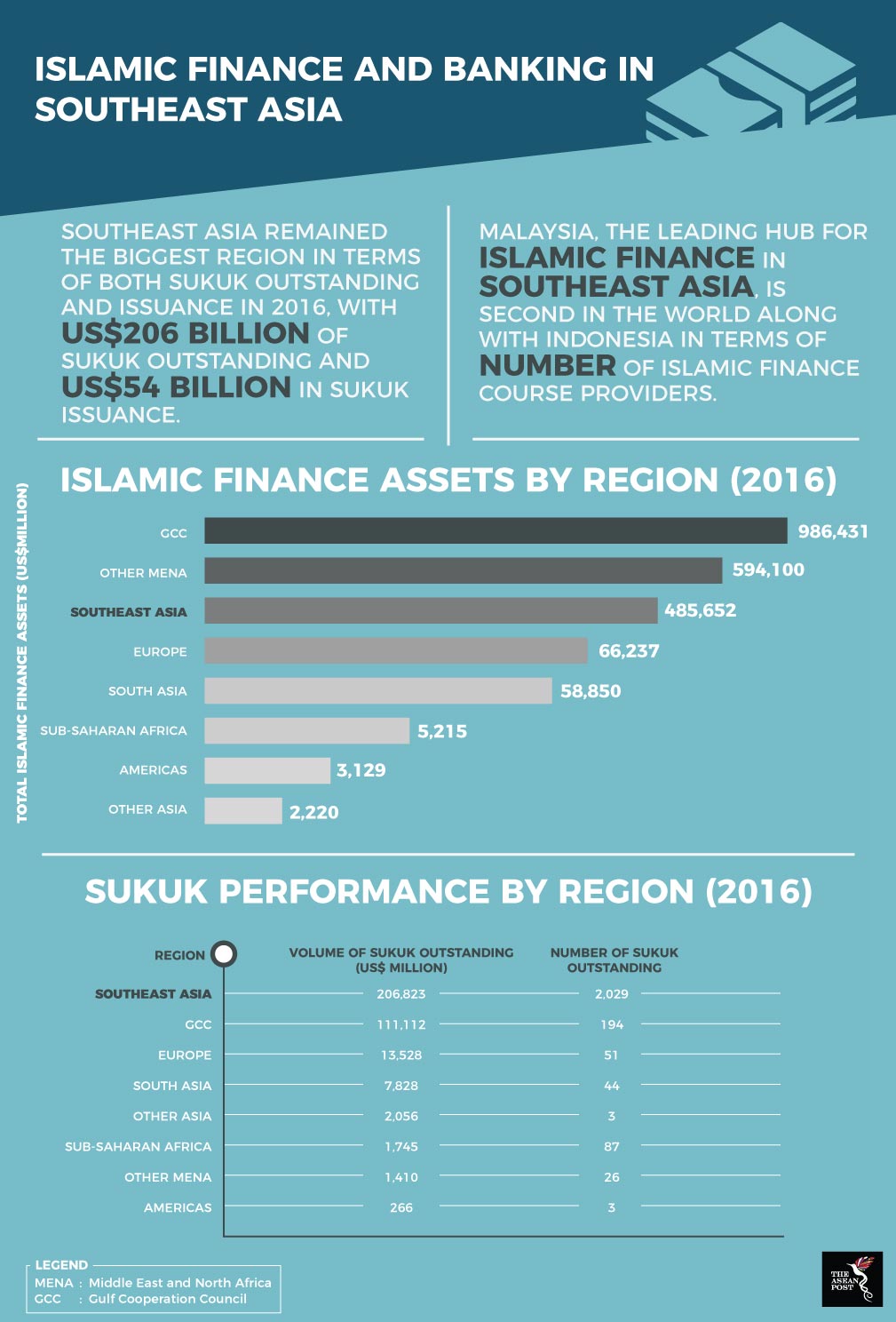

According to a 2017 report by Thomson Reuters, Islamic finance is a US$2.2 trillion industry and is expected to grow to US$3.8 trillion by 2022. From a regional perspective, the more prominent players include the gulf states – Bahrain, Kuwait, Saudi Arabia, Oman, Qatar and the United Arab Emirates (UAE). However, the Southeast Asian region is fast catching up and, in some aspects, have outperformed the gulf states.

Malaysia leads the charge and according to the Islamic Finance Development Indicator (IFDI), is the highest ranked in the world, followed by Bahrain in second and the UAE in third. Malaysia excels in terms of the performance of its Islamic finance institutions by virtue of its research into Islamic finance as well as educating and creating general awareness of Islamic finance across the banking sector.

Collectively as a region, Southeast Asia’s strengths lie in sukuk – the Islamic equivalent of conventional bonds. It was the biggest in terms of both, sukuk outstanding (US$206 billion) and sukuk issuance (US$54 billion) in 2016. Malaysia accounts for 82 percent of Southeast Asia’s total sukuk outstanding and 72 percent of the region’s issuances. In June 2017, Malaysia broke new ground in sukuk development when it issued the world’s first ever green sukuk, amounting to US$58.4 million. The funds are being used to finance a major solar-power project in the western state of Sabah.

Other Southeast Asian states looking to get a piece of the action include Indonesia and Brunei which, according to the 2017 report recorded the most improved performances compared to other countries. The Brunei Darussalam Islamic Finance (BDIF) is an initiative to project the sultanate as an international hub for Islamic finance. Indonesia on the other hand has launched a roadmap moving towards 2019 which aims to create sustainable Islamic finance services that can compete with conventional banking products.

Islamic finance may be in its nascent stages globally but Southeast Asia has already got a head start thanks to the fact that the region has been championing Islamic finance from the very beginning. This translates to more opportunities to help shape and develop the Islamic finance ecosystem. Hence, countries in this region which are quick to snap up available opportunities can reap the benefits in the years to come.