The improving start-up ecosystem in Southeast Asia is nurturing more homegrown start-ups, many of which have become successful with investors now on the lookout for the next unicorn (a start-up valued at US$1 billion). A start-up is a fledgling company that is working to solve a problem and is usually designed to grow fast.

A start-up comes about when an individual (or sometimes more than one person) with a small amount of funds – usually from family or friends – decides to create a company. It is the entry of investors which will take a start-up to the next level. Venture capitalists (VCs) will invest in start-ups and if things go well, the company can raise a Series A fund of between US$5 million and US$10 million. To obtain these funds, start-ups have to pitch their products to VCs.

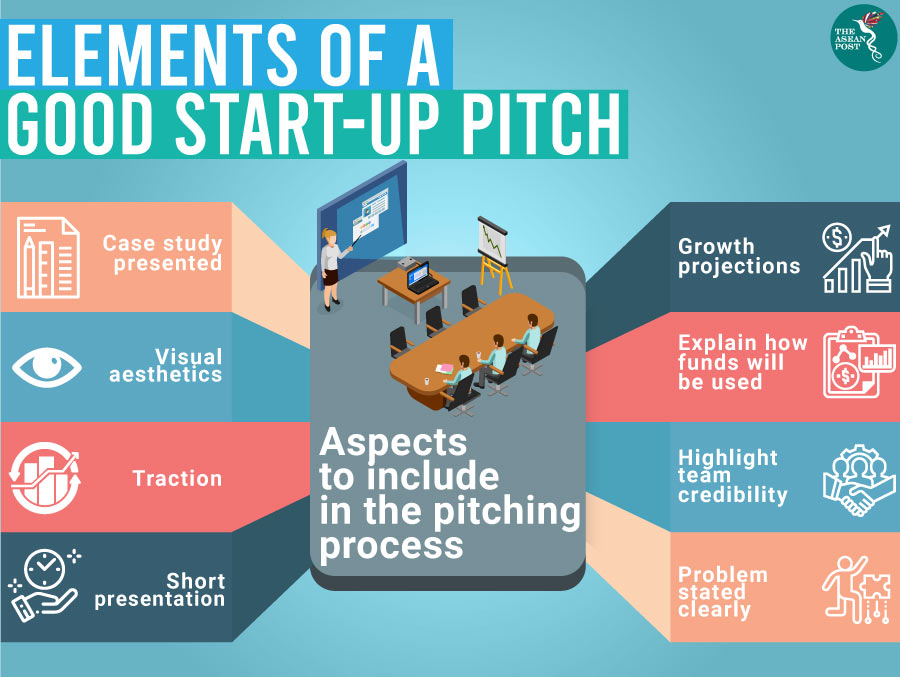

Pitching allows start-ups to introduce their business ideas with the main goal of attracting investors or stakeholders to support them financially. The amount of time a start-up gets to pitch is usually limited to just minutes.

At the recent Malaysia Tech Week (MTW19), the Malaysia Digital Economy Corporation (MDEC), together with venture company 500 Startups hosted the MTW’19 Pitch Pit. The format was simple – start-ups got to do a brief three-minute presentation each. Although the prize money was imaginary, winners got a chance to do one-to-one mentoring sessions with Amazon Web Services (AWS). All the start-ups also benefitted from competing in front of an invited group of media and select investors.

Hosted by Khailee Ng, Managing Partner of 500 Startups, the event was well-attended. The full-house consisted of entrepreneurs, investors and VCs. According to Khailee, a demo day event can easily bring in 200 to 300 different types of investors. Demo days are slightly different from pitch pits as start-ups get intensive mentorship and training ahead of the pitch event.

Competition is ASEAN

A common mistake that start-ups make when pitching is “over talking” without getting people excited about their business or product. Martin Zwilling, founder and CEO of Startup Professionals, says that investor needs to make sure start-ups have a business as well as a product. Investors are attracted to pitches which include growth projections, a high gross margin, the team’s capabilities and also an exit strategy.

Khailee, however, says that his philosophy is for start-ups to “put their best foot forward… and lean into the strongest point. If sales and traction are impressive, then lean into that.”

ASEAN now has an attractive investment market as well as an expansive digital environment. Start-ups are no longer a new thing, which means the competition is greater. More capital and more talent are going into the same set of problems. What is important is “how can start-ups execute quickly and how can they build progress or traction with their company to be defensible,” explained Khailee.

“Two things go hand in hand – how fast and how defensible you are. That is relevant to start-ups in ASEAN because now the competition is ASEAN,” he added.

Strict process

500 Startups does not believe in making snap decisions. In order to proceed to invest in a company, they follow a strict process including taking the time to ask all the right questions and making comparative decisions.

“A lot of the first impression is sometimes you are right sometimes you are wrong. Intuition, complemented with data, experience, diverse sets of opinions across the team and tech experts – creates a holistic decision. Founders are driven by idealism first and are in charge of their story,” said Khailee.

It’s easy to get bogged down by data and charts when making a pitch, losing sight of your goals in the process. In the end, the pitch is just the tip of the iceberg, and you have a long way to go if you want your start-up to become a unicorn.

Related articles: