The economies of Association of Southeast Asian Nations (ASEAN) member states are greatly influenced by global financial and geopolitical conditions. The rise of protectionist trade sentiments and looming threats of a full-blown US-China trade war, geopolitical tensions in and around the region – due in part to China’s increasing influence – and the tightening of global financial policies evidenced by the United States (US) Federal Reserve’s tentative interest rate hikes and plans to reduce its US$4.5 trillion balance sheet are some of the uncertainties that governments in these nations have to contend with.

Nevertheless, ASEAN’s markets remain cautiously bullish and its economies are projected to have rosy outlooks for the year and the near future. CLM (Cambodia, Lao PDR and Myanmar) economies are enjoying growth numbers upwards of seven percent while the others are averaging at approximately 4.6 percent. This in turn, has posited a favourable outlook for the region’s insurance sector.

Overview of the insurance sector in ASEAN

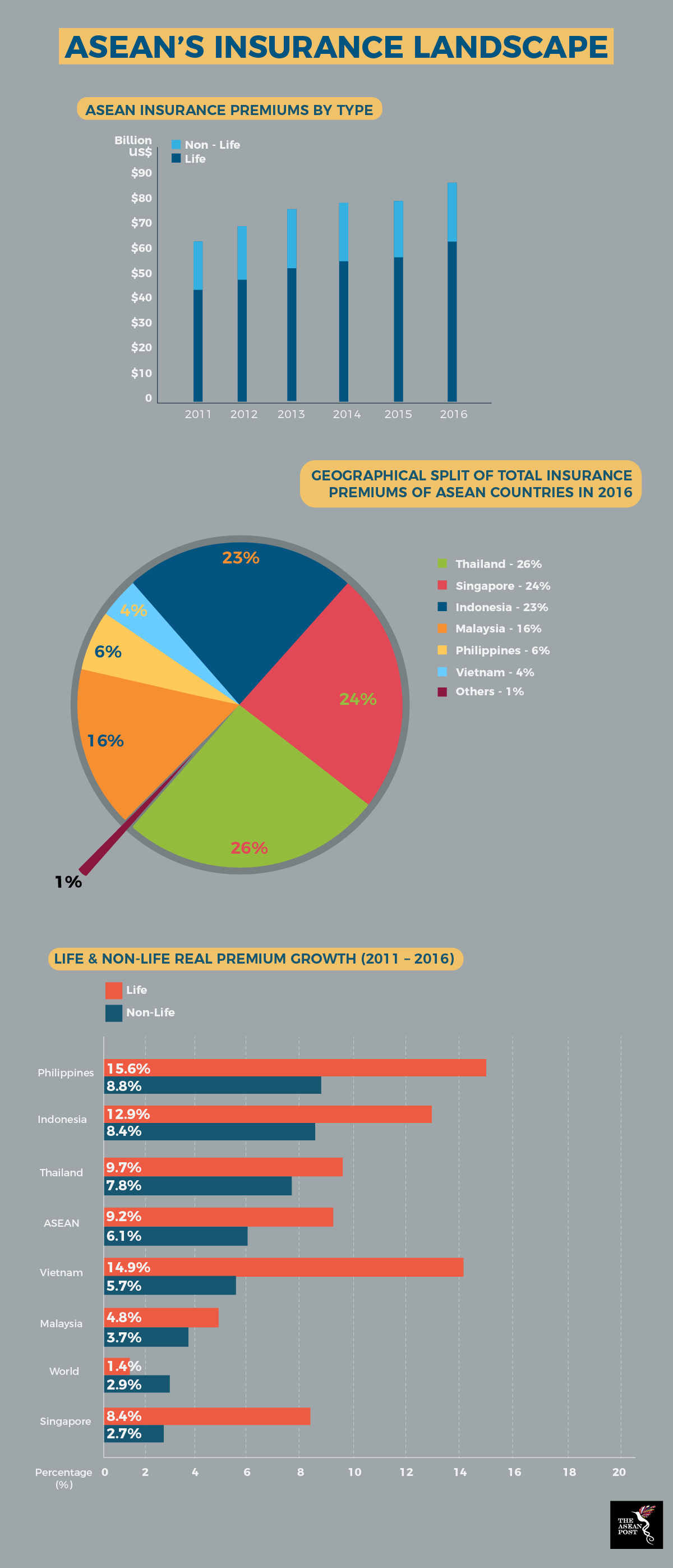

In 2016, insurance penetration in ASEAN stood at 3.4 percent which is nearly half of the global average at six percent. However, this number is slated to rise as ASEAN economies continue to grow.

According to a 2017 report endorsed by the ASEAN Insurance Council, the life insurance business represents the lion share of total premiums in the region at 73 percent – compared to the global share of 55 percent. Nevertheless, ASEAN’s life insurance penetration which sits at 2.4 percent, still lags behind the global average of 3.5 percent. The market for life insurance in ASEAN, however, has been growing. Between 2011 and 2016, it expanded by 9.2 percent per annum, significantly higher than the region’s average economic growth.

For non-life insurance premiums, the gap is much wider, accounting for only one percent of the Gross Domestic Product (GDP) compared to a global average of 2.8 percent. Nevertheless, the gap is fast narrowing as the non-life insurance market in ASEAN outpaced regional GDP growth by one percent between 2011 and 2016 (6.1 percent versus 5.1 percent).

Source: ASEAN Insurance Pulse 2017

Why is there a growing need for insurance in ASEAN?

The need for insurance within the region is underpinned by several factors.

According to Moody’s, which presented a positive outlook for the year’s Asia-Pacific insurance market, rising levels of prosperity will improve long term demand for life insurance. Besides that, the booming insurance technology (insurtech) industry is likely to disrupt existing insurance markets and make insurance more freely available throughout various segments of society. However, progress is still slow.

Besides that, the ASEAN region is a disaster-prone area, hence, there is a need for disaster risk financing which can help ASEAN members become more financially resilient against natural disasters as part of their broader disaster risk management agendas. According to the World Bank, every year, on average, the region suffers damage upwards of US$4.4 billion, a consequence of natural hazards, and this number is only slated to increase as the years go by. The need for ASEAN members to develop adequate disaster financing strategies to lessen the fiscal burden that natural disasters can have on governments is timely, now more than ever.

Another area to look at is insurance for long-term infrastructure programs. Financial services firm, DBS predicts that the infrastructure investment gap within the region to reach US$3 trillion between 2016 and 2020. Current bank and capital market finance won’t be able to fund what’s necessary to meet the sprawling infrastructure ambitions of ASEAN member states. Hence, long term investors like insurance companies can step in and be a useful cog in the region’s financial architecture. Among other things, they would be able to provide long-term predictable funding to the private and public sectors. The EU-ASEAN Business Council suggests five key areas to look at vis-à-vis promoting long term investments by insurance companies – inclusive regulations for infrastructure investment; capital markets development; support for green financing; action to expand blended finance and a pipeline of bankable projects.

In short, growth in the insurance market will hugely benefit ASEAN governments and their citizens. However, more needs to be done to address the uninsured and milk the potential benefits of insurance for long-infrastructure investments.