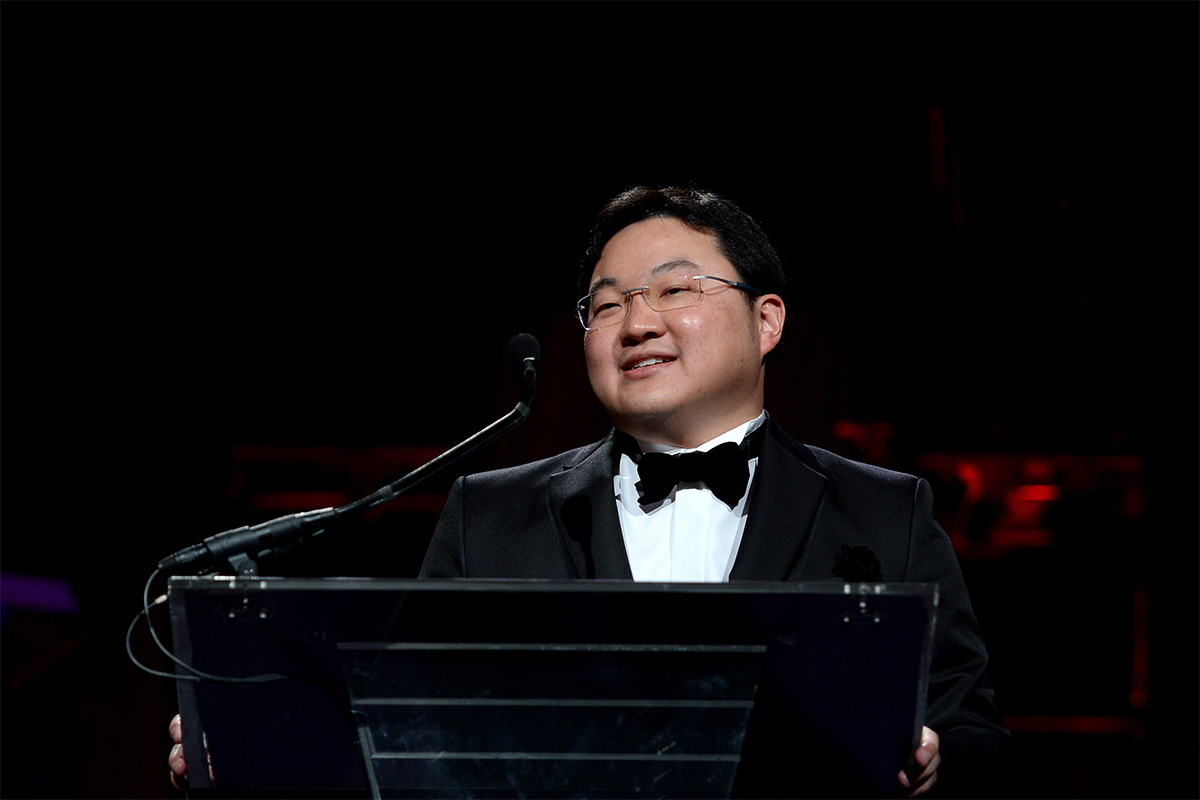

Malaysian authorities conducting a probe into troubled state investment fund 1Malaysia Development Bhd (1MDB) have issued an arrest warrant for financier Low Taek Jho and are preparing warrants for two others, including a former Goldman Sachs Group Inc. banker, people with knowledge of the matter said.

The Malaysian Anti-Corruption Commission (MACC) has also issued an arrest warrant for Nik Faisal Ariff Kamil, a former official at a 1Malaysia Development Bhd unit. The agency is preparing warrants for the fund’s ex-chief, Shahrol Halmi, and Roger Ng, a former Goldman Sachs banker focused on Malaysia who left the firm in 2014.

The four individuals haven’t been charged with any wrongdoing, and it isn’t clear what suspicions underpin the warrants. Their representatives declined to comment or weren’t immediately reachable. A representative for the MACC declined to comment.

Investigators’ recent actions underscore the determination of Prime Minister Mahathir Mohamad, who returned to power in a shock election win in May, to get to the bottom of an alleged multibillion-dollar fraud at the fund. 1MDB, set up in 2009 by former premier Najib Razak – who lost to mentor-turned-foe Mahathir in the election – is also at the centre of globe-spanning probes.

Low cooperating

Earlier on Thursday, the MACC said it summoned Low, who United States (US) prosecutors have portrayed as a central figure in the plot to embezzle money from 1MDB, and Nik Faisal. Low has instructed his lawyers to make contact with the MACC and will help with the investigation, his representative said in an emailed statement.

The MACC has the power to issue arrest warrants and seize property, though any charges must be brought by a public prosecutor.

Malaysian investigators said last month they have met with their counterparts from the US and Singapore to discuss working together. Authorities have enough evidence on Low’s crimes, Home Affairs Minister Muhyiddin Yassin said in a speech to employees at the ministry on Thursday.

Goldman’s work

Mahathir’s new administration has moved quickly as it tries to uncover the extent of the alleged fraud surrounding 1MDB. Najib Razak and his wife were questioned for hours and had their homes raided by investigators last month. The head of the MACC said on 22 May that he expected charges to be filed “very soon,” without explicitly saying against whom.

Goldman Sachs’s work with 1MDB and the US$593 million fees it received for arranging bond deals for the Malaysian fund have come under scrutiny from regulators around the world, including agencies in the US and Singapore. The bank said in November it has received requests from “various government bodies” and is cooperating.

Ng, who was the bank’s head of Southeast Asia sales and trading when he resigned in April 2014, helped 1MDB raise funds, according to one of the people, who asked not to be named discussing private information. He’s currently the managing director for Asia at energy drink maker Celsius Holdings Inc., according to the Celsius website.

Singapore’s Commercial Affairs Department, the police’s economic crime unit, and prosecutors in the city have interviewed current and former Goldman Sachs executives who worked on 1MDB bond offerings. Investigators in the city-state were also looking into the firm’s links with Low.

Leissner ban

Goldman Sachs’s ties with 1MDB have already ensnared one former senior executive. Tim Leissner, the former chairman of Southeast Asia who was the lead banker to the fund, has been barred from the financial industries in Singapore and the US. He left Goldman Sachs in February 2016.

Shahrol was CEO of 1MDB from its inception in 2009 to 2013 and remained a director of the fund until 2016. He has previously said that he’s “done no wrong” and has “nothing to hide.” Najib Razak has repeatedly denied any wrongdoing.

A Malaysian parliamentary committee report released in April 2016 recommended that Shahrol and other 1MDB managers be investigated. The report identified at least US$4.2 billion of unverified or unauthorized transactions at the development fund. – Bloomberg